Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

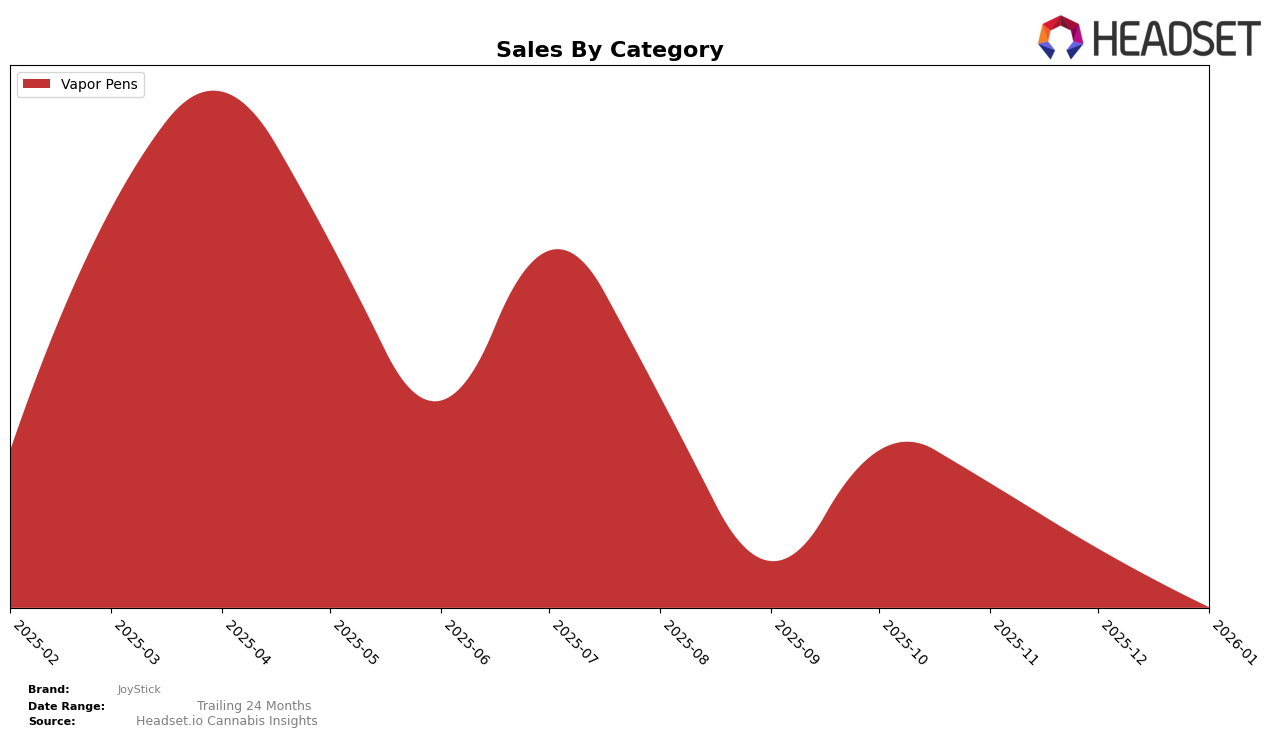

JoyStick has shown a notable presence in the Vapor Pens category in New Jersey, although their performance has seen a gradual decline over recent months. Starting at 18th place in October 2025, JoyStick dropped to 19th in November and further to 22nd by December and January 2026. This downward trend in rankings is mirrored by a consistent decrease in sales figures, which fell from $345,200 in October to $252,990 by January. Such a decline suggests that competitive pressures or market dynamics might be impacting JoyStick's positioning within this key category.

Interestingly, JoyStick's absence from the top 30 rankings in other states and categories indicates potential areas for growth or challenges they might be facing beyond New Jersey. The lack of presence in the top 30 could be seen as a missed opportunity or a need for strategic realignment to capture more market share. However, the consistent presence in New Jersey's Vapor Pens category highlights a focused strength that could be leveraged for expansion into other markets or categories. Understanding the factors behind their New Jersey performance could provide insights into replicating success elsewhere.

Competitive Landscape

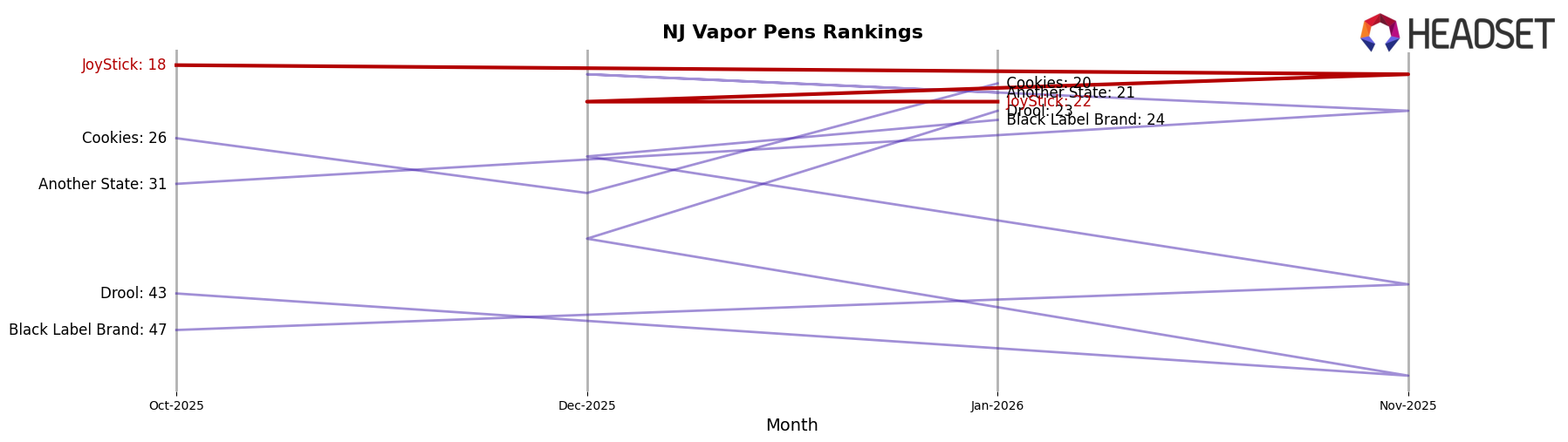

In the competitive landscape of vapor pens in New Jersey, JoyStick has maintained a relatively stable position, ranking between 18th and 22nd from October 2025 to January 2026. Despite a slight decline in sales over this period, JoyStick remains a strong contender, particularly when compared to brands like Cookies, which fluctuated in and out of the top 20, and Black Label Brand, which showed a consistent upward trend in rank, moving from 47th to 24th. Drool also demonstrated a notable rise in rank, suggesting increased competition. Meanwhile, Another State maintained a strong presence, consistently ranking in the top 20. These dynamics indicate that while JoyStick holds a solid position, the brand faces growing competition from both established and emerging players, necessitating strategic efforts to bolster its market share and sales in the coming months.

Notable Products

In January 2026, JoyStick's top-performing product was the Mega Melon Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank from previous months with sales of 1215 units. The Fruit Frenzy Distillate Cartridge (1g) secured the second position, consistent with its debut rank in December 2025. Cheat Code Cookies Distillate Cartridge (1g), which was ranked first in December 2025, fell to third place. Guava Glitch Distillate Cartridge (1g) re-entered the rankings at fourth after being unranked in previous months. Cyberdew Distillate Cartridge (1g) held steady at the fifth position, showing consistent performance since November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.