Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

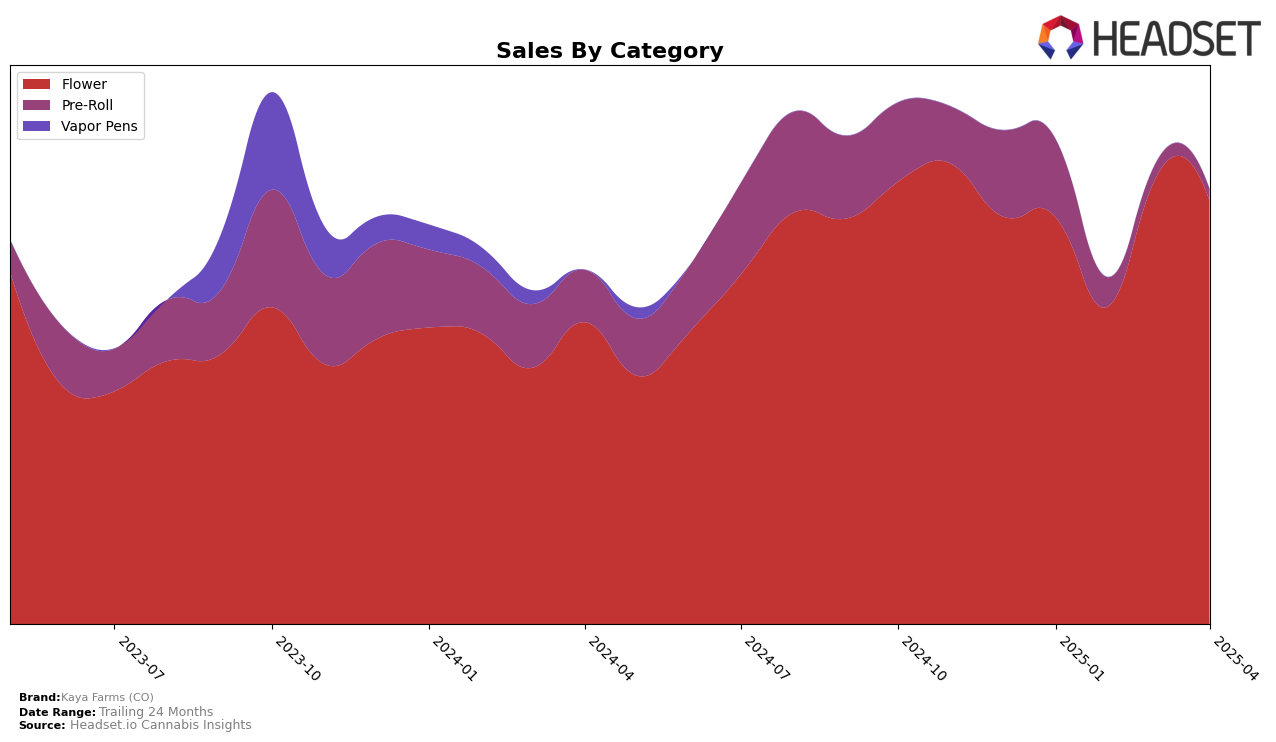

In the state of Colorado, Kaya Farms (CO) has shown notable performance in the Flower category. Starting the year with a rank of 37 in January 2025, the brand experienced a dip in February, moving to rank 46, before bouncing back to its initial position in March. By April, Kaya Farms (CO) successfully broke into the top 30, securing the 29th spot. This upward trend in the Flower category indicates a positive reception from consumers, despite the fluctuations in sales figures. The brand's ability to improve its position over the months suggests effective strategies or product offerings that resonate well with the market.

Conversely, in the Pre-Roll category within Colorado, Kaya Farms (CO) faced challenges maintaining a strong presence. The brand started at rank 48 in January and slid further to rank 69 in February. Notably, Kaya Farms (CO) did not make it into the top 30 in March and April, indicating a struggle to compete in this category. This absence from the top ranks could be a point of concern, highlighting potential areas for improvement in product offerings or marketing strategies. The contrasting performances in these two categories provide insights into where Kaya Farms (CO) might focus its efforts to enhance its market position.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Kaya Farms (CO) has shown a notable upward trend in rank from January to April 2025, moving from 37th to 29th position. This improvement is significant when compared to competitors like Natty Rems, which experienced a decline from 18th to 27th, and Kind Love, which fluctuated but ultimately fell to 30th. Meanwhile, 14er Boulder made a remarkable leap from 50th to 28th, closely aligning with Kaya Farms (CO)'s trajectory. Despite this, Kaya Farms (CO) has managed to maintain a competitive edge in sales, with a consistent increase in sales figures from March to April, indicating strong market performance. The brand's ability to climb the ranks amidst fluctuating performances of its competitors highlights its growing presence and potential in the Colorado flower market.

Notable Products

In April 2025, the top-performing product for Kaya Farms (CO) was Punch Breath (3.5g) in the Flower category, securing the number one rank with sales reaching 990 units. Following closely, Ghost Gelato Pre-Roll (1g) climbed to the second position, despite a previous dip to fifth in February, with sales of 940 units. Orange Creamsicle (Bulk), another Flower category product, took the third spot, marking its debut in the rankings. White 99 (3.5g) and Shazam (3.5g) occupied the fourth and fifth ranks, respectively, both being new entries in the rankings for April. These shifts indicate a dynamic change in consumer preferences, with new products entering the top five and some maintaining strong sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.