Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

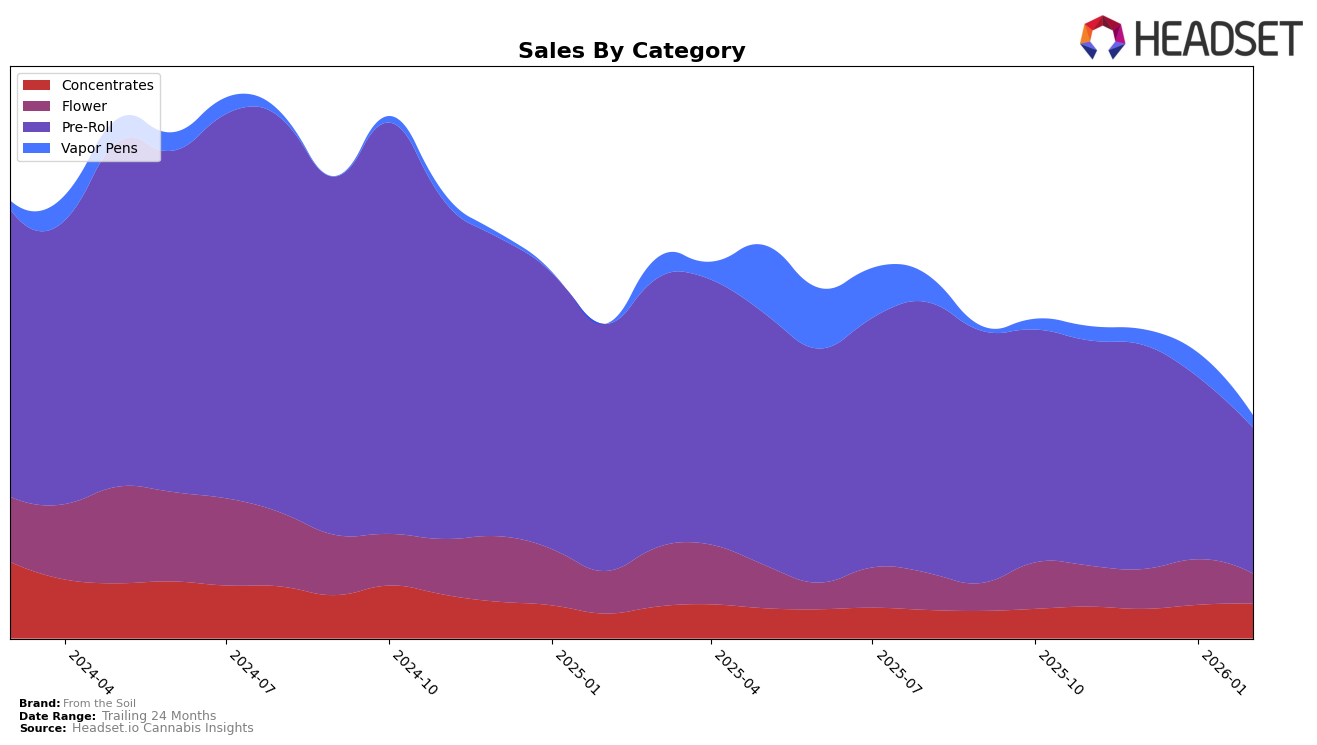

From the Soil has shown a notable trajectory in the Washington market, particularly within the Concentrates category. The brand has climbed from a rank of 39 in November 2025 to an impressive 27 by February 2026. This upward movement suggests a strengthening presence and growing consumer preference in this category. Interestingly, the Flower category tells a different story, where From the Soil's rank fluctuated, peaking at 79 in January 2026 but then falling back to 88 in February 2026. This inconsistency may indicate challenges in maintaining a competitive edge in the Flower segment.

In the Pre-Roll category, From the Soil has maintained a strong position, consistently ranking within the top 15 throughout the observed months. However, the brand's performance in Vapor Pens is less prominent, only appearing in the rankings in January 2026 at position 100, indicating they were not in the top 30 in other months. This suggests that while they have a foothold in Pre-Rolls, there's significant room for growth in Vapor Pens. Overall, the data reflects a brand with a stronghold in certain categories but facing competitive pressures and potential growth opportunities in others within Washington.

Competitive Landscape

In the competitive landscape of the Washington Pre-Roll market, From the Soil has experienced notable fluctuations in its ranking, which could impact its sales trajectory. From November 2025 to February 2026, From the Soil saw a decline in rank from 12th to 15th, indicating increased competition and potential challenges in maintaining market share. In contrast, Equinox Gardens consistently held a higher rank, maintaining 11th place through January 2026 before dropping slightly to 13th in February. Meanwhile, Forbidden Farms showed a gradual improvement, moving from 16th to 14th place, suggesting a strengthening position. Captain Yeti also displayed competitive resilience, peaking at 13th in December before settling at 16th in February. These dynamics highlight the competitive pressures From the Soil faces, necessitating strategic adjustments to regain its footing and enhance its sales performance in the evolving market.

Notable Products

In February 2026, the top-performing product from From the Soil was the Indica RSO Syringe (1g) in the Concentrates category, maintaining its first-place rank for four consecutive months with sales reaching 2469 units. The Lemon Amnesia Pre-Roll 2-Pack (1.5g) held the second spot for the second month in a row, following a rise from third place in December 2025. The GMO RootBeer Pre-Roll 2-Pack (1.5g) consistently remained in third place since January 2026, after initially ranking fourth in December 2025. The Lemon Haze Supreme Pre-Roll 2-Pack (1.5g) secured the fourth position, mirroring its rank from January 2026. Notably, the Alien Orange Cookie Pre-Roll 2-Pack (1g) debuted in the rankings in February 2026, coming in at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.