Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

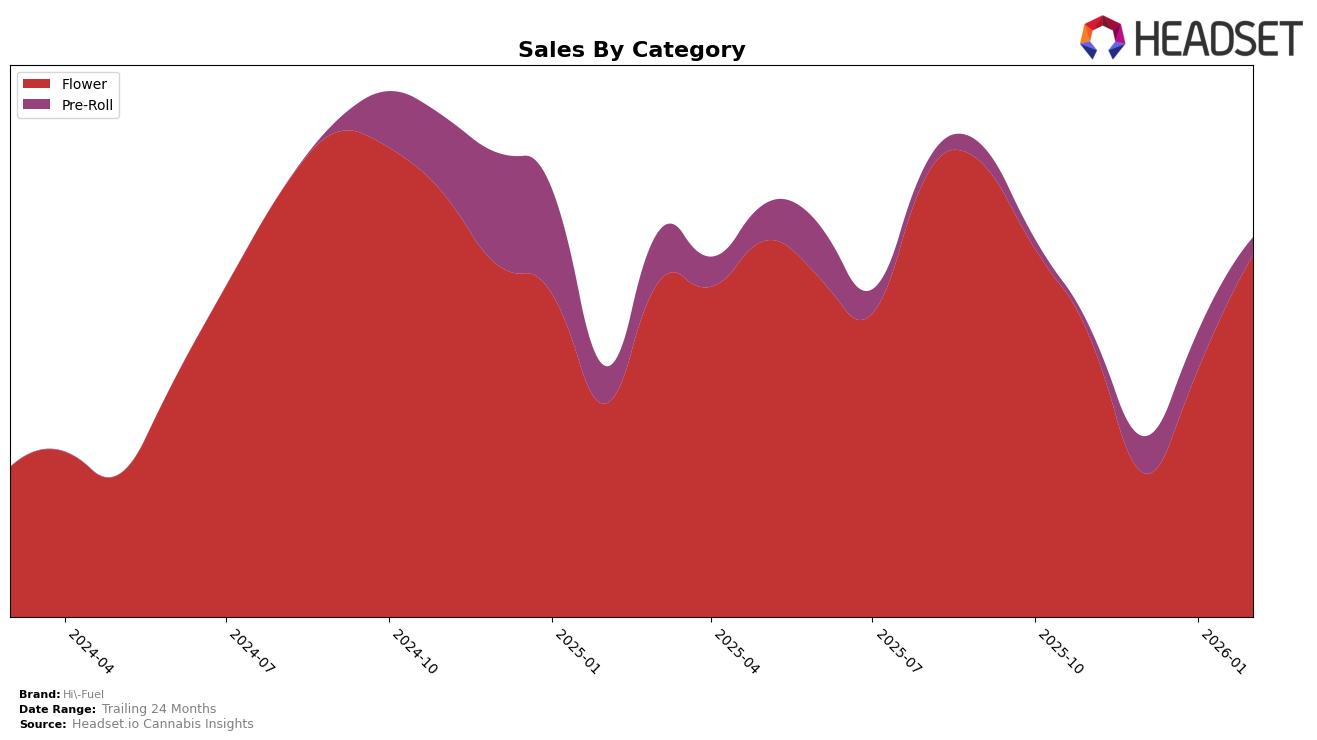

Hi-Fuel has demonstrated notable fluctuations in its performance across different categories and states, with some intriguing patterns emerging. In the Flower category within Colorado, Hi-Fuel has shown a significant upward trajectory. Starting from a rank of 37 in November 2025, the brand managed to climb to the 23rd position by February 2026, despite a dip in December where it fell to 57th place. This upward movement is accompanied by a substantial increase in sales from $119,946 in December 2025 to $304,408 by February 2026, indicating a strong recovery and growth in consumer demand. The fluctuation in rankings suggests a competitive landscape where Hi-Fuel is gaining traction, perhaps due to strategic adjustments or shifts in consumer preferences.

In contrast, the Pre-Roll category in Colorado presents a different story for Hi-Fuel. The brand did not make it to the top 30 in November 2025, and while it entered the rankings at 56th in December, it showed varied performance in the following months, peaking at 48th in January 2026 before dropping to 62nd in February. This inconsistency might reflect challenges in maintaining a steady market presence or could be indicative of stronger competition in this segment. The sales figures mirror this volatility, with a notable drop from $31,988 in December 2025 to $13,652 in February 2026, suggesting potential areas for improvement in marketing strategies or product offerings to stabilize and enhance their market position in the Pre-Roll category.

Competitive Landscape

In the competitive landscape of the Colorado Flower category, Hi-Fuel has experienced notable fluctuations in its market position over recent months. Starting from a rank of 37 in November 2025, Hi-Fuel saw a decline to 57 in December 2025, before rebounding to 39 in January 2026 and achieving a significant improvement to 23 by February 2026. This upward trajectory in early 2026 suggests a positive response to strategic changes or market conditions. In contrast, Summit and Canna Club have maintained relatively stable positions, with Summit consistently hovering around the 20s and Canna Club showing a slight dip from 17 to 21. Meanwhile, NOBO and Ardo have demonstrated more volatility, with NOBO peaking at 18 in January 2026 and Ardo making a significant leap from the 60s to the 20s by February 2026. This dynamic environment highlights the competitive pressures Hi-Fuel faces, yet its recent ascent indicates potential for continued growth if current strategies are sustained.

Notable Products

In February 2026, Pu Tang 2.0 Popcorn (Bulk) emerged as the top-performing product for Hi-Fuel, securing the number one rank with sales of 1,413 units. Following closely, Presidential Runtz (3.5g) took the second spot, while Suga Ray Leonard (3.5g) ranked third. Platinum Cherry Gelato (3.5g) and Super Buff Cherry (1g) rounded out the top five at fourth and fifth positions, respectively. Compared to previous months, these products have consistently climbed the ranks, with Pu Tang 2.0 Popcorn (Bulk) making a significant leap to the top. Notably, these products have shown a steady increase in sales, indicating growing consumer preference and market presence.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.