Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

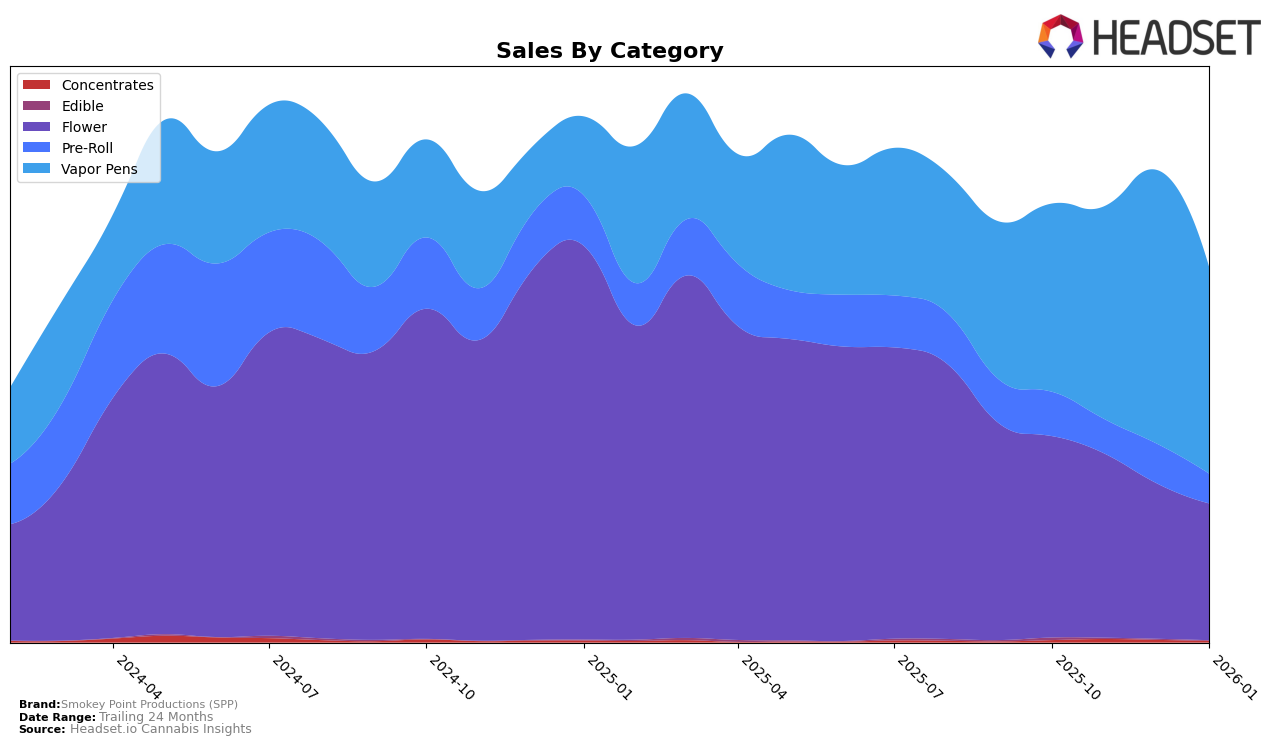

Smokey Point Productions (SPP) has shown varied performance across different product categories in Washington. In the Flower category, SPP has experienced a declining trend, with rankings slipping from 33rd in October 2025 to 45th by January 2026. This downward movement is reflected in their sales, which have decreased over the same period. Such a trend indicates a challenge in maintaining competitive positioning within the Flower category. On the other hand, the Vapor Pens category shows a more stable performance, with SPP maintaining a relatively consistent ranking, fluctuating only slightly between 23rd and 26th place. This suggests a stronger foothold and possibly a more loyal customer base within this segment.

In contrast, SPP's performance in the Pre-Roll category in Washington has been more erratic, with rankings oscillating from 79th to 90th place over the four-month span. Despite these fluctuations, SPP did not manage to break into the top 30, highlighting a potential area for growth or reevaluation. The sales figures for Pre-Rolls also reflect this inconsistency, indicating that while there might be periodic spikes in interest, sustaining momentum has been challenging. Overall, SPP's performance across categories suggests areas of both strength and potential improvement, particularly in maintaining visibility and consumer interest in the highly competitive cannabis market.

Competitive Landscape

In the competitive landscape of Vapor Pens in Washington, Smokey Point Productions (SPP) has shown a dynamic performance over recent months. Despite not making it into the top 20, SPP's rank improved from 27th in October 2025 to 23rd by December 2025, before slightly dropping to 26th in January 2026. This fluctuation highlights the competitive pressure from brands like Bodhi High, which consistently maintained a higher sales volume, and Mama J's, which made a notable leap from being unranked in October to 25th by January. Meanwhile, AiroPro and Kelso Kandy (aka Kelso Kreeper) have also been close competitors, with AiroPro slightly trailing SPP in January. These shifts suggest a volatile market where strategic adjustments could help SPP capitalize on its upward trend and potentially surpass competitors with similar sales trajectories.

Notable Products

In January 2026, the top-performing product from Smokey Point Productions (SPP) was the Strawberry Runtz Live Resin Cartridge (1g) in the Vapor Pens category, reclaiming its top spot from November 2025 after a dip to fifth place in December. The Cereal Milk Live Resin Cartridge (1g) ranked second, showing a consistent increase from its third-place position in December. The Jilly Bean Live Resin Cartridge (1g) made its debut in January rankings, securing the third position. Garlic Mimosa Live Resin Cartridge (1g) dropped from second in December to fourth in January, while Northern Lights Haze Live Resin Cartridge (1g) fell from first in December to fifth, with a notable sales figure of 639 units. These shifts indicate dynamic changes in consumer preferences for Smokey Point Productions' Vapor Pens over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.