Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

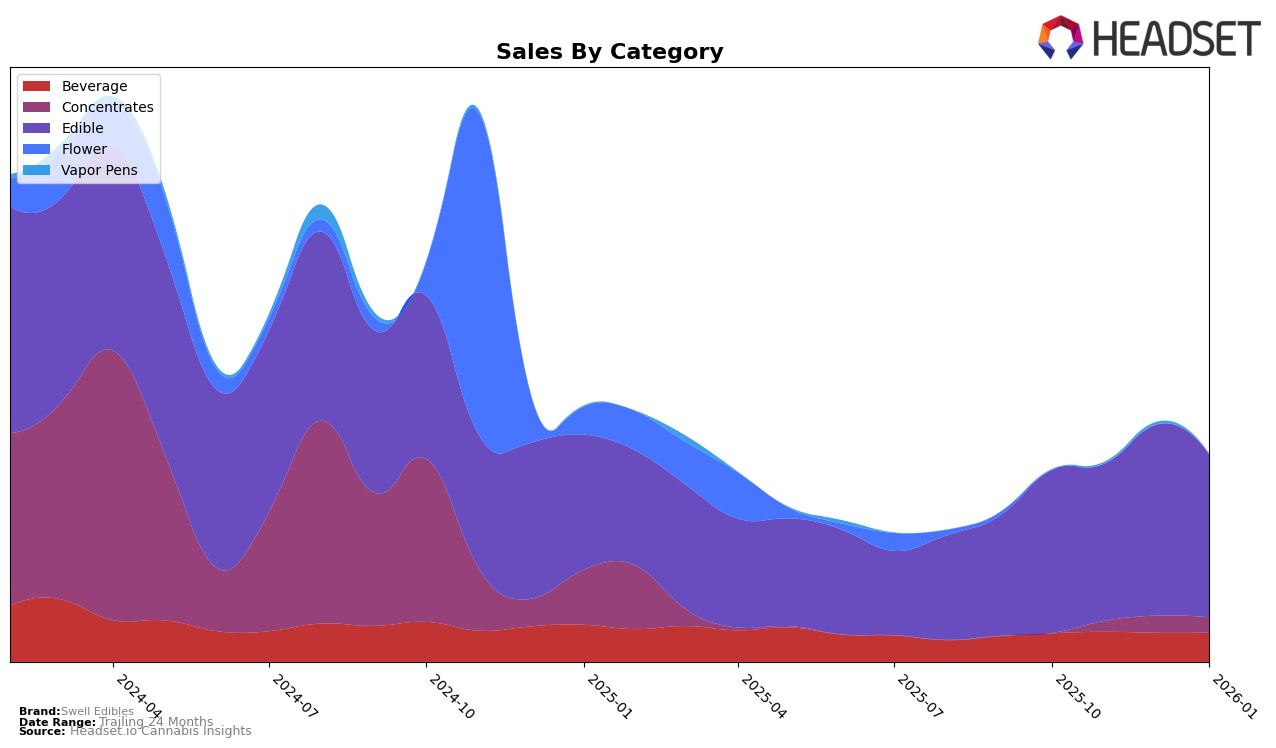

Swell Edibles has shown a consistent presence in the Washington market, particularly in the Beverage category, where they have maintained a steady ranking around the 19th and 20th positions from October 2025 to January 2026. This stability indicates a solid foothold in the market, although it suggests that there is room for growth to climb higher in the rankings. The sales figures for this category have demonstrated slight fluctuations, with a noticeable increase in November 2025, followed by a slight dip in December, and a recovery in January 2026. This pattern suggests a relatively stable demand with some seasonal variations.

In the Edible category within Washington, Swell Edibles experienced more variability in their rankings, moving from 22nd in October 2025 to 24th by January 2026. This downward trend in rankings, despite a significant sales spike in December 2025, suggests that while their products are well-received, they face stiff competition that affects their positioning. Notably, their December sales performance was a standout, hinting at a potential seasonal demand or successful promotional efforts. However, the drop in rankings by January indicates that maintaining momentum in this competitive category might require strategic adjustments.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Washington, Swell Edibles has experienced fluctuating rankings and sales, indicating a dynamic market presence. As of January 2026, Swell Edibles held the 24th rank, a slight decline from its 22nd position in October 2025, showcasing a need for strategic adjustments to regain its footing. Meanwhile, Cosmic Candy consistently maintained a position within the top 20, albeit slipping slightly to 22nd in January 2026, suggesting a stable yet competitive edge over Swell Edibles. Goodiez Gummies showed resilience by improving its rank to 23rd in January 2026, surpassing Swell Edibles, which highlights the competitive pressure from emerging brands. Additionally, Kelly's Sweet Hash Edibles demonstrated a notable upward trend, moving from 27th to 25th, potentially posing a future threat if Swell Edibles does not innovate or enhance its market strategies. These insights underscore the importance for Swell Edibles to focus on differentiating its offerings and strengthening its market position amidst strong competition.

Notable Products

In January 2026, the top-performing product for Swell Edibles was Hell's OG Cured Budder (1g) in the Concentrates category, maintaining its first-place ranking from December 2025 with sales of 699 units. The Indica Watermelon Wipeout Fruit Burst Chews 10-Pack (100mg) in the Edible category rose to second place, improving from its third-place position in December, with sales reaching 656 units. KEEN - Blue Raspberry Indica Cannabis Shot (100mg THC, 1.75oz) entered the rankings at third place, showing a strong performance with 607 units sold. Sativa Mystery Monsoon Fruit Burst Chews 10-Pack (100mg) moved up to fourth place from its previous absence in December, indicating a positive trend. Finally, KEEN - Indica Strawberry Lemonade Cannabis Shot (100mg) debuted in the rankings at fifth place, marking its first appearance with 496 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.