Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

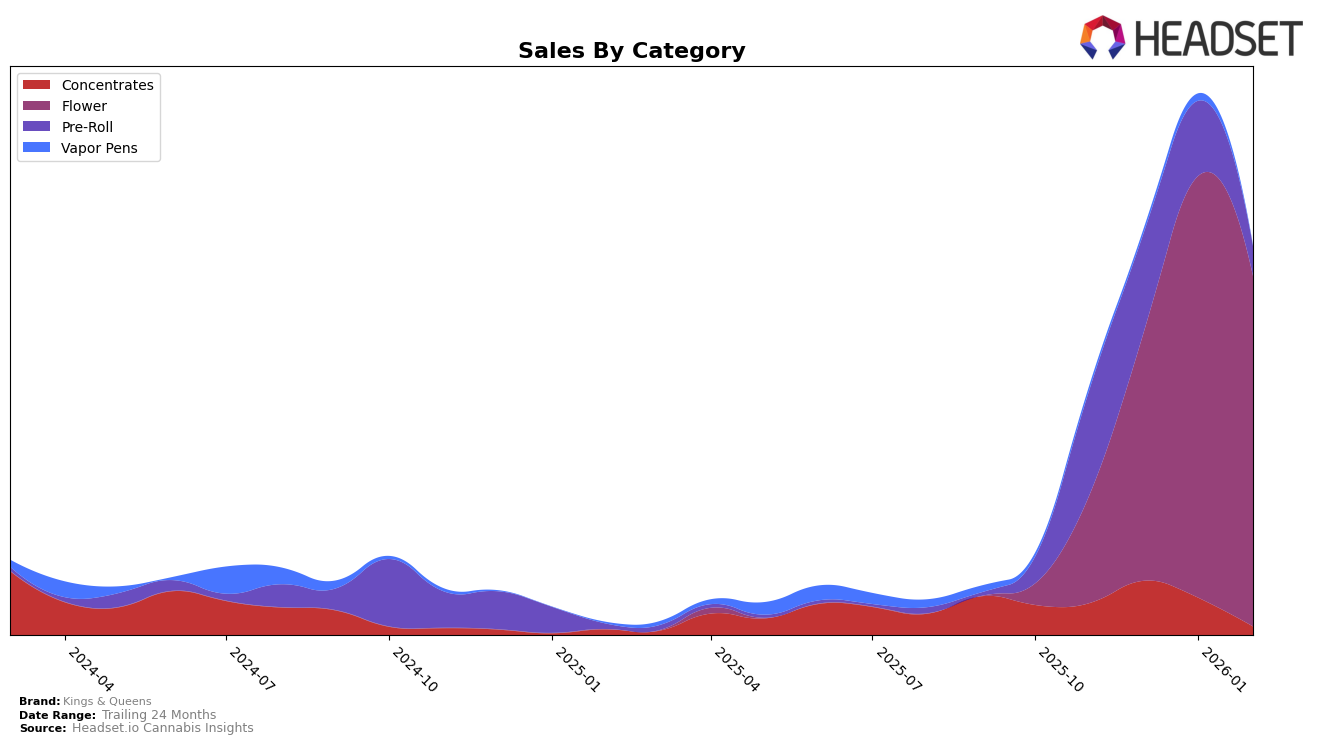

Kings & Queens has shown varied performance across different categories and states, reflecting both strengths and areas for improvement. In Maryland, the brand has maintained a consistent presence in the Concentrates category, ranking between 22nd and 23rd from November 2025 to January 2026, yet it fell out of the top 30 by February 2026. This drop indicates a potential challenge in maintaining market share within this category. Conversely, in the Flower category, Kings & Queens experienced a steady decline from November 2025 to February 2026, dropping from 48th to 53rd, which suggests a need for strategic adjustments to regain momentum. The Pre-Roll category also saw a significant decline, with the brand's ranking slipping from 24th in November 2025 to 42nd by February 2026, highlighting a notable decrease in market competitiveness.

In New York, Kings & Queens demonstrated a more dynamic performance in the Flower category. The brand was not in the top 30 in November 2025 but made a significant leap to 67th place by December 2025, followed by a further rise to 46th in January 2026. However, this upward trend slightly reversed by February 2026, with the brand ranking 51st. This fluctuation points to a competitive market environment and suggests that while the brand has gained some traction, sustaining this growth might require targeted efforts to stabilize its position. Overall, Kings & Queens' journey across these states and categories reflects a blend of promising advancements and challenges that could shape its strategic direction in the coming months.

Competitive Landscape

In the competitive landscape of the New York flower category, Kings & Queens has shown a dynamic shift in its market position over recent months. Notably absent from the top 20 rankings in November 2025, Kings & Queens made a significant leap to rank 67th in December 2025, followed by further improvement to 46th in January 2026, before slightly declining to 51st in February 2026. This upward trajectory in rank, despite the slight dip in February, indicates a positive trend in brand recognition and consumer preference. In comparison, Dragonfly Cannabis demonstrated a more volatile pattern, starting at 84th in November 2025 and peaking at 34th in January 2026, before dropping to 49th in February 2026. Meanwhile, House of Sacci maintained a stable presence, hovering around the mid-50s, which suggests a consistent consumer base but less aggressive growth compared to Kings & Queens. Heady Tree and Ithaca Organics Cannabis Co. also presented varying trajectories, with Heady Tree experiencing a decline from 31st in December 2025 to 53rd in February 2026, while Ithaca Organics improved from 89th in December 2025 to 52nd in February 2026. These trends highlight Kings & Queens' potential to capitalize on its recent gains and continue its growth in the competitive New York flower market.

Notable Products

In February 2026, Grape Mochi (3.5g) emerged as the top-performing product for Kings & Queens, climbing from a third-place rank in January 2026 to first place. Garlic Budder (3.5g) made a significant debut, securing the second spot with notable sales of 780 units. Hellcat #15 (3.5g) followed closely, ranking third, while Frosted Flakes (3.5g) and Zours (3.5g) held the fourth and fifth positions, respectively. This marks a notable shift from the previous month, where Grape Mochi (3.5g) was gaining momentum, but Garlic Budder and Hellcat #15 were not yet ranked. The consistent rise of Grape Mochi (3.5g) highlights its growing popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.