Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

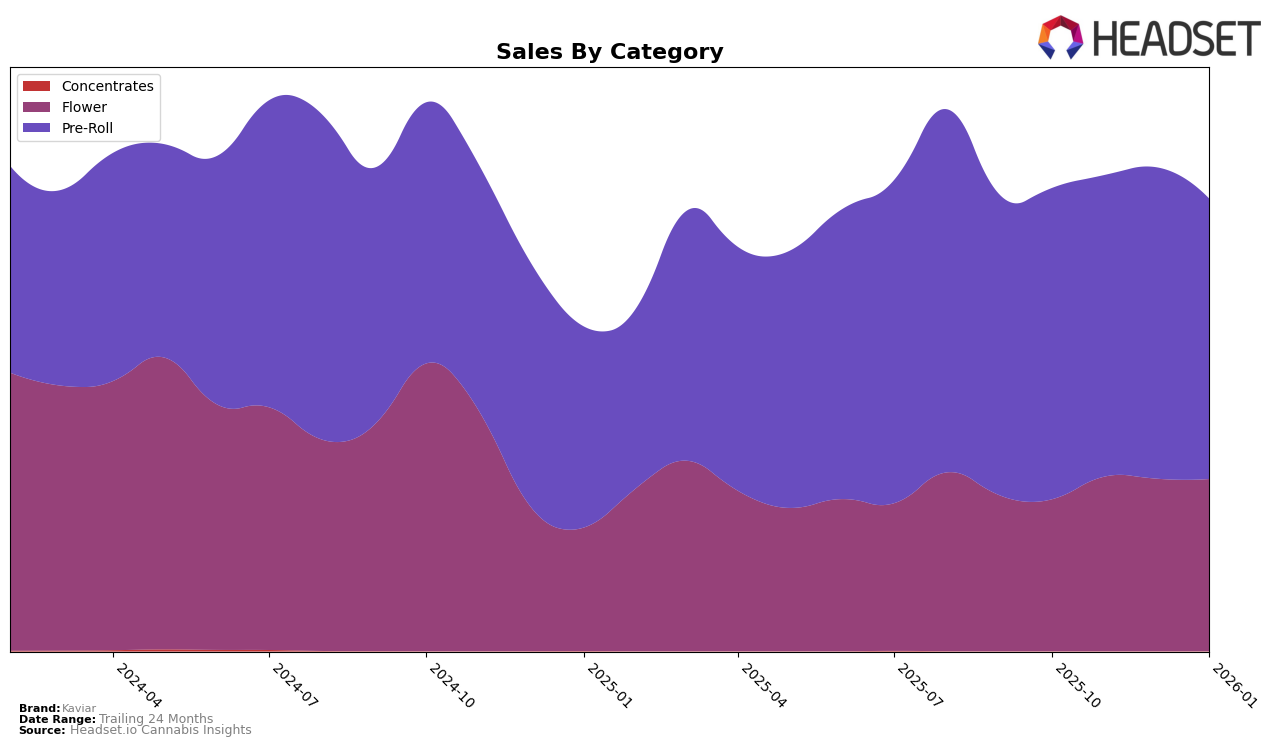

Kaviar has shown consistent performance in the pre-roll category in Colorado, maintaining a steady rank of 3rd place from October 2025 through January 2026. Despite this stability in rank, there is a noticeable downward trend in sales over these months, suggesting potential market saturation or increased competition. In contrast, the brand's presence in the pre-roll category in Maryland has seen a slight improvement, moving from 12th to 10th place, indicating a strengthening foothold in that state. However, Kaviar's performance in Missouri has been less remarkable, as it did not break into the top 30, highlighting a challenging market environment for the brand in that region.

In Illinois, Kaviar's performance in the flower category has been stable, holding the 19th rank from November 2025 through January 2026, following a slight improvement from the 21st position in October 2025. The pre-roll segment in Illinois paints a more dynamic picture, with Kaviar climbing from 21st to 16th place over the same period, reflecting a positive trend in consumer preference for their pre-roll products. This upward movement in the pre-roll category contrasts with the more static performance in the flower category, suggesting targeted strategies might be yielding better results in pre-rolls. Such movements highlight the varying market dynamics and competitive landscape across different states and product categories.

Competitive Landscape

In the competitive landscape of the flower category in Illinois, Kaviar has shown a steady improvement in its ranking, moving from 21st place in October 2025 to consistently holding the 19th position from November 2025 through January 2026. This upward trend in rank is indicative of a positive reception in the market, supported by a notable increase in sales from $667,515 in October to $769,945 by January. In contrast, Paul Bunyan has made significant strides, climbing from 28th to 20th place, closely trailing Kaviar by January, which suggests a competitive threat. Meanwhile, Savvy has maintained a higher rank than Kaviar, although its sales dipped slightly in January, potentially opening a window for Kaviar to close the gap. Tales & Travels has remained behind Kaviar, while Sol Canna experienced a decline from 14th to 18th place, which could be advantageous for Kaviar as it seeks to further improve its market position.

Notable Products

In January 2026, the top-performing product from Kaviar was the Indica Live Resin Infused Pre-Roll (1.5g) in the Pre-Roll category, reclaiming its number one position from October 2025 with sales at 7541 units. Following closely, the Kaviar x Happy Eddie - Zen Wen Infused Pre-Roll (1.5g) maintained its second-place ranking from December 2025. The Kaviar x Happy Eddie - The CEO Hybrid Infused Pre-Roll (1.5g) saw a drop to third place, despite being the top product in December 2025. The Sativa Minis Infused Pre-Roll 5-Pack (3g) improved its position slightly, moving up to fourth place. Lastly, the Indica Minis Infused Pre-Roll 5-Pack (3g) rounded out the top five, having re-entered the rankings in January after missing December data.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.