Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

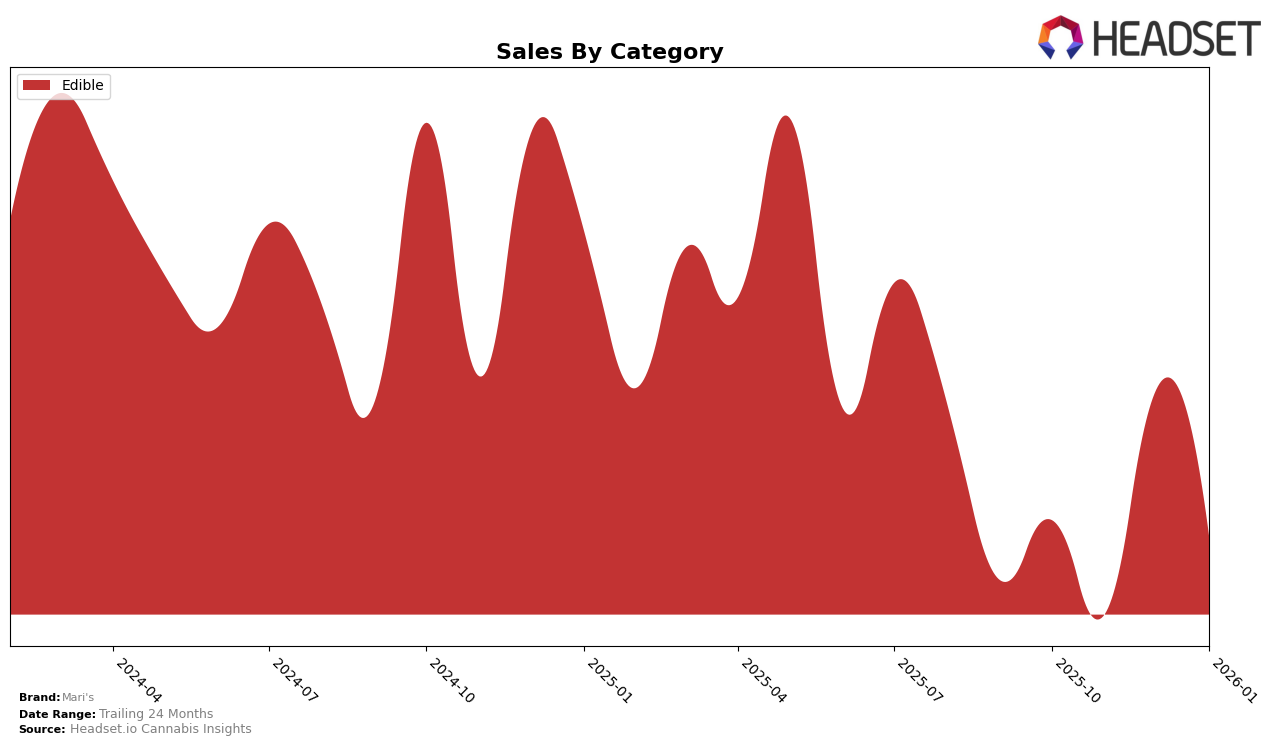

Mari's, a notable brand in the cannabis industry, has maintained a consistent presence in the Edible category within Washington. Over the months from October 2025 to January 2026, Mari's held a steady rank at 19th place, indicating a stable performance in a competitive market. This consistency suggests that while Mari's is not climbing the ranks, it has managed to sustain its position amidst fluctuating market dynamics. This could be interpreted as a positive sign of brand loyalty and consistent consumer demand, even as monthly sales experienced slight variations, with a peak in December 2025.

