Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

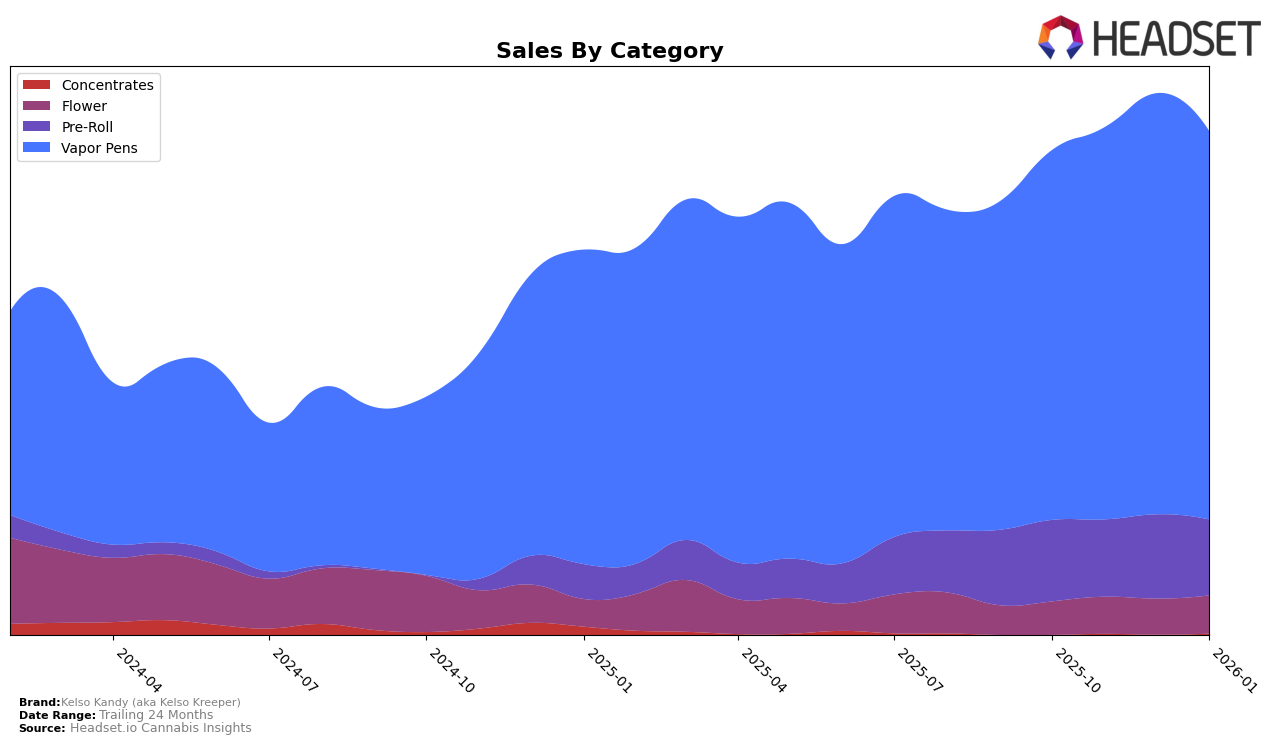

Kelso Kandy (aka Kelso Kreeper) has shown interesting performance dynamics across different categories and states. In the Pre-Roll category in Washington, the brand has not yet cracked the top 30, with rankings hovering in the 80s and 90s over the past few months. This suggests a consistent presence but indicates room for improvement in gaining market share. The sales figures for Pre-Rolls have seen some fluctuations, with a notable dip in January 2026. This might reflect seasonal trends or competition pressures, which could be areas for further exploration.

Conversely, in the Vapor Pens category, Kelso Kandy (aka Kelso Kreeper) has maintained a solid position within the top 30, consistently ranking around 27th to 29th in Washington. This stable ranking suggests a strong foothold in this category, with sales figures showing a positive trend, particularly in November and December 2025. The brand's ability to hold its ground in the top tier of this category might point to effective strategies in product differentiation or customer loyalty. Observing these trends over a longer period could provide deeper insights into the brand's competitive edge in the Vapor Pens market.

Competitive Landscape

In the competitive landscape of Vapor Pens in Washington, Kelso Kandy (aka Kelso Kreeper) has shown a consistent presence, maintaining its rank at 29th in both December 2025 and January 2026, despite a slight dip in November 2025. This stability is noteworthy given the fluctuations observed among competitors. For instance, AiroPro maintained a higher rank, consistently staying in the mid-20s, though its sales have been on a downward trend from October 2025 to January 2026. Similarly, Honey Tree Extracts experienced a decline in sales, yet managed to improve its rank slightly by January 2026. Meanwhile, Trichome Extracts / Canna Pacific showed a positive trend in sales, which helped it climb from 31st in November to 28th in January. Despite these shifts, Kelso Kandy's consistent sales performance suggests a loyal customer base that could be leveraged for future growth, especially if it can capitalize on the declining sales of some higher-ranked competitors.

Notable Products

In January 2026, the top-performing product for Kelso Kandy (aka Kelso Kreeper) was the Blue Hawaiian BHO Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking from the previous months with a sales figure of 3317. The Blue Hawaiian Infused Pre-Roll (0.8g) held steady at the second position, although its sales decreased compared to December 2025. The Grape Slushie Infused Pre-Roll (0.8g) consistently ranked third since its introduction in December 2025. New to the rankings, the Berry Gelato Distillate Cartridge (1g) entered the list at fourth place, while the Watermelon Distillate Cartridge (1g) dropped to fifth from its previous fourth position in December. Overall, the Vapor Pens category dominated the top rankings, highlighting a strong preference for these products among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.