Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

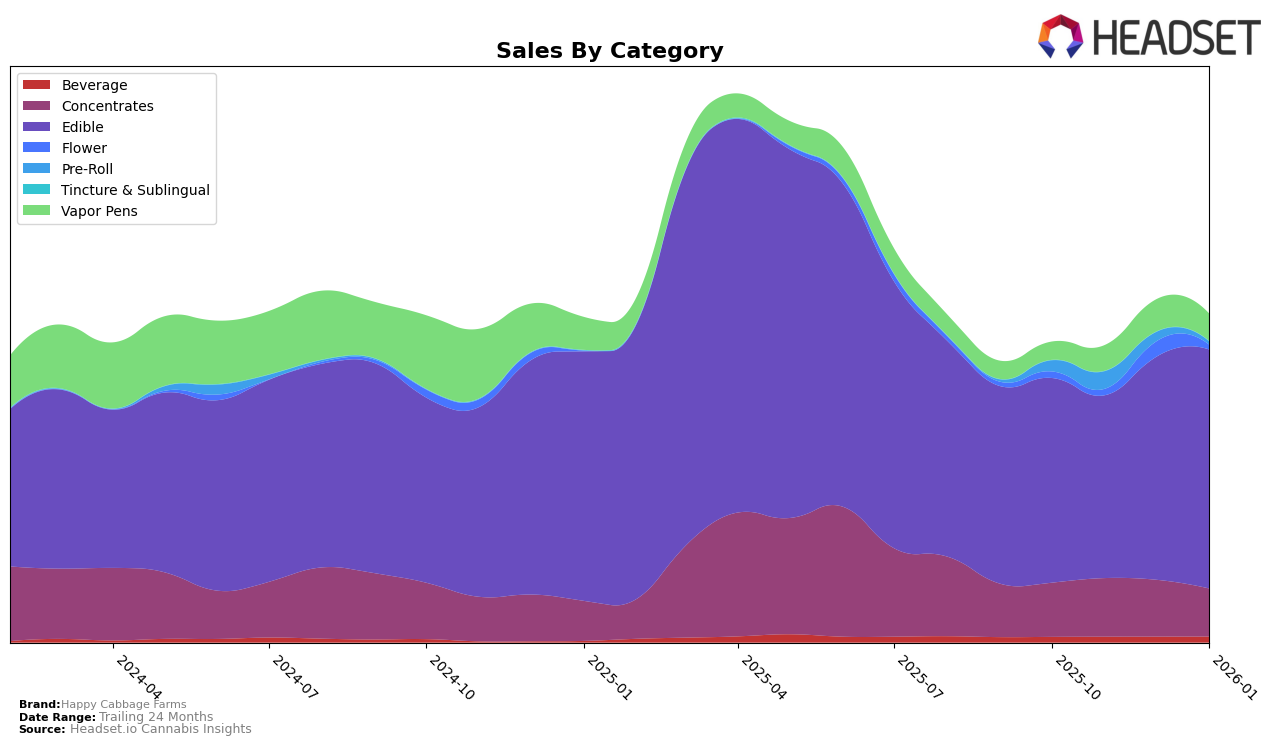

Happy Cabbage Farms has shown varying performance across different states and categories. In New York, the brand did not make it to the top 30 in the Concentrates and Edible categories, with rankings of 34 and 65 respectively in October 2025. This suggests that while the brand is present in these categories, it faces significant competition. Conversely, in Oregon, Happy Cabbage Farms demonstrates a strong foothold, particularly in the Edible category, where it consistently ranked within the top 10 from October 2025 to January 2026. The brand also maintained a stable presence in the Concentrates category, albeit with a slight decline from 25th to 27th position over the same period.

In Oregon, Happy Cabbage Farms experienced fluctuations in the Pre-Roll category, peaking at 65th in November 2025 but not ranking in the top 30 by January 2026. This indicates potential challenges in maintaining market share in this segment. Meanwhile, in the Vapor Pens category, the brand improved its standing from 68th to 55th by December 2025, before a slight dip to 60th in January 2026, reflecting some positive momentum. In Washington, the brand maintained a consistent performance in the Edible category, hovering around the 21st to 23rd positions, which suggests a steady demand for their products in this market.

