Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

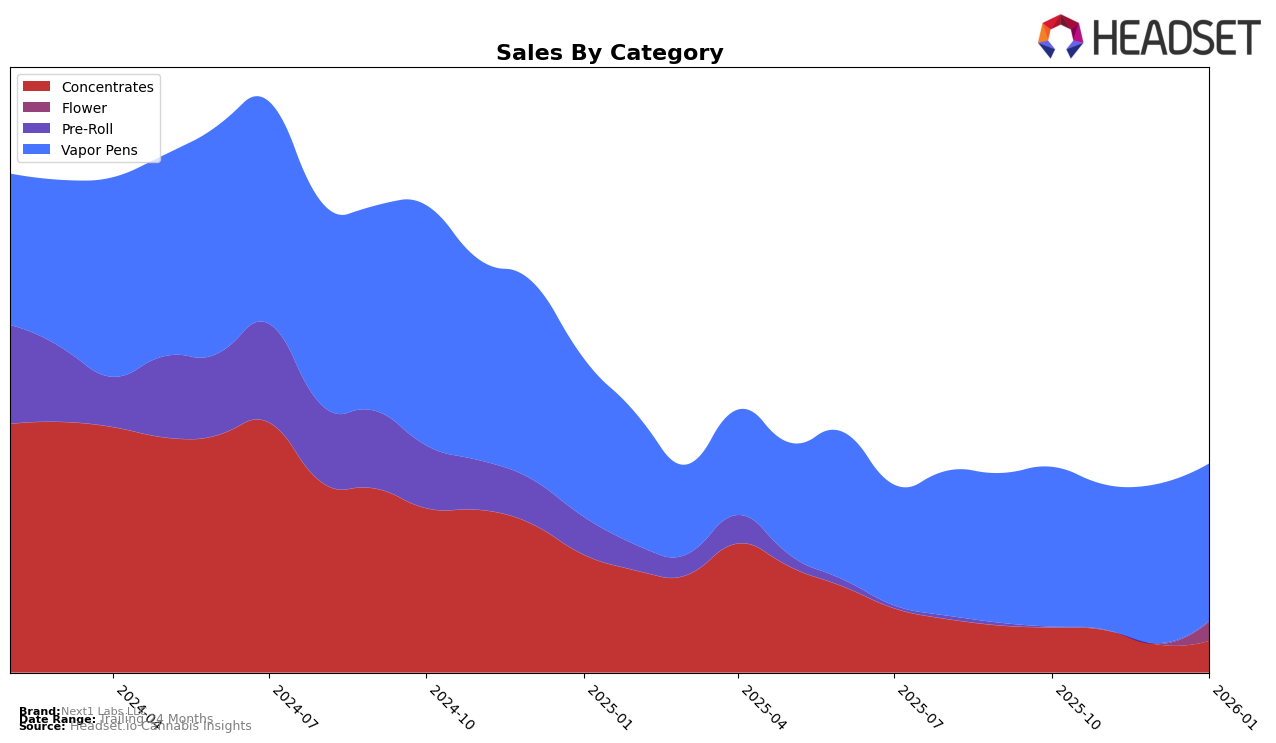

Next1 Labs LLC has shown varied performance across different product categories in the state of Colorado. In the Concentrates category, the brand maintained its position at rank 29 through October and November 2025, but then dropped out of the top 30 by December 2025 and January 2026. This decline in ranking is accompanied by a noticeable drop in sales from October to December, although there was a slight recovery in January. In contrast, their presence in the Flower category was not as strong, as they did not make it into the top 30 rankings during the observed months, indicating a potential area for growth or reevaluation. The Vapor Pens category, however, tells a different story with a consistent presence in the top 30, though with a slight downward trend from rank 25 in October to rank 27 by January.

The performance of Next1 Labs LLC in the Vapor Pens category is particularly noteworthy, as it consistently ranks within the top 30, suggesting a steady demand for their products in this segment in Colorado. Despite a minor drop in ranking, the sales figures indicate a relatively stable market position, with only slight fluctuations in monthly sales. This contrasts with the brand's performance in the Concentrates category, where sales and rankings have both seen a decline, pointing to potential challenges or increased competition. The absence of top 30 rankings in the Flower category suggests that Next1 Labs LLC might not be focusing heavily on this segment, or they are facing stiff competition. These insights could guide strategic decisions for the brand, such as reinforcing their strengths in Vapor Pens while exploring opportunities for growth or improvement in other categories.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Next1 Labs LLC has experienced a slight decline in its market position over the past few months. From October 2025 to January 2026, the brand's rank slipped from 25th to 27th, indicating a need for strategic adjustments to regain its footing. During this period, competitors like 710 Labs and Bakked have shown resilience, with Bakked improving its rank from 29th to 26th, overtaking Next1 Labs LLC. Meanwhile, TasteBudz (CO) maintained a relatively stable position, though it briefly surpassed Next1 Labs LLC in November 2025. The sales trends reflect these shifts, with Next1 Labs LLC's sales figures showing a slight decline, while Bakked achieved a notable increase in January 2026. This competitive environment underscores the importance for Next1 Labs LLC to innovate and enhance its market strategies to compete effectively in the vapor pen category.

Notable Products

In January 2026, the top-performing product from Next1 Labs LLC was the Bacio Gelato Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank from the previous month with sales of 2697 units. The Pina Express Distillate Cartridge (1g) saw a significant rise to the second position, improving from fourth in December 2025. Sunset Sherbet Distillate Cartridge (1g) entered the rankings at third place, highlighting its strong debut performance. Sour Diesel Distillate Cartridge (1g) dropped slightly to fourth, despite an increase in sales compared to December 2025. High-C Distillate Cartridge (1g) fell to fifth place, marking a notable decrease from its top position in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.