Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

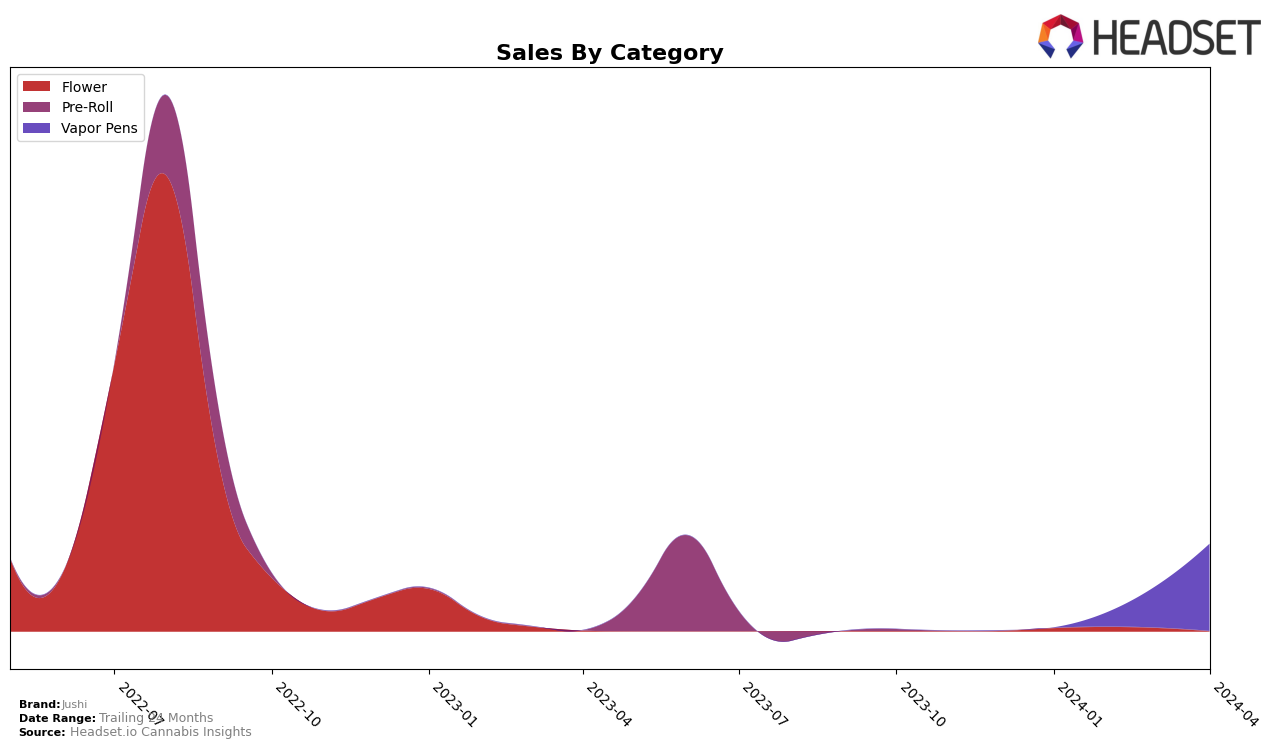

In the competitive landscape of the cannabis market, Jushi's performance in Ohio under the Vapor Pens category has shown notable movement. Initially, Jushi was not ranked within the top 30 brands for Vapor Pens in Ohio for the first three months of 2024, indicating a potential challenge in market penetration or consumer preference during this period. However, a significant turnaround was observed in April 2024, where Jushi made its debut in the rankings at 29th position. This entry into the rankings suggests a positive shift in either marketing strategies, consumer acceptance, or distribution effectiveness. While the specific sales figures for January through March are not disclosed, the April sales amounted to $41,753, marking Jushi's impactful entry into the Ohio market. This upward trend in the rankings, despite the initial absence, could indicate a growing consumer interest or improved brand visibility.

The absence from the top 30 rankings in the initial months of 2024 in Ohio's Vapor Pens category could be viewed from various perspectives. For Jushi, this could have been a period of strategizing or overcoming market entry barriers. The subsequent ranking in April, however, is a clear indicator of progress. This movement is significant for stakeholders and analysts tracking the brand's performance across states and categories, as it highlights the brand's resilience and potential for growth in competitive markets. The entry at 29th position, while on the lower end of the spectrum, is a crucial first step for Jushi in establishing its presence in the Ohio cannabis market. Future trends will be essential to watch, as they will indicate whether this initial ranking was a momentary spike or the beginning of a consistent upward trajectory in brand performance and consumer preference.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Ohio, Jushi made a notable entry in April 2024, ranking 29th among its peers. This debut is significant as it positions Jushi in the competitive mix, albeit with lower sales figures compared to established brands like Fuzed and Willie's Reserve, which have shown consistent performance but with fluctuating ranks and sales in the months leading up to April. Fuzed, in particular, maintained a stronger presence with higher sales and a more stable rank, indicating a solid consumer base. On the other hand, brands like Superflux and The Solid experienced more significant rank changes and lower sales, suggesting a more volatile market position. Jushi's entry, while lower in sales, hints at potential growth opportunities and challenges as it navigates the competitive dynamics of the Ohio Vapor Pens market.

Notable Products

In April 2024, Jushi's top-selling product was the Maui Wowie Distillate Disposable (0.5g) from the Vapor Pens category, achieving remarkable sales figures of 978 units. Following closely was the Strawberry Cough Distillate Disposable (0.5g), also from the Vapor Pens category, securing the second rank. The third place was taken by the Watermelon Zkittles Distillate Disposable (0.5g), ensuring that Vapor Pens dominated the top ranks for the month. Notably, the Stardawg Guava (2.83g) from the Flower category, which was the top product in January 2024, did not make it to the top ranks in April. This shift underscores a significant change in consumer preference within Jushi's product range over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.