Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

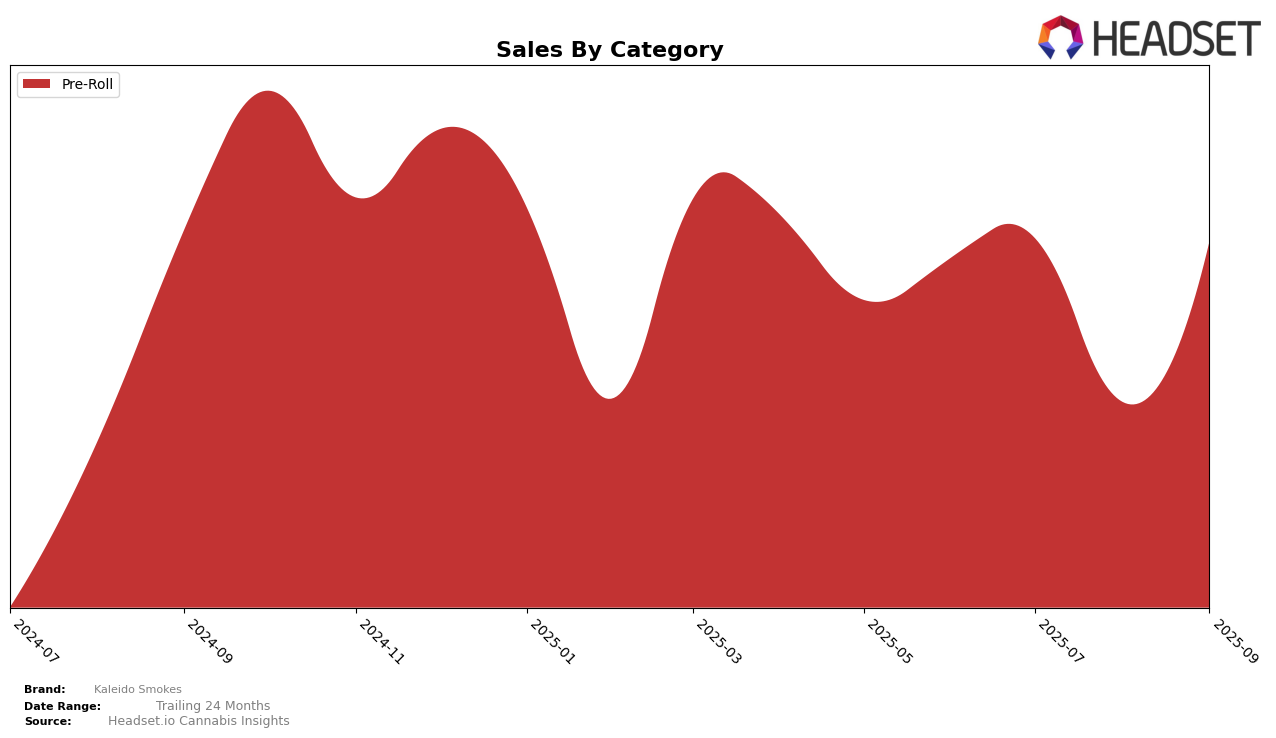

In the state of Illinois, Kaleido Smokes has shown a dynamic performance in the Pre-Roll category over the past few months. Starting from June 2025, the brand was ranked 25th, and it experienced a slight dip in July, moving to the 26th position. However, August saw a significant drop as the brand fell out of the top 30, landing at the 40th position. This decline could be attributed to various market factors or increased competition. Interestingly, by September, Kaleido Smokes made a strong comeback, climbing up to the 21st position, indicating a potential strategic shift or successful marketing efforts that helped regain its standing in the market.

Despite the fluctuations in ranking, Kaleido Smokes' sales figures in Illinois provide a more nuanced view of its performance. The brand's sales peaked in July with $181,972, suggesting a period of strong consumer interest or effective promotional strategies. However, August saw a sharp decline in sales, which aligned with their drop in ranking. By September, sales figures rebounded to $180,509, reflecting the brand’s ability to recover and possibly adapt to market demands. This rebound in both sales and ranking positions Kaleido Smokes as a resilient player in the Illinois Pre-Roll market, though the brand will need to maintain momentum to ensure sustained success.

Competitive Landscape

In the competitive landscape of the Illinois pre-roll category, Kaleido Smokes has experienced a dynamic shift in its market position over the summer of 2025. While it was not ranked in the top 20 during June, July, or August, it made a notable comeback in September, securing the 21st position. This upward movement suggests a positive trend, potentially driven by strategic marketing or product innovation. In contrast, competitors like Binske maintained a consistent presence in the top 20, albeit at the lower end, while Verano saw a significant decline from 4th in June to 22nd in September, indicating potential challenges in maintaining their earlier momentum. Meanwhile, Kaviar showed resilience by climbing back into the top 20 in September after a dip in August. These shifts highlight a competitive and fluctuating market where Kaleido Smokes' recent improvement could signal a promising trajectory if sustained.

Notable Products

In September 2025, the top-performing product for Kaleido Smokes was the Wild Ghost Berry Liquid Diamond Infused Pre-Roll 5-Pack, maintaining its number one position from August with a notable sales figure of 2239 units. Following closely, the Tropical Skunk Party Infused Pre-Roll 5-Pack secured the second spot, consistent with its previous month's ranking, though it experienced a drop in sales compared to July. The Indigo Outlaw Infused Pre-Roll 5-Pack climbed to third place after being fourth in August, indicating a positive shift in consumer preference. Meanwhile, Jungle Hooch Infused Pre-Roll 5-Pack, which consistently held the third position from June through August, fell to fourth place in September. This change in rankings highlights a dynamic market where consumer interests are shifting, particularly favoring the Wild Ghost Berry variant.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.