Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

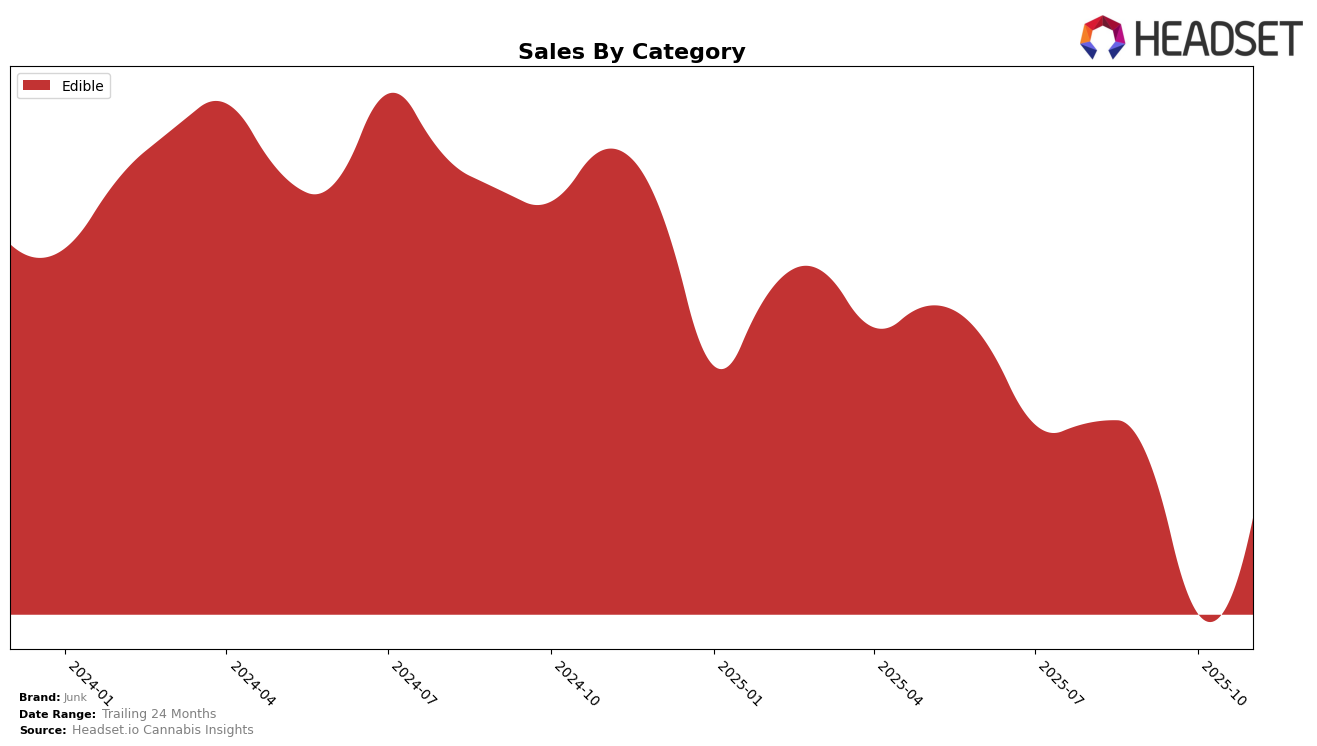

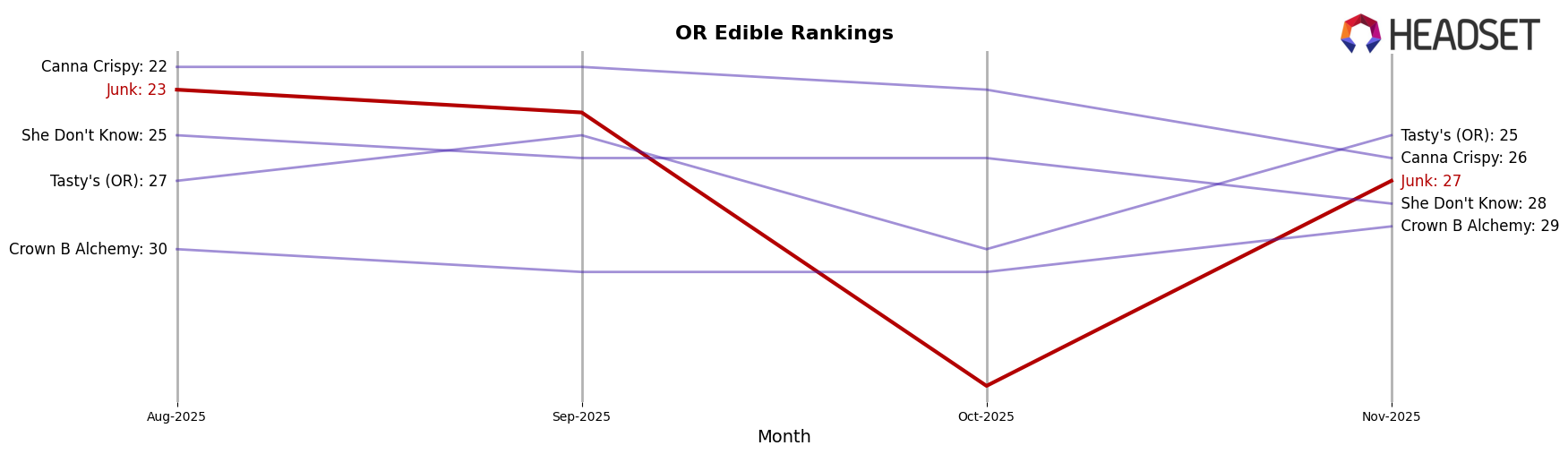

In the state of Oregon, the cannabis brand Junk has experienced fluctuating performance in the Edible category over the past few months. In August 2025, Junk was ranked 23rd, but by October, it had fallen out of the top 30, indicating a significant decline in its market standing. However, in November, Junk managed to recover somewhat, climbing back to the 27th position. This movement suggests that while Junk faces challenges in maintaining a consistent ranking, there are efforts underway to regain its foothold in the competitive Oregon market.

Junk's sales figures in Oregon also reflect this volatility, with a notable drop in October compared to previous months, followed by a partial rebound in November. The brand's ability to re-enter the top 30 by November could be attributed to strategic adjustments or market dynamics that favored its offerings. While specific sales figures for September and November show a decrease compared to August, the brand's resilience in bouncing back to the 27th rank is a positive sign. However, the absence from the top 30 in October serves as a reminder of the competitive landscape Junk faces in the Edible category.

Competitive Landscape

