Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

