Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

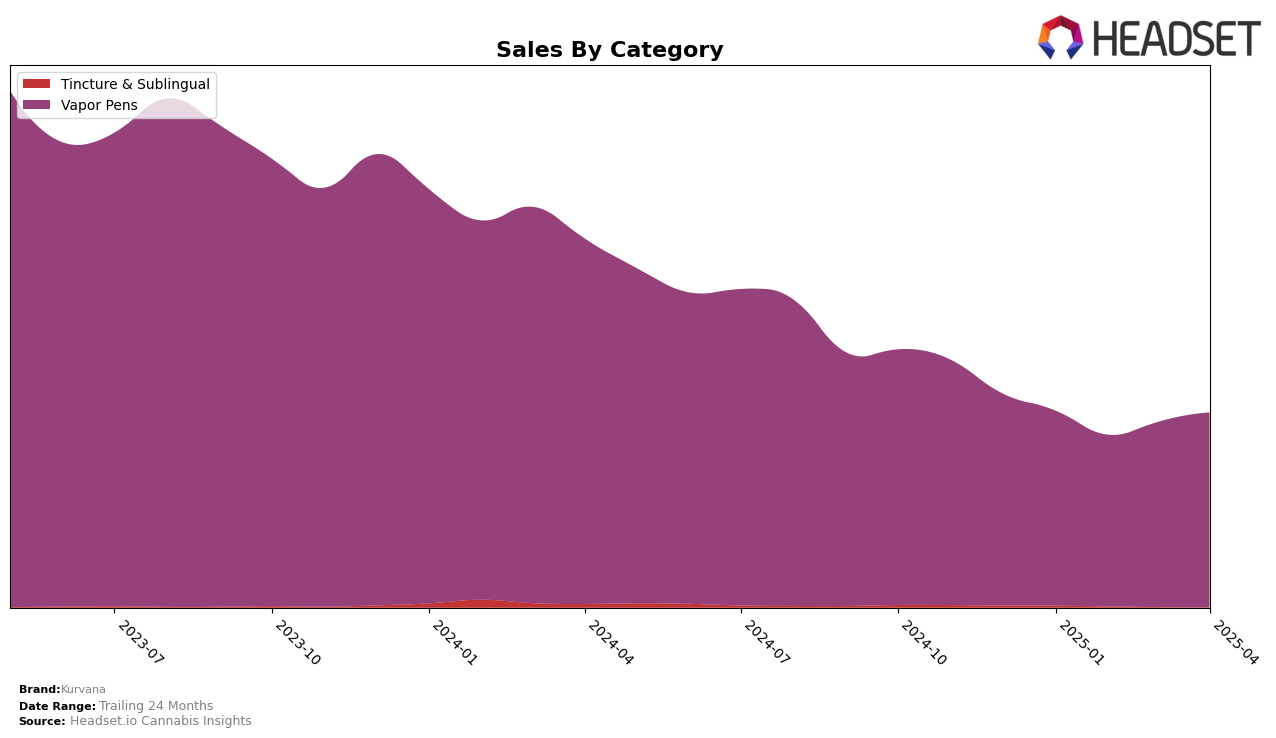

Kurvana's performance in the Vapor Pens category in California has shown a steady upward trend in rankings over the first four months of 2025. Starting the year in the 23rd position, Kurvana improved its standing to 21st by April. This consistent climb in rank indicates a positive reception and growing consumer interest in their products within the state. Despite a slight dip in sales in February, the overall sales figures suggest a recovery, with April sales nearly matching those of January. This resilience in sales performance, coupled with the upward rank movement, highlights Kurvana's strengthening foothold in the competitive California market.

However, it's important to note that Kurvana's presence is not as prominent in other states or categories, as they did not appear in the top 30 rankings outside of California for the Vapor Pens category during this period. This could suggest a more localized success or a strategic focus on the California market, where they have managed to make notable progress. The absence from the top 30 in other regions might indicate potential areas for growth or a need for strategic expansion to enhance their national footprint. Observing Kurvana's future strategies and market entries will be crucial for understanding their long-term positioning and growth trajectory across different states and product categories.

Competitive Landscape

In the competitive landscape of vapor pens in California, Kurvana has shown a steady improvement in rank from January to April 2025, moving from 23rd to 21st place. This upward trend is indicative of a positive shift in market presence, despite being outside the top 20 initially. Notably, Sauce Essentials experienced a fluctuating rank, ending in 19th place in April, which suggests a competitive edge over Kurvana but with less stability. Meanwhile, ABX / AbsoluteXtracts saw a decline from 18th to 20th, indicating potential vulnerabilities that Kurvana could capitalize on. Micro Bar and UP! also demonstrated varying performances, with Micro Bar dropping to 23rd and UP! improving to 22nd, both of which could impact Kurvana's strategic positioning. These dynamics highlight Kurvana's potential to further climb the ranks by leveraging its current momentum and addressing the market opportunities presented by competitors' inconsistencies.

Notable Products

In April 2025, Kurvana's top-performing product was ASCND - Purple Punch Full Spectrum Cartridge (1g) in the Vapor Pens category, which climbed to the number one rank with notable sales of 1319 units. ASCND - Candy Jack Full Spectrum Cartridge (1g) secured the second position, showing a significant rise from its absence in previous months' rankings. ASCND - Jet Fuel Full Spectrum Cartridge (1g) held the third spot, slightly dropping from its second place in March. The Orange Cookies and Wedding Cake variants also made it to the top five, ranking fourth and fifth respectively, both making their debut in the rankings. Overall, April saw a reshuffling in product popularity, with Purple Punch making a remarkable leap to the top.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.