Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

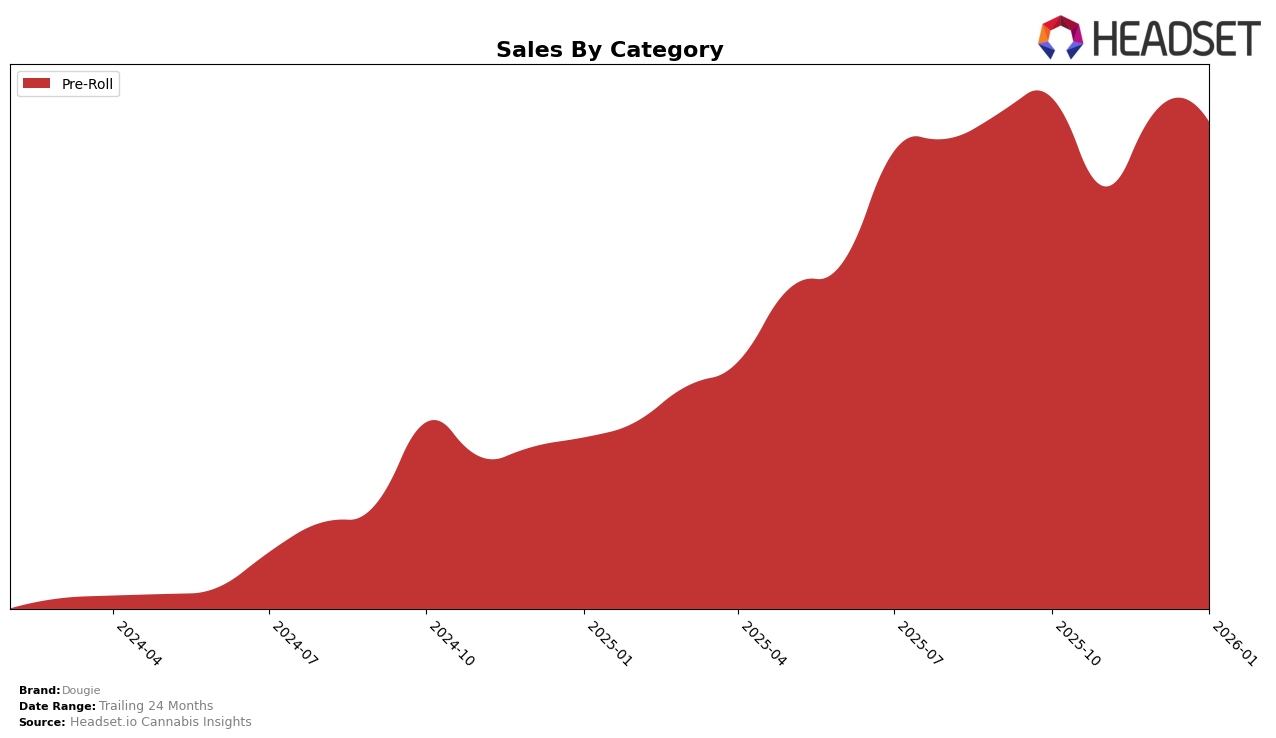

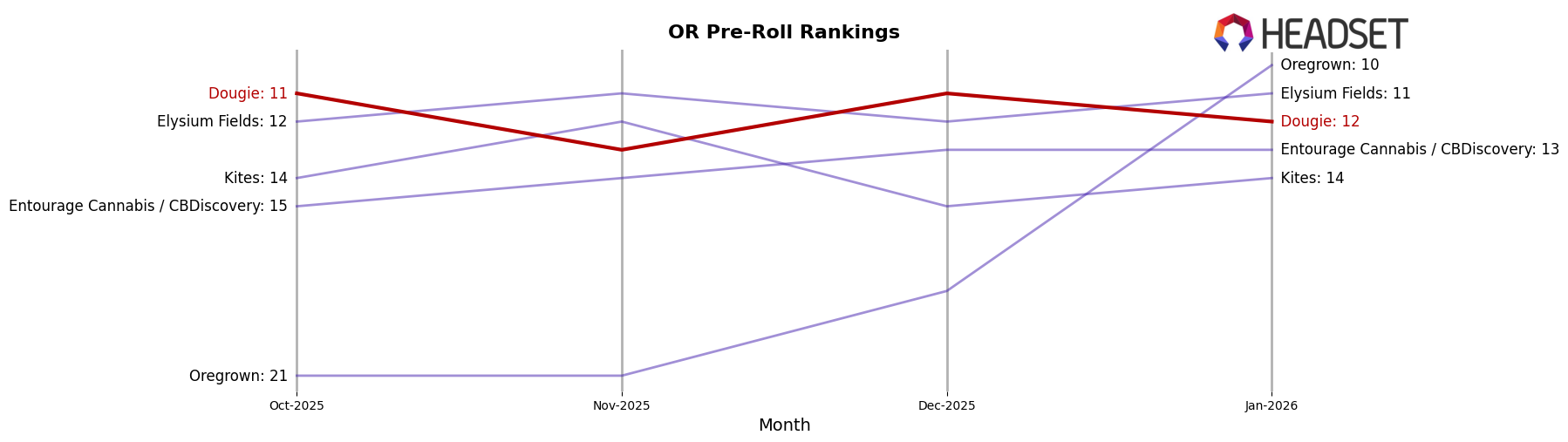

Dougie has shown a consistent presence in the Pre-Roll category in Oregon, maintaining a rank within the top 15 over the past few months. Starting at 11th place in October 2025, the brand experienced a slight dip to 13th in November but rebounded to 11th in December, before settling at 12th in January 2026. This fluctuation suggests a stable yet competitive positioning within the category. Despite the dip in November, the brand managed to recover its rank by December, indicating resilience and a potentially loyal customer base that keeps it within striking distance of the top 10. The sales figures reflect this stability, with a notable peak in October followed by a slight decrease in the subsequent months, which could be attributed to seasonal buying patterns or increased competition during the holiday period.

While Dougie's performance in Oregon's Pre-Roll category offers insights into its brand strength, it is important to note that no data is available for its ranking in other categories or states, suggesting that the brand might not have a significant presence outside this specific market or category. This absence from the top 30 in other areas could be seen as a limitation in Dougie's market penetration or a strategic focus on maintaining a stronghold in Oregon's Pre-Roll category. For stakeholders and potential investors, this could either highlight an opportunity for expansion or a need to consolidate and strengthen existing market positions. Understanding the dynamics of Dougie's performance across different states and categories could provide a more comprehensive picture of its market strategy and growth potential.