Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

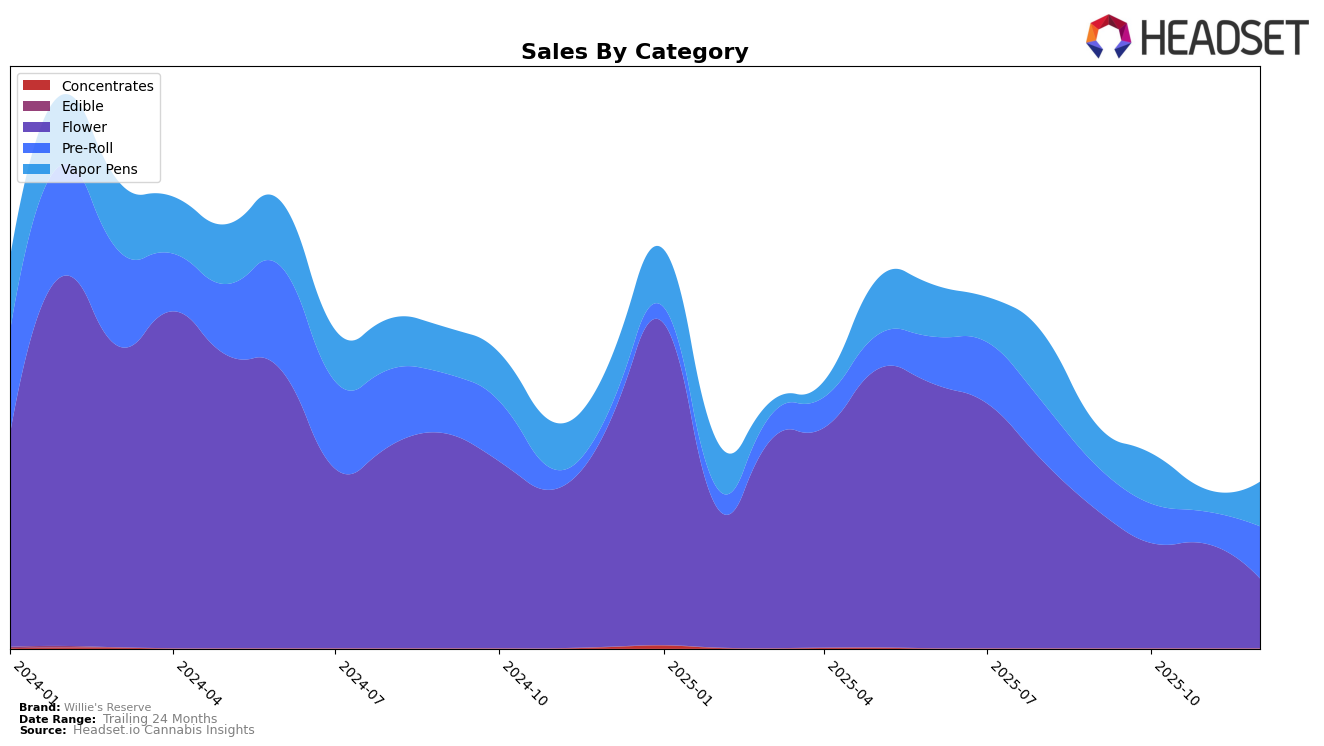

In the state of Missouri, Willie's Reserve has shown varying performance across different cannabis categories. In the Flower category, the brand maintained a consistent rank of 40th from September to November 2025, before dropping to 45th in December. This decline is notable, considering the brand's sales in this category decreased significantly from $242,391 in November to $142,727 in December. The Pre-Roll category saw a similar trend with rankings fluctuating slightly between 45th and 51st, before returning to 45th in December. Interestingly, the Vapor Pens category saw an improvement, as the brand entered the rankings at 74th in October and reached 78th by December, despite not being in the top 30 initially.

In Ohio, Willie's Reserve demonstrated a more stable performance in some categories while experiencing notable changes in others. The Flower category saw the brand's rank slightly decrease from 58th to 61st over the four months, with sales showing a downward trend. However, the Pre-Roll category brought some positive news as Willie's Reserve entered the top 30 in December, securing the 22nd position. This suggests a strong performance in this category, contrasting with their earlier absence from the rankings. Meanwhile, in the Vapor Pens category, the brand's rank fluctuated but ended exactly where it started in September, at 42nd, indicating a recovery after a dip in November.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Willie's Reserve has experienced fluctuating rankings, starting at 40th place from September to November 2025, before dropping to 45th in December 2025. This decline in rank coincides with a significant decrease in sales from November to December. In contrast, Cloud Cover (C3) maintained a consistent presence in the top 40, indicating a more stable performance, despite a downward sales trend. Meanwhile, The Solid showed resilience, improving its rank to 38th in October and November, before slightly dropping to 41st in December, with sales peaking in November. Belushi's Farm also showed some volatility, peaking at 43rd in October before settling at 46th in December. Notably, Old Pal improved its rank from 55th to 47th in November, although it fell back to 50th in December, indicating a competitive push that could impact Willie's Reserve's market share if sustained. These dynamics suggest that while Willie's Reserve remains a recognizable brand, it faces stiff competition and potential market share erosion from brands like Cloud Cover (C3) and The Solid, which are showing more consistent or improving performance trends.

Notable Products

In December 2025, the top-performing product from Willie's Reserve was the Gastro Pop Pre-Roll (1g), securing the number one rank with sales of 1780 units. The Granddaddy Purple Distillate Cartridge (1g) followed closely in second place, maintaining its strong presence from previous months where it ranked first in September and second in October. The Headband Pre-Roll (1g) achieved the third rank, showing a notable entry into the top five for the first time. The Maui Wowie BDT Cartridge (1g) was ranked fourth, while the Maui Waui Preroll (1g) completed the top five list. This month saw a reshuffling in the rankings, with the introduction of new products in the top positions compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.