Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

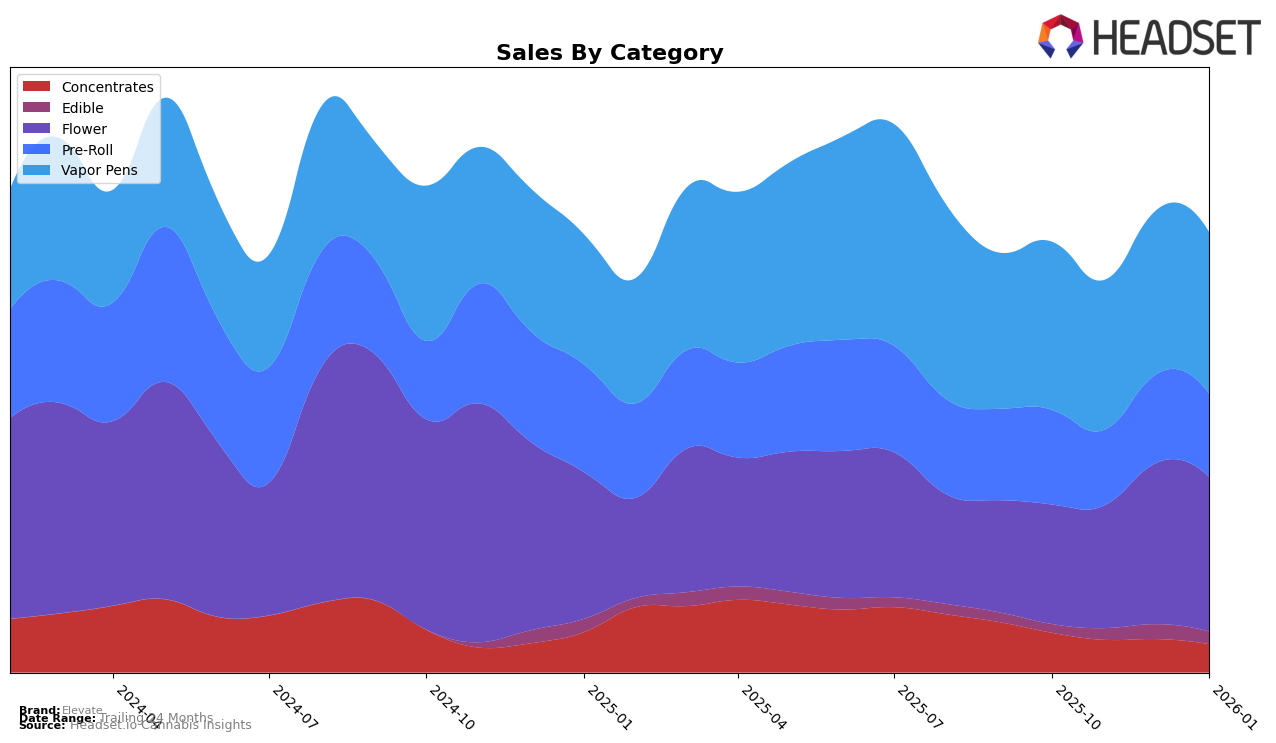

Elevate's performance across various states and categories reveals intriguing trends and shifts in market positioning. In Arizona, the brand struggled to make a significant impact in the Flower, Pre-Roll, and Vapor Pens categories, failing to secure a spot in the top 30 rankings over the observed months. This indicates a potential area for growth or reevaluation of strategy in this state. Conversely, in Illinois, Elevate showed a promising upward trajectory in the Flower category, climbing from 46th in October 2025 to 29th by January 2026. This consistent improvement suggests a growing consumer acceptance or successful marketing efforts for their Flower products in Illinois.

In Missouri, Elevate demonstrated a strong presence, especially in the Concentrates category, maintaining a top 10 position throughout the months, although there was a slight decline from 5th to 9th place. The brand also showed resilience in the Pre-Roll and Vapor Pens categories, staying within the top 10 rankings, despite minor fluctuations. However, in the Edible category, Elevate only managed to break into the top 30 from November 2025 onwards, indicating a slower market penetration compared to other product lines. This diverse performance across categories highlights the brand's established strength in certain areas while also pointing to opportunities for growth and improvement in others.

Competitive Landscape

In the Missouri vapor pen market, Elevate has experienced a notable shift in its competitive positioning from October 2025 to January 2026. Initially ranked 6th in October, Elevate saw a decline to 10th place by January, indicating a competitive pressure from other brands. During this period, Indi Vapes consistently outperformed Elevate, maintaining a higher rank and closely matching its sales figures. Meanwhile, Kushy Punch showed a positive trend, climbing from 11th to 8th place, surpassing Elevate by January. Despite these challenges, Elevate's sales remained robust, though slightly declining, which suggests a need for strategic adjustments to regain its competitive edge. Other competitors like Ostara Cannabis and CODES remained lower in rank, but their presence indicates a dynamic market landscape that Elevate must navigate to enhance its market position.

Notable Products

In January 2026, the top-performing product for Elevate was Grease Monkey (3.5g) in the Flower category, maintaining its number one rank from the previous two months with sales of 5601 units. The Watermelon Z Botanical Min-E-Bar Distillate Disposable (1g) entered the rankings at the second position, indicating a strong market entry. Banana Runtz Botanical Terp Distillate Cartridge (1g) held steady at third place, showing consistent demand. Pineapple Planet (3.5g) debuted at the fourth position, suggesting growing consumer interest in this Flower variant. Grape Goji OG Distillate Botanical Terp Disposable (1g) dropped one position to fifth, which could indicate a slight decline in preference compared to other products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.