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, Dougie has experienced fluctuating ranks over the last few months, indicating a dynamic market presence. While Dougie started strong in October 2025 with an 11th place rank, it saw a dip to 13th in November before recovering to 11th in December, and then slightly dropping to 12th in January 2026. This fluctuation is notable when compared to competitors like Elysium Fields, which maintained a relatively stable position around the 11th and 12th ranks, and Entourage Cannabis / CBDiscovery, which consistently held the 13th rank. Meanwhile, Oregrown showed a significant upward trend, moving from outside the top 20 in October to 10th place by January, suggesting a strong sales push. Despite these shifts, Dougie's sales figures reveal resilience, with a notable rebound in December, although it was not enough to maintain its initial ranking position. This analysis highlights the importance for Dougie to strategize effectively to maintain and improve its market position amidst strong competition.

Notable Products

In January 2026, the top-performing product from Dougie was the Gelato 41 Infused Blunt (1g) in the Pre-Roll category, leading with sales of 1801 units. The Willie Nelson Infused Blunt (2g) secured the second position, followed by the Grandaddy Purple Infused Blunt (2g) in third place. Notably, the Blue Cheese Infused Blunt (2g) dropped from its previous second place in December 2025 to fourth place in January 2026, with sales of 1033 units. Grape Ape Infused Blunt (2g) rounded out the top five. This month's rankings indicate a shift in consumer preferences, with Gelato 41 making a significant leap to the top spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.