Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

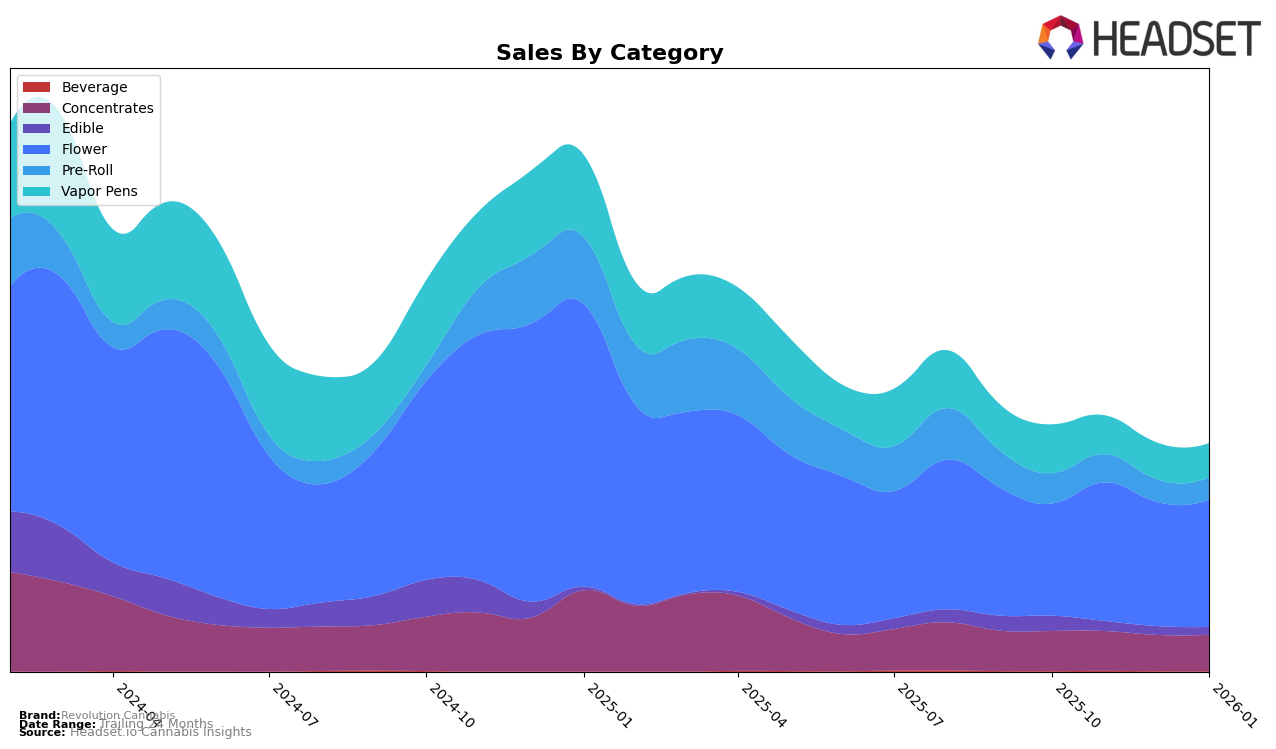

Revolution Cannabis has demonstrated varied performance across different product categories in Illinois. In the Concentrates category, the brand maintained a strong market presence, holding steady at the 5th rank in both October and November 2025, before slipping slightly to 8th place in December 2025 and January 2026. This consistent presence in the top 10 underscores their strong positioning in this category. However, their performance in the Edible category paints a different picture, as they did not make it into the top 30 rankings in any month from October 2025 to January 2026, indicating potential challenges or a lack of focus in this segment.

In the Flower category, Revolution Cannabis showed a positive trend, improving their rank from 20th in October 2025 to 16th by January 2026. This upward movement suggests a growing consumer preference or strategic improvements in this category. On the other hand, in the Pre-Roll category, the brand experienced a decline, moving from 18th to 25th over the same period. Meanwhile, Vapor Pens saw a downward trend as well, with the brand maintaining the 33rd rank from December 2025 to January 2026, after starting at 27th in October 2025. These shifts highlight the competitive nature of the Illinois market and the varying dynamics across different product categories.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Revolution Cannabis has shown a notable upward trajectory in rankings over the past few months. Starting from the 20th position in October 2025, Revolution Cannabis climbed to the 16th spot by January 2026. This improvement in rank indicates a positive trend in market presence and consumer preference. In contrast, Nature's Grace and Wellness experienced fluctuations, peaking at 11th in December 2025 before dropping to 14th in January 2026. Similarly, 93 Boyz saw a decline from 10th in October 2025 to 15th in January 2026, suggesting a potential shift in consumer loyalty or market dynamics. Meanwhile, Savvy maintained a relatively stable position, hovering around the 16th and 17th ranks. Sol Canna also experienced a drop from 12th in November 2025 to 18th in January 2026, which could indicate challenges in sustaining sales momentum. These shifts highlight Revolution Cannabis's growing competitiveness and potential to capture more market share in the coming months.

Notable Products

In January 2026, Baker's Dream (3.5g) emerged as the top-performing product for Revolution Cannabis, climbing from the second position in the previous two months to rank first, with sales reaching 2316.0 units. Indiana Bubblegum (3.5g), which held the top spot in November and December 2025, slipped to second place with 1339.0 units sold. Lemon Punk (3.5g) made its debut on the rankings, securing the third position. Purple Milk (3.5g) fell one spot from December 2025 to rank fourth in January 2026. Paradise (3.5g) entered the rankings for the first time, rounding out the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.