While Mari's performance in Washington's Edible category remains stable, the absence of rankings in other states and categories suggests potential areas for growth or concern. The lack of presence in the top 30 brands elsewhere might indicate either a strategic focus on the Washington market or a need to expand and strengthen their market presence in other regions. This gap presents both a challenge and an opportunity for Mari's to evaluate its market strategies and consider diversification or expansion efforts to enhance its brand visibility and capture more market share across different states and product categories.

```Competitive Landscape

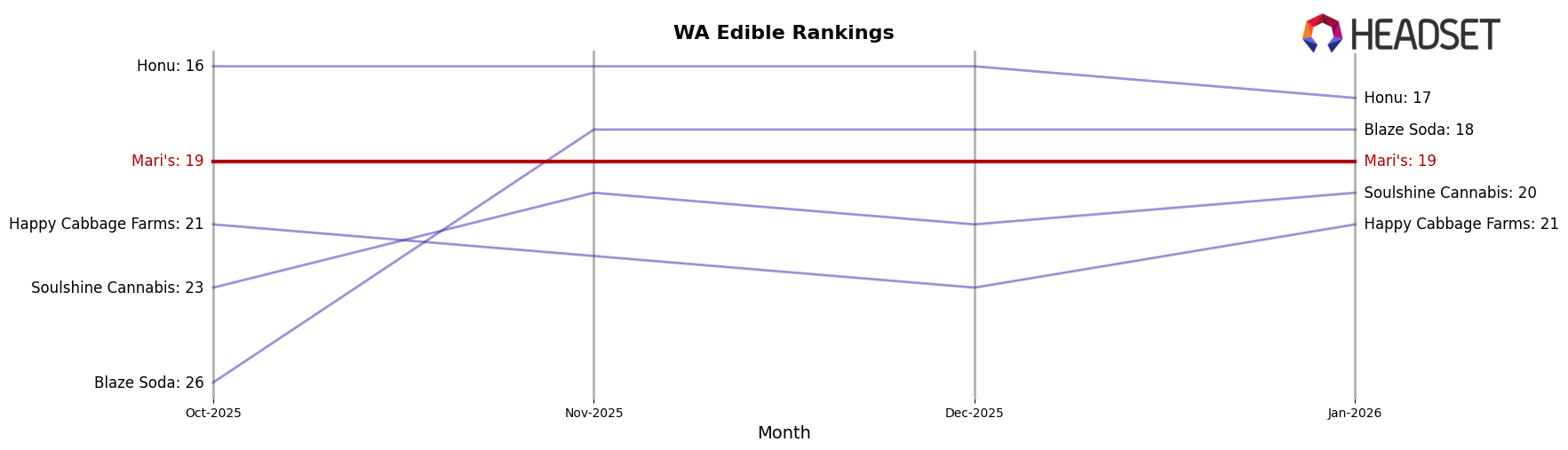

In the Washington edible market, Mari's has maintained a consistent rank of 19th from October 2025 to January 2026, indicating stability amidst fluctuating market dynamics. During this period, Honu maintained a slightly higher position, ranking 16th consistently until January 2026, when it dropped to 17th. This suggests that while Honu has been a strong competitor, its sales have shown some volatility, potentially opening opportunities for Mari's to capitalize on any market shifts. Meanwhile, Soulshine Cannabis improved its position from 23rd to 20th, showing a positive growth trend that could pose a future challenge if Mari's does not innovate or enhance its offerings. Blaze Soda made a significant leap from 26th to 18th, indicating a strong upward trajectory that Mari's should monitor closely. Lastly, Happy Cabbage Farms showed some fluctuations but remained close behind Mari's, suggesting a competitive environment where small changes in strategy could significantly impact rankings and sales.

Notable Products

In January 2026, Mari's top-performing product was the Sativa Peppermint Move Mints 20-Pack (100mg), maintaining its first-place ranking consistently since October 2025, with sales reaching 949 units. The Sativa Wintermint Move Mints 20-Pack (100mg) also held steady in second place throughout the same period, showing a slight increase in sales to 938 units. The Sativa Move Mints 10-Pack (100mg) made a notable jump from fifth place in December 2025 to third place in January 2026, indicating a rising popularity. The Indica Watermelon Retire Mints 20-Pack (100mg) slipped from third to fourth place, while the CBN/CBD/THC 1:1:1 Peppermint Pillow Mint 20-Pack (100mg CBN, 100mg CBD, 100mg THC) reclaimed its position at fifth place after not ranking in December. Overall, the product rankings for Mari's show stability at the top, with some shifts in the lower positions, reflecting changing consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.