Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

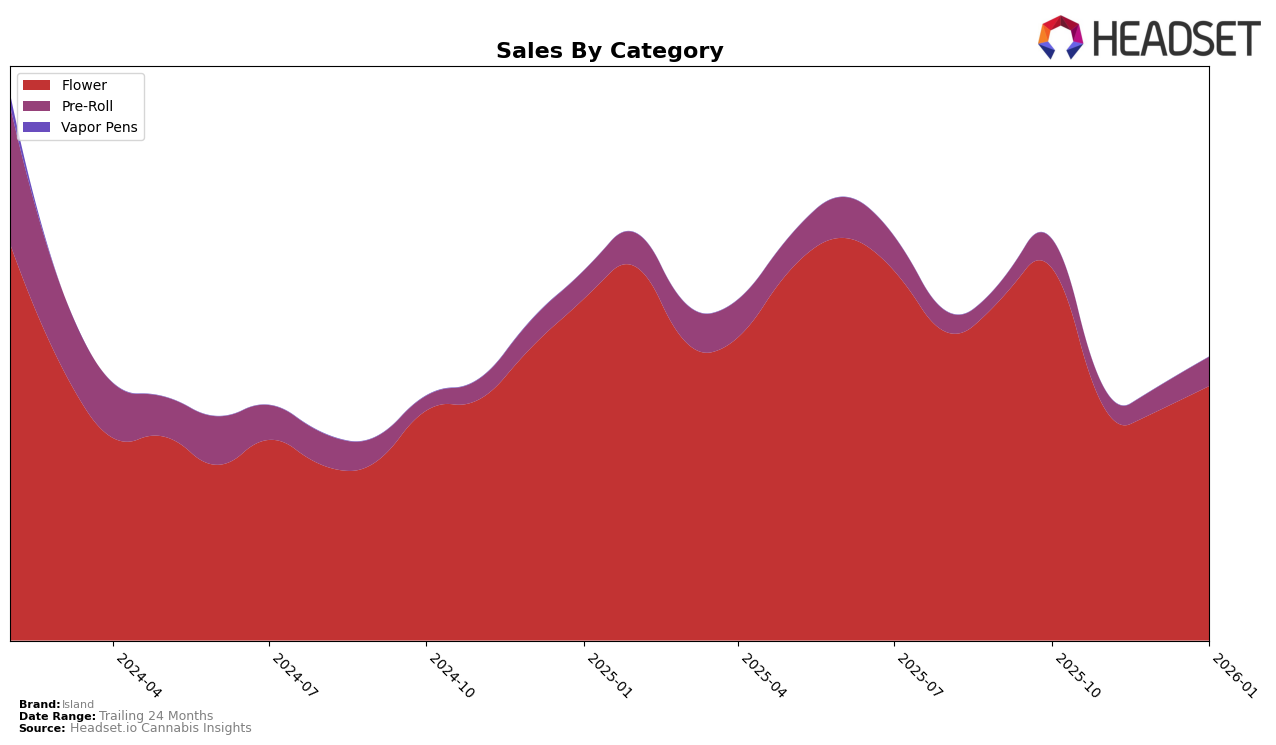

In the state of Illinois, Island has demonstrated a steady performance in the Flower category. Despite a dip in rankings from October to December 2025, where it moved from 17th to 23rd place, the brand showed resilience by regaining one spot in January 2026, reaching 22nd place. This slight upward movement might indicate strategic adjustments or increased consumer demand. In contrast, the Pre-Roll category presents a more challenging landscape for Island, as it consistently remained outside the top 30, with rankings fluctuating between 37th and 47th. This suggests that while Island maintains a presence in Illinois, it faces significant competition, especially in the Pre-Roll segment.

Meanwhile, in Massachusetts, Island's performance in the Flower category has been more volatile. The brand was ranked 44th in October 2025 but did not appear in the top 30 for November and December, indicating a potential decline or increased competition during those months. Interestingly, Island reappeared in the rankings in January 2026, albeit at 81st place, which could suggest a recovery or a seasonal impact on sales. This pattern highlights the dynamic nature of the cannabis market in Massachusetts and suggests that Island may need to explore new strategies to improve its standing in this competitive environment.

Competitive Landscape

In the Illinois Flower category, Island has experienced a fluctuating rank over the months from October 2025 to January 2026, starting at 17th and dropping to 23rd in November and December, before slightly improving to 22nd in January. This indicates a challenging competitive landscape, with brands like Paul Bunyan showing a notable upward trajectory, moving from 28th in October to 20th by January, suggesting a potential threat to Island's market position. Meanwhile, Tales & Travels maintained a relatively stable rank, hovering around 20th to 21st, which could imply a steady consumer base that Island might need to contend with. Additionally, Legacy Cannabis (IL) experienced a dip in December but recovered slightly in January, indicating volatility that Island could potentially exploit. Island's sales figures have seen a downward trend from October to December, with a slight recovery in January, suggesting that while there is room for improvement, strategic marketing efforts could help regain lost ground in this competitive market.

Notable Products

In January 2026, the top-performing product for Island was Kush Mints Pre-Roll (1g) in the Pre-Roll category, securing the number one rank with sales reaching 1,680 units. Following closely was Garlic Z Pre-Roll (1g), which improved its position from fifth in December 2025 to second place in January 2026, with sales of 1,312 units. Marz (14g) in the Flower category entered the rankings at third place with a notable sales figure of 1,228 units. Crazy Hazy Pre-Roll (1g), previously ranked first in December 2025, slipped to fourth place in January 2026. Meanwhile, Crazy Hazy (7g) in the Flower category made its debut at fifth place, indicating a strong market entry with sales of 1,017 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.