Competitive Landscape

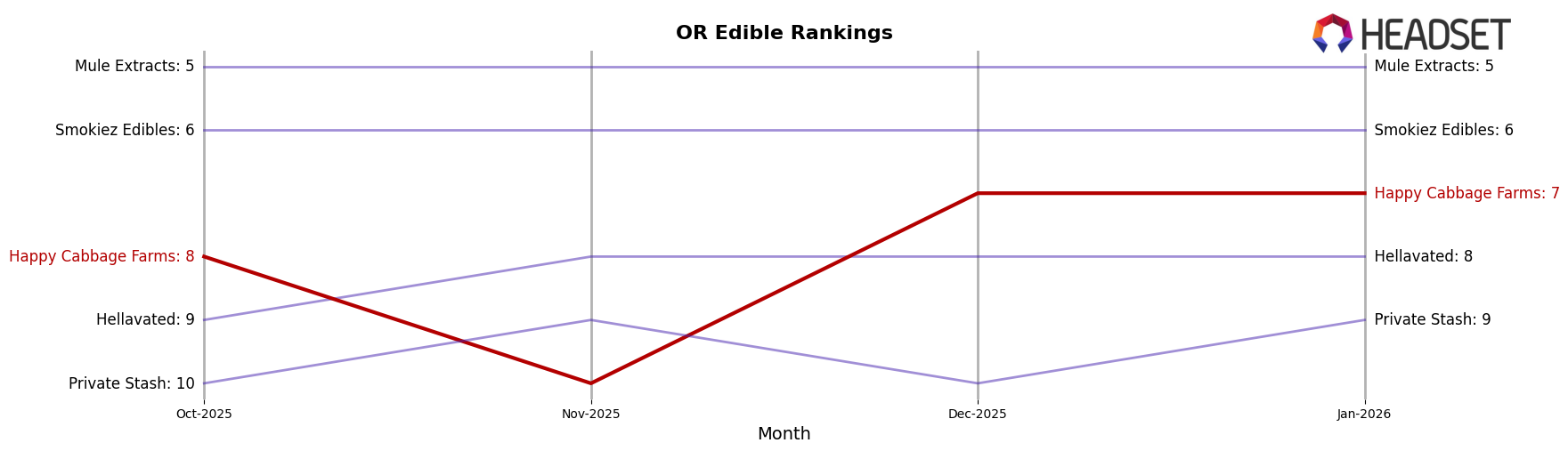

In the competitive landscape of the edible category in Oregon, Happy Cabbage Farms has demonstrated notable resilience and growth. Despite starting at the 8th rank in October 2025, it experienced a brief dip to the 10th position in November, only to rebound to the 7th position by December and maintain this rank into January 2026. This upward trajectory is particularly impressive given the consistent performance of competitors like Smokiez Edibles and Mule Extracts, which have held steady at the 6th and 5th positions, respectively, throughout the same period. Meanwhile, Hellavated and Private Stash have shown less volatility, with Hellavated maintaining its 8th position since November and Private Stash fluctuating between the 9th and 10th spots. The sales figures for Happy Cabbage Farms reveal a positive trend, with a significant increase from November to January, suggesting a growing consumer preference and market share in the Oregon edibles market.

Notable Products

In January 2026, the top-performing product for Happy Cabbage Farms was Blox - Midnight Melons Hash Rosin Gummies 10-Pack (100mg), which climbed to the number one position with sales reaching 4457 units. Blox - Green Apple Solventless Hash Gummy (100mg) followed closely in second place, having dropped from its top spot in the previous two months. Blox - CBN/THC 1:1 Slumber Berry Solventless Rosin Gummies 10-Pack (100mg CBN, 100mg THC) made a notable entry into the rankings, securing the third spot with 4105 units sold. Blox - Cherry Limeade Solventless Rosin Gummy (100mg) experienced a slight decline, moving from second to fourth place. Finally, Blox - CBD/THC 1:1 Strawberry Serenity Gummies 10-Pack (100mg CBD, 100mg THC) remained consistent in the fifth position, reflecting steady consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.