Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

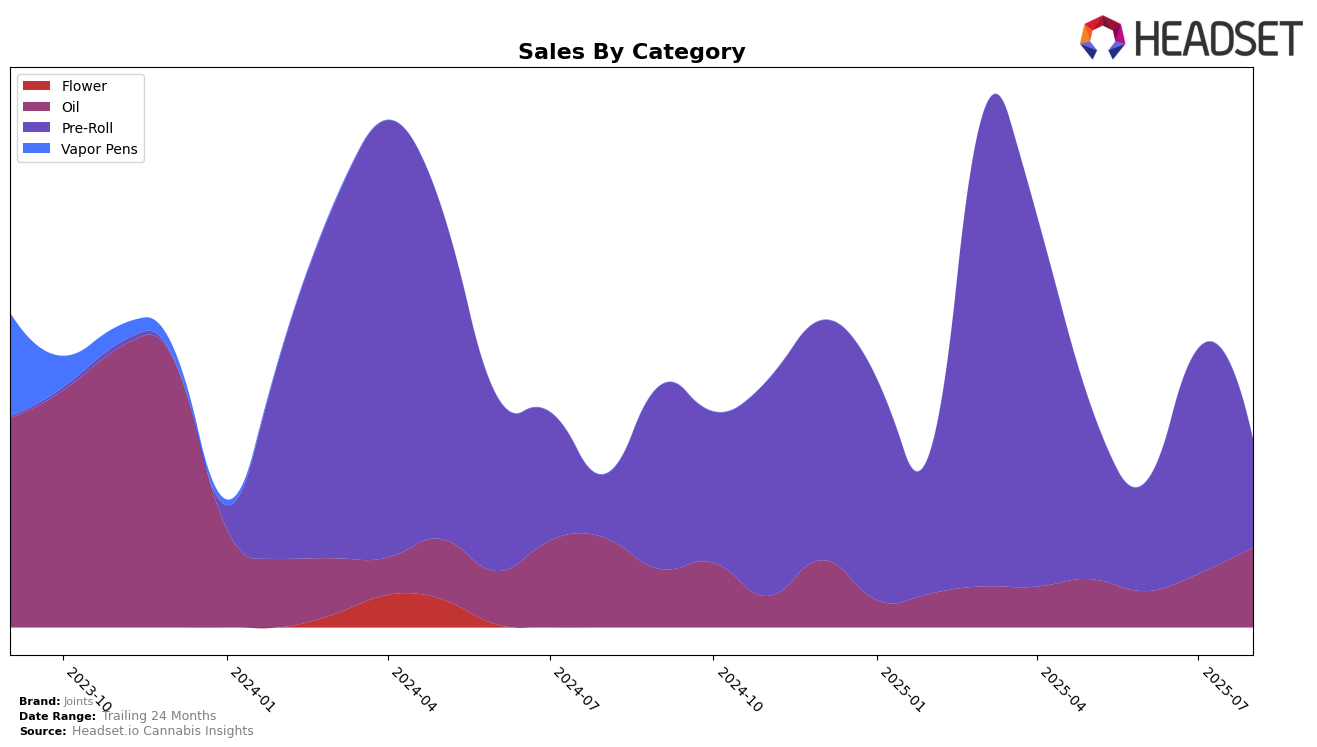

Joints has shown an intriguing performance trend across various categories and states. Notably absent from the top 30 rankings in the Pre-Roll category in Colorado from May to August 2025, this might be a point of concern for the brand. Despite this, the sales figures in May 2025 were recorded at $10,548, indicating a presence in the market, albeit not strong enough to break into the top 30. The absence from the rankings in subsequent months suggests potential challenges or increased competition within the category that may have impacted their market position.

While Joints did not secure a top 30 position in the Pre-Roll category in Colorado, this could also indicate an opportunity for strategic realignment or increased marketing efforts to boost visibility and sales. The data does not reveal the performance in other states or categories, leaving room for speculation about their overall market strategy and performance. Observing these trends could be crucial for stakeholders looking to understand the brand's positioning and potential areas for growth or improvement.

Competitive Landscape

In the competitive landscape of the Colorado pre-roll category, Joints has faced significant challenges in maintaining a strong market presence. Notably, Joints did not rank within the top 20 brands from May to August 2025, indicating a struggle to capture market share. In contrast, Old Pal experienced a notable decline, dropping from 12th place in May to 38th in June, which could suggest volatility in consumer preferences or distribution issues. Meanwhile, Hi-Fuel showed fluctuating performance, with ranks of 60th in May, improving to 45th in June, but then slipping to 64th by July. This indicates a competitive environment where brands are vying for consumer attention amidst shifting trends. For Joints, understanding these dynamics and the factors contributing to the success or decline of competitors like Next1 Labs LLC, which did not rank in the top 20, could be crucial in strategizing for future growth and improving their market position.

Notable Products

In August 2025, the top-performing product from Joints was the Supreme Purps Infused Pre-Roll (2g), maintaining its first-place ranking from July, with notable sales of 140 units. Following closely, CBD Respite MAX Oil (60ml) rose to second place from fifth in July, indicating a significant increase in consumer interest. The Supreme Purps Hash Infused Pre-Roll (1g) dropped one position to third place, suggesting a slight decline in popularity. Melon Force One Hash Infused Pre-Roll (1g) maintained its fourth-place ranking from the previous month, showing steady demand. Midnight Envy Infused Pre-Roll (2g) entered the top five for the first time, reflecting a new trend among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.