Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

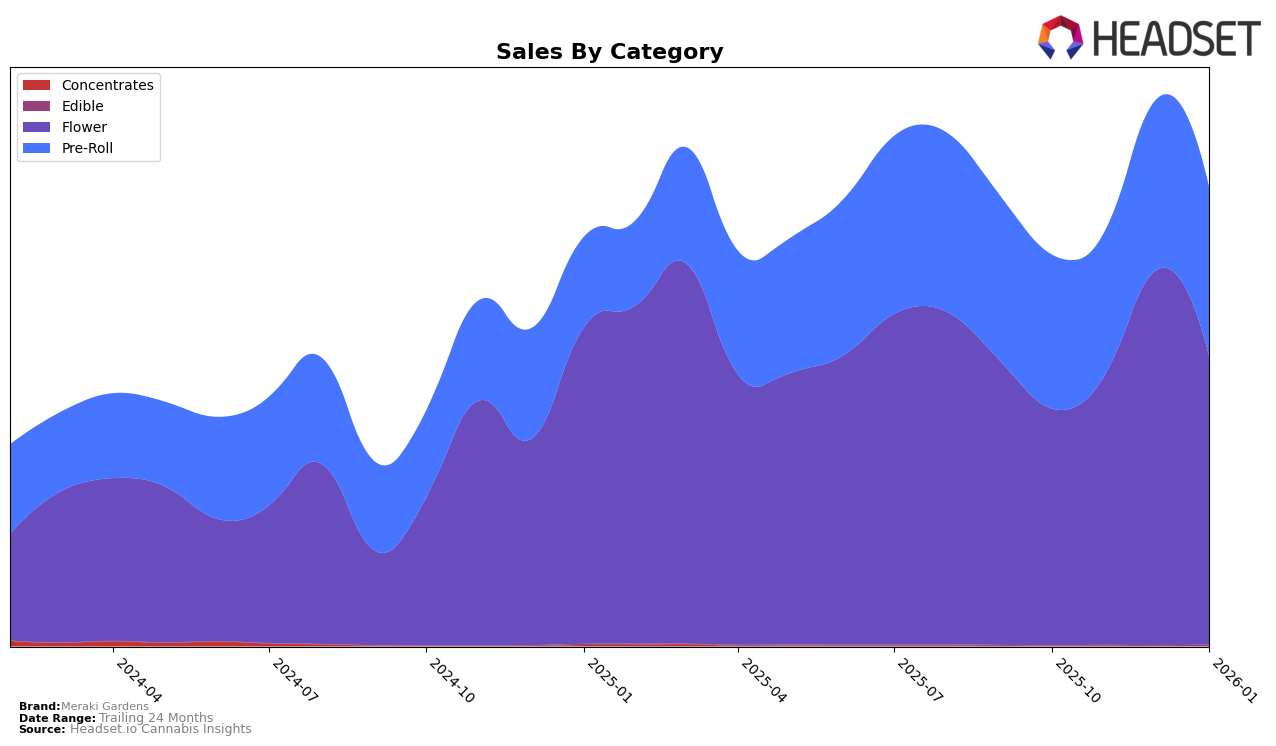

Meraki Gardens has shown varied performance across different states and categories. In Colorado, the brand's presence in the Flower category has been inconsistent, with rankings fluctuating between 41st and 61st over the past few months. This volatility might be indicative of a competitive market or shifting consumer preferences. Notably, Meraki Gardens did not break into the top 30 in Colorado, which could suggest an area for potential growth or a need for strategic adjustments. Despite this, there was a noticeable peak in sales during November 2025, suggesting a temporary boost in demand or successful promotional activities during that period.

In contrast, Meraki Gardens has maintained a stronger foothold in Oregon, particularly in the Flower category where it consistently ranked within the top 10, even reaching as high as 3rd place in December 2025. The Pre-Roll category also demonstrates stability, with rankings consistently in the top 10. This consistent performance in Oregon highlights the brand's strong market presence and consumer preference in the state. The sales figures in Oregon indicate a robust demand, especially in December 2025, when Flower sales surged significantly. This suggests that Meraki Gardens has successfully captured a loyal customer base in Oregon, potentially driven by product quality or brand reputation.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Meraki Gardens has shown a dynamic performance over the past few months. Starting in October 2025, Meraki Gardens held the 7th rank, but experienced a dip to 10th in November, before surging to an impressive 3rd place in December. However, by January 2026, it settled at 6th. This fluctuation in rank is mirrored in their sales performance, with a notable peak in December. In comparison, Grown Rogue consistently maintained a strong position, hovering around the top 3, while Otis Garden made a significant leap from 13th in October to 4th in November, reflecting a strategic gain in market share. Meanwhile, Urban Canna and High Tech displayed more stable rankings, with Urban Canna consistently outperforming Meraki Gardens in sales, indicating a need for Meraki to strategize on maintaining its December momentum to compete effectively with these established brands.

Notable Products

In January 2026, Maltese Tiger (Bulk) emerged as the top-performing product for Meraki Gardens, securing the number one rank with notable sales of 3890 units. Pure Michigan (Bulk) followed closely in second place, showing strong performance in the Flower category. Disco Biscuits (3.5g) claimed the third spot, while Sour Diesel (Bulk) dropped from its previous second-place ranking in December 2025 to fourth position in January 2026, despite having had 6756 sales in December. Super Lemon Haze (Bulk) rounded out the top five, maintaining a steady presence in the rankings. The shift in rankings from December highlights the dynamic nature of product performance within Meraki Gardens' offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.