Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

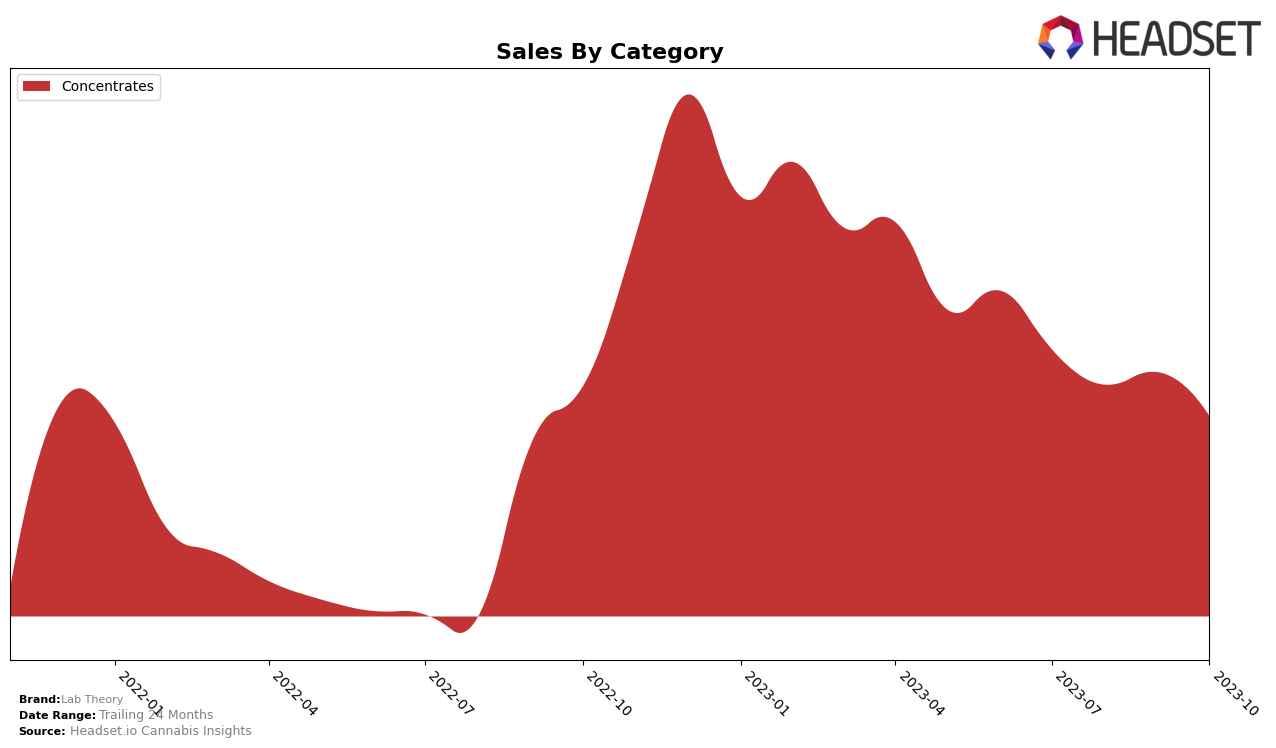

In the cannabis concentrates category, Lab Theory's performance has shown significant disparities across different provinces. In Alberta, the brand has struggled to maintain a steady rank, fluctuating from 37th place in July to 40th place in October. This inconsistency, coupled with a noticeable drop in sales from September to October, suggests a need for strategic improvement in this market. On the other hand, in British Columbia, Lab Theory has managed to maintain a strong presence in the top 20 brands, with ranks ranging from 16th to 18th over the four months. Despite a slight dip in sales, the brand's steady ranking demonstrates its solid foothold in this province.

Contrastingly, in Ontario, Lab Theory's performance in the concentrates category has been considerably weaker. The brand's ranking has progressively slipped from 67th in July to 74th in October, and this decline is reflected in its dwindling sales. It's important to note that not appearing in the top 20 brands for a given month indicates a less than optimal performance. While these numbers may seem concerning, they also present an opportunity for the brand to reassess and revitalize their strategy in this market. The data suggests a trend, but further analysis would be needed to fully understand the brand's position and potential in Ontario.

Competitive Landscape

In the Concentrates category within British Columbia, Lab Theory has seen a slight decrease in rank from July to October 2023, moving from 16th to 17th place. This indicates a potential decline in sales, as it's being outperformed by competitors such as Pura Vida and Nugz, who have maintained higher ranks throughout the same period. Interestingly, despite a drop in rank, Nugz seems to be selling significantly more than Lab Theory. Other competitors like Phyto Extractions and Greybeard are showing a gradual improvement in rank, indicating an increase in sales and posing a potential threat to Lab Theory. It's worth noting that both Phyto Extractions and Greybeard were not in the top 20 brands in July, but have since climbed into the top 20, highlighting the dynamic nature of this market.

Notable Products

In October 2023, the top-performing product from Lab Theory was the 'Sour Cookies Live Resin THCA Diamonds (1g)' in the Concentrates category, maintaining its number one rank from previous months with a sales figure of 692 units. The 'Hybrid Diamonds (1g)' also in the Concentrates category, held onto its second position but experienced a decrease in sales from 481 units in September to 340 units in October. 'Apple Toffee Diamonds & Sauce (1g)', another Concentrates product, moved up to the third position in October from the fourth in September, with a slight increase in sales from 9 to 29 units. 'Apple Toffee Diamonds (1g)' dropped to the fourth position in October, with a significant drop in sales from 58 units in September to just 7 units. Lastly, 'Tangie Cookies Live Resin (1g)' reentered the top five in October, after not being ranked in September, with sales of 4 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.