Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

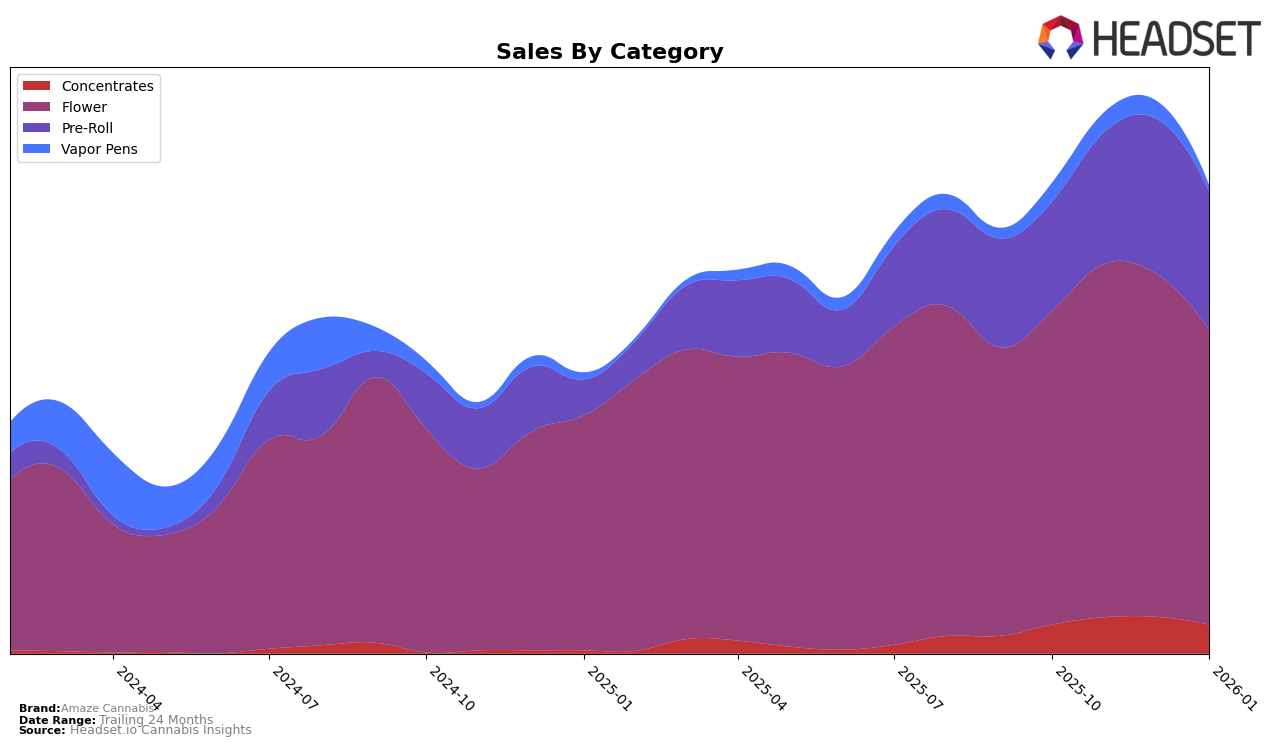

Amaze Cannabis has shown a strong performance in the Missouri market across several categories, with notable rankings in Concentrates and Pre-Roll segments. In the Concentrates category, the brand climbed to the 3rd position in November 2025, although it experienced a slight drop to 6th place by January 2026. This indicates a competitive landscape but also highlights their ability to maintain a strong presence. Interestingly, in the Vapor Pens category, Amaze Cannabis was not ranked in the top 30 as of the latest data, which could be a potential area for improvement or a reflection of a strategic focus on other segments.

In the Flower category, Amaze Cannabis consistently held the 5th position from October 2025 through January 2026, showcasing stability and consumer preference in this segment. The Pre-Roll category also saw significant success, with the brand securing the 2nd position from November 2025 to January 2026, demonstrating their strong market appeal and product quality. However, the Vapor Pens category saw a decline in rankings, dropping from 34th to 44th place from November 2025 to January 2026, which could suggest either a shift in consumer preferences or challenges in this product line. Overall, Amaze Cannabis appears to have a solid footing in the Missouri market, with opportunities for growth in certain categories.

Competitive Landscape

In the competitive Missouri flower market, Amaze Cannabis has consistently maintained its 5th rank from October 2025 through January 2026, showing a stable position amidst fluctuating sales figures. Despite a slight dip in sales in January 2026, Amaze Cannabis remains ahead of Good Day Farm, which improved its rank from 8th to 6th during the same period. Meanwhile, Illicit / Illicit Gardens and Sinse Cannabis consistently outperformed Amaze Cannabis, with Illicit maintaining a top 3 position and Sinse holding 4th place. Vivid (MO) showed a downward trend, dropping from 6th to 7th, which could provide an opportunity for Amaze Cannabis to capitalize on its stable ranking and potentially increase its market share. This analysis highlights the importance of strategic positioning and market awareness for Amaze Cannabis to navigate the competitive landscape effectively.

Notable Products

In January 2026, Amaze Cannabis's top-performing product was Triple Burger (3.5g) from the Flower category, maintaining its number one rank despite a decrease in sales to 15,172 units. Purple Octane x Jealously (3.5g) made a significant leap to the second rank, driven by an impressive increase in sales. Red Runtz (3.5g) also climbed the ranks, moving up to third place with notable sales growth from the previous month. Cap Junky (3.5g) saw a drop to fourth place, reflecting a decline in sales compared to prior months. A new entry, Cadillac Rainbow (3.5g), entered the rankings at fifth place, showcasing its emerging popularity in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.