Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

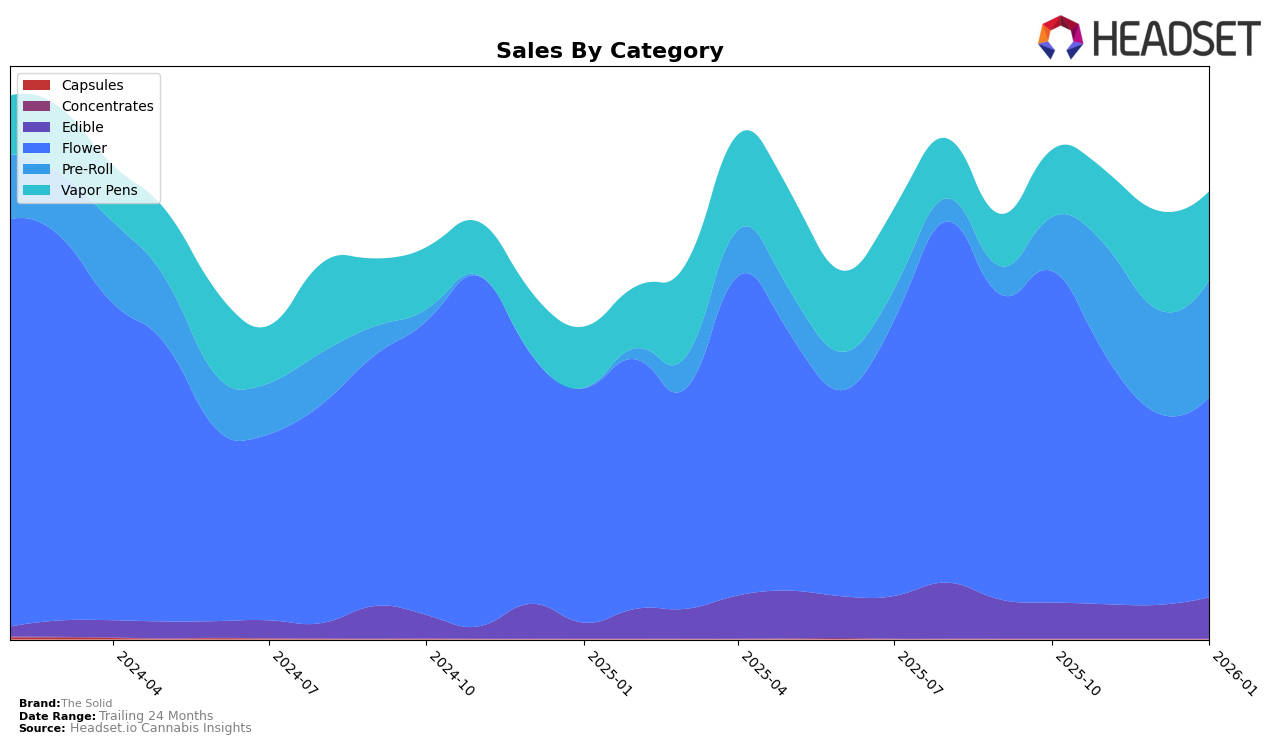

The Solid has shown varied performance across different states and product categories, with some notable trends. In Missouri, the brand's Flower category witnessed a slight improvement, moving from the 40th position in December 2025 to 36th in January 2026, accompanied by a notable increase in sales from $231,833 to $309,894. However, their Pre-Roll and Vapor Pens categories did not make it into the top 30, indicating room for improvement in these segments. Despite the ranking challenges, the steady sales in Missouri suggest a loyal customer base that could potentially be leveraged for future growth.

In contrast, Ohio presents a mixed bag for The Solid. The brand's Edible category showed a positive trend, climbing from the 32nd position in December 2025 to 24th in January 2026, hinting at growing consumer interest. The Pre-Roll category also performed well, maintaining a strong presence in the top 10, with a ranking of 8 in January 2026. However, the Flower category experienced a decline, falling from 26th in October 2025 to 46th by January 2026, suggesting potential challenges in maintaining its position in this segment. Such fluctuations highlight the competitive nature of the Ohio market and the need for strategic adjustments to sustain growth.

Competitive Landscape

In the competitive landscape of the Missouri flower category, The Solid has shown a noteworthy upward trend in its ranking, moving from 38th in October 2025 to 36th by January 2026. This improvement is significant, especially when compared to competitors like Robust, which experienced a decline from 17th to 31st in the same period. Despite Cloud Cover (C3) maintaining a relatively stable position outside the top 20, The Solid's sales have shown resilience with a notable increase in January 2026, contrasting with the declining sales trend of The Standard, which dropped from 33rd to 37th. This suggests that The Solid is gaining traction and potentially capturing market share from competitors who are experiencing a downturn in both rank and sales.

Notable Products

In January 2026, the top-performing product for The Solid was Lemon Cherry Gelato x Permanent Marker Pre-Roll (0.5g) in the Pre-Roll category, which ascended to the number one rank from the second position in December 2025, achieving notable sales of 7725 units. Brr Berry Pre-Roll (1g) made a significant entrance, securing the second spot, while Sour Lemon Marker Pre-Roll (0.5g) moved down to third from its previous top position in December. Peach Biscotti (3.5g), categorized under Flower, debuted at fourth place, indicating a strong performance. Sticky Banana Pre-Roll (1g) rounded out the top five, showcasing a diverse range of popular products in the Pre-Roll category for The Solid this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.