Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

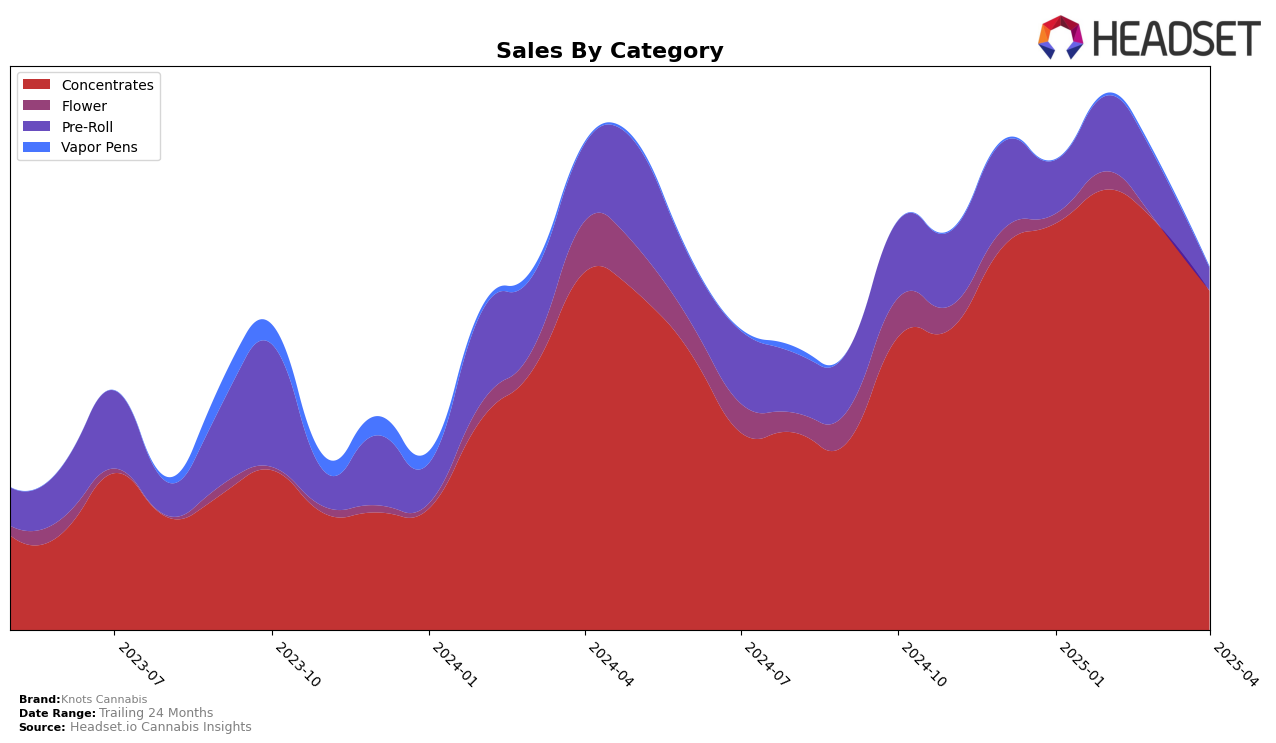

In the state of Washington, Knots Cannabis has shown fluctuating performance in the Concentrates category. Starting the year outside the top 30, they made notable progress by February, climbing to the 26th position. However, this upward trend was not sustained as March saw a slight dip to the 27th rank, and by April, they had dropped back to the 30th position. This movement indicates a volatile presence in the market, with their ranking oscillating around the lower end of the top 30. The sales figures reflect this volatility, with a peak in February followed by a noticeable decline in April, suggesting potential challenges in maintaining consistent consumer demand or possibly increased competition.

It's important to note that Knots Cannabis's presence in the Concentrates category in Washington is their only recorded activity across states and categories for the first quarter of 2025. The absence of rankings in other categories or states indicates that the brand has yet to establish a significant footprint beyond this specific market segment and location. This could be seen as a limitation in their current market strategy, highlighting potential areas for expansion or diversification. The brand's fluctuating performance in Washington might serve as a critical learning point for future strategic adjustments aimed at achieving more stable growth and exploring new opportunities across different states or product categories.

Competitive Landscape

In the Washington concentrates market, Knots Cannabis has experienced fluctuations in its rank, moving from 31st in January 2025 to a peak of 26th in February, before settling at 30th by April. This movement reflects a competitive landscape where brands like Lifted Cannabis Co and Dank Czar have seen more dramatic rank changes, with Lifted Cannabis Co dropping out of the top 20 by March and Dank Czar improving to 28th by April. Despite these shifts, Knots Cannabis has maintained a relatively stable position, suggesting a consistent sales performance amidst a competitive field. However, the brand faces pressure from From the Soil, which improved its rank to 29th in April, potentially indicating a closing gap in sales performance. This dynamic market environment underscores the importance for Knots Cannabis to leverage advanced data insights to refine its strategies and maintain its competitive edge.

Notable Products

In April 2025, the top-performing product for Knots Cannabis was White Truffle Hash Rosin (1g) in the Concentrates category, which ascended from fifth place in March to secure the number one spot, with sales reaching 309 units. Following closely, GMO Hash Rosin (1g) maintained its strong position, moving from fourth to second place. Fruit Loopz PB & J Hash Rosin Infused Pre-Roll (1g) made an impressive debut, entering the rankings at third place in the Pre-Roll category. Grease Monkey Hash Rosin (1g) experienced a slight decline, dropping from third in March to fourth in April. Lastly, GMO Micron Hash Rosin (1g) entered the top five, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.