Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

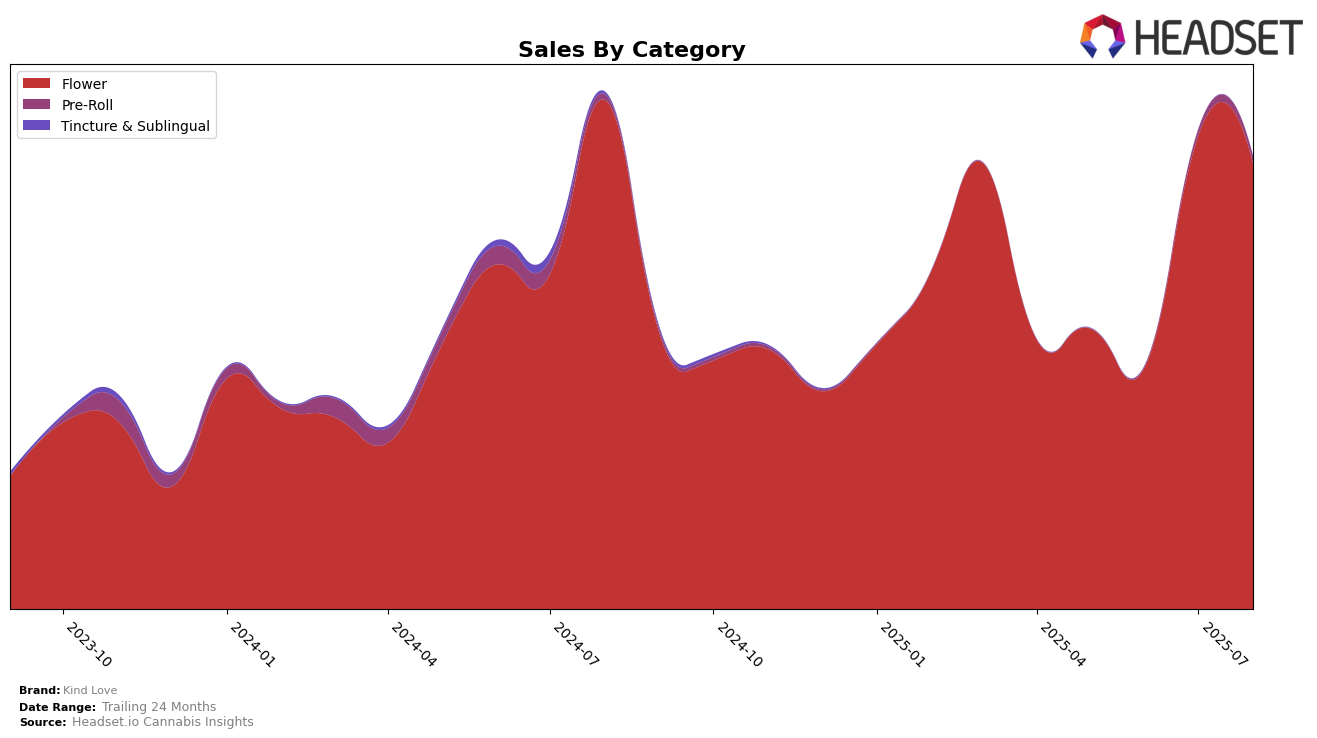

Kind Love has demonstrated a notable performance in the Flower category within Colorado. Over the summer months of 2025, the brand made significant strides, moving from the 45th position in May to a consistent 21st position by July and August. This upward trajectory indicates a strong market presence and growing consumer recognition in the state. The leap from outside the top 30 in May to a solid position in the top 25 by July suggests effective strategies in either product quality or marketing, or possibly both, which have resonated well with consumers. The sales figures reflect this positive trend, with a substantial increase from May to July, reinforcing the brand's ascending trajectory in the market.

However, it's important to note that Kind Love's performance in other states or categories is not detailed here, which could imply that the brand has not yet achieved a top 30 ranking outside of Colorado's Flower category. This absence in other rankings might suggest areas for potential growth or highlight regions where the brand could focus on improving its competitive stance. The consistent rank in Colorado's Flower category, however, underscores a strong foothold in this particular market, which could serve as a foundation for expansion into other categories or states.

```Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Kind Love has shown a notable improvement in its market position over the summer of 2025. Starting from a rank of 45 in May, Kind Love ascended to rank 21 by July and maintained this position in August, indicating a significant upward trend. This improvement is mirrored in its sales, which nearly doubled from May to July. In comparison, Green Farms also experienced a substantial rank increase from 41 in May to 17 in July, although it fell to 22 in August. Meanwhile, 14er Boulder maintained a relatively stable position, peaking at rank 10 in July but dropping to 19 in August. Artsy Cannabis Co and Hi-Fuel experienced more volatility, with Artsy Cannabis Co dropping from rank 12 in May to 24 in July before recovering to 20 in August, while Hi-Fuel consistently hovered around the mid-20s. These dynamics suggest that while Kind Love is gaining traction, it faces stiff competition from brands like Green Farms and 14er Boulder, which have also shown strong performance in the same period.

Notable Products

In August 2025, the top-performing product from Kind Love was Mint Julep (Bulk) in the Flower category, achieving the number one rank, up from fifth place in July, with sales reaching 1714 units. Poppin Bottlez (3.5g) secured the second position, marking its first appearance in the rankings. Hippy Crasher (Bulk) maintained a steady position at third place, showing consistent performance across the months. Oreoz (Bulk) entered the rankings at fourth place, while Yummy Yummy (3.5g) rounded out the top five. The rankings reflect a dynamic shift in consumer preferences, with notable upward movement for Mint Julep (Bulk) from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.