Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

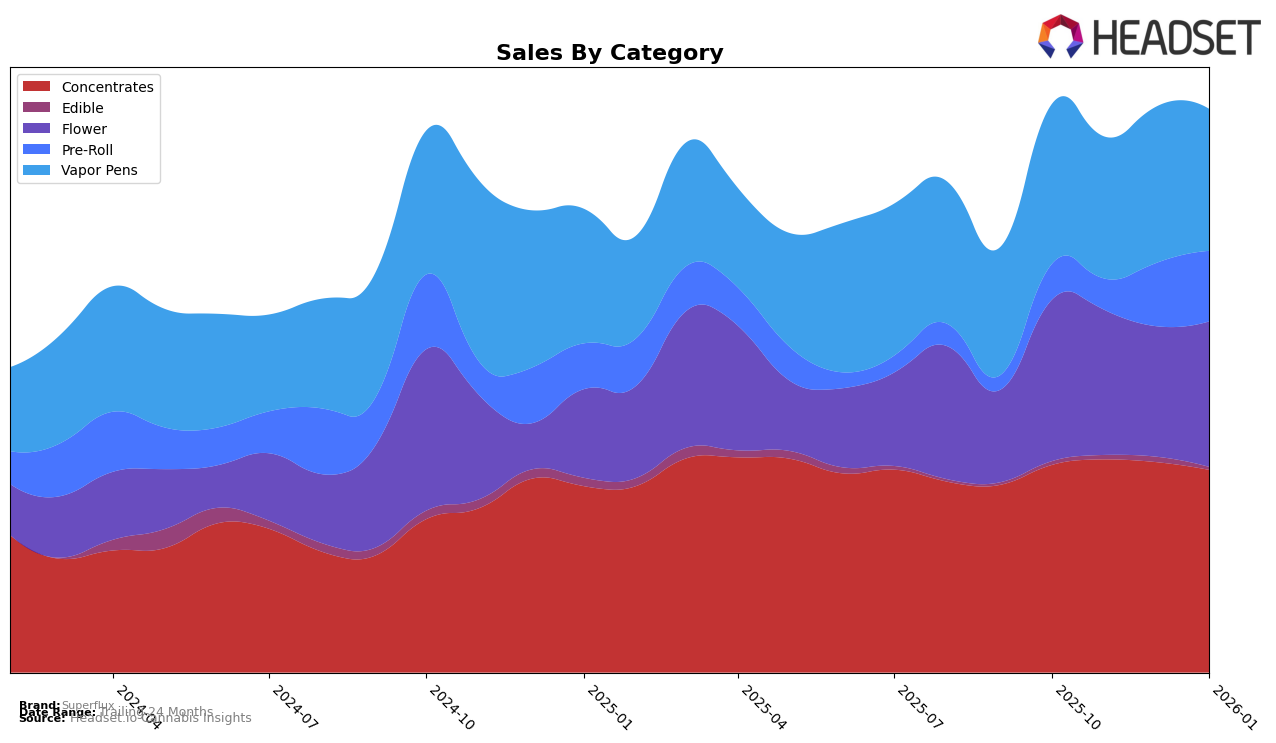

Superflux has demonstrated notable performance variations across different states and product categories. In Illinois, the brand's Concentrates category has shown strong performance, maintaining a top-three ranking from October to December 2025, before dropping to seventh in January 2026. This decline could be indicative of increased competition or shifting consumer preferences. In contrast, Superflux's presence in the Flower category in Illinois has been less prominent, with rankings outside the top 30 until a slight improvement to 60th place in January 2026. Meanwhile, in Ohio, Superflux has made significant strides in the Concentrates category, climbing from seventh place in October 2025 to an impressive third place by January 2026, suggesting a growing consumer base or successful marketing strategies in that state.

In Massachusetts, Superflux has experienced a steady decline in the Vapor Pens category, slipping from 56th place in October 2025 to 68th by January 2026, which may reflect challenges in maintaining market share or adapting to consumer demands. However, their performance in the Concentrates category in Massachusetts remains relatively stable, with rankings fluctuating between seventh and tenth place throughout the period. In New Jersey, Superflux has shown resilience in the Vapor Pens category, improving from 36th place in December 2025 to 30th in January 2026, indicating a potential recovery or strategic adjustments. These movements underscore the dynamic nature of the cannabis market and the importance of regional strategies for Superflux's continued success.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Superflux has experienced a notable shift in its market position over recent months. Initially ranked 26th in October 2025, Superflux saw a decline to 33rd by January 2026, indicating a downward trend in its competitive standing. This shift is particularly significant when compared to competitors like GreenJoy, which maintained a stronger position, ranking 24th in October 2025 and only dropping to 31st by January 2026. Meanwhile, Savvy showed fluctuations but ended January 2026 at 35th, slightly below Superflux. Despite these changes, Superflux's sales figures have shown resilience, with a slight rebound in January 2026 after a dip in December 2025. This suggests that while Superflux faces competitive pressure, particularly from brands like GreenJoy, its sales performance remains relatively stable, indicating potential for recovery if strategic adjustments are made.

Notable Products

In January 2026, the top-performing product for Superflux was PB Crunch Diamond Infused Pre-Roll 2-Pack (1g), which climbed from fifth place in December 2025 to first place with sales of 3656 units. Jungle Grapes Diamond Infused Pre-Roll 2-Pack (1g) also saw a rise in rankings, moving from fourth to second place. Grapple Pie Infused Pre-Roll 2-Pack (1g) experienced a drop, going from first in December to third in January. Jamberry OG Infused Live Resin Ground (3.5g) made its debut at fourth place. Donny Burger Diamond Infused Pre-Roll 2-Pack (1g) fell from second to fifth, indicating a shift in consumer preferences within the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.