In the competitive landscape of the Oregon edible market, Junk has experienced notable fluctuations in its rank and sales over the past few months. While Junk was not in the top 20 brands from August to November 2025, it did see a slight recovery in November, moving up to rank 27 from a low of 36 in October. This improvement comes despite a general decline in sales from August to October, with a partial rebound in November. In contrast, Canna Crispy consistently maintained a higher rank, even though its sales dipped in November. Meanwhile, Tasty's (OR) showed resilience by improving its rank to 25 in November, surpassing Junk. She Don't Know remained relatively stable, closely trailing Junk in November. These dynamics suggest that while Junk is facing stiff competition, there is potential for growth if it can capitalize on the upward trend seen in November.

Notable Products

For November 2025, Junk's top-performing product is the THC/CBN 2:1 Dreamboat Functional Magic Gummy 10-Pack, which reclaimed its number one rank after a dip in October. This product achieved a notable sales figure of 496 units. Tiger Blood Gummies 10-Pack, which held the first position in the previous two months, is now ranked second. The CBD:THC 3:2 Dynamites Sour Orange moved up to third place, showing a significant increase from its previous fifth position in August. Sleepy Dreamboat Gummies maintained a steady fourth rank, while CBD/THC 1:1 Field Trip Functional Magic Gummies dropped to fifth, continuing its decline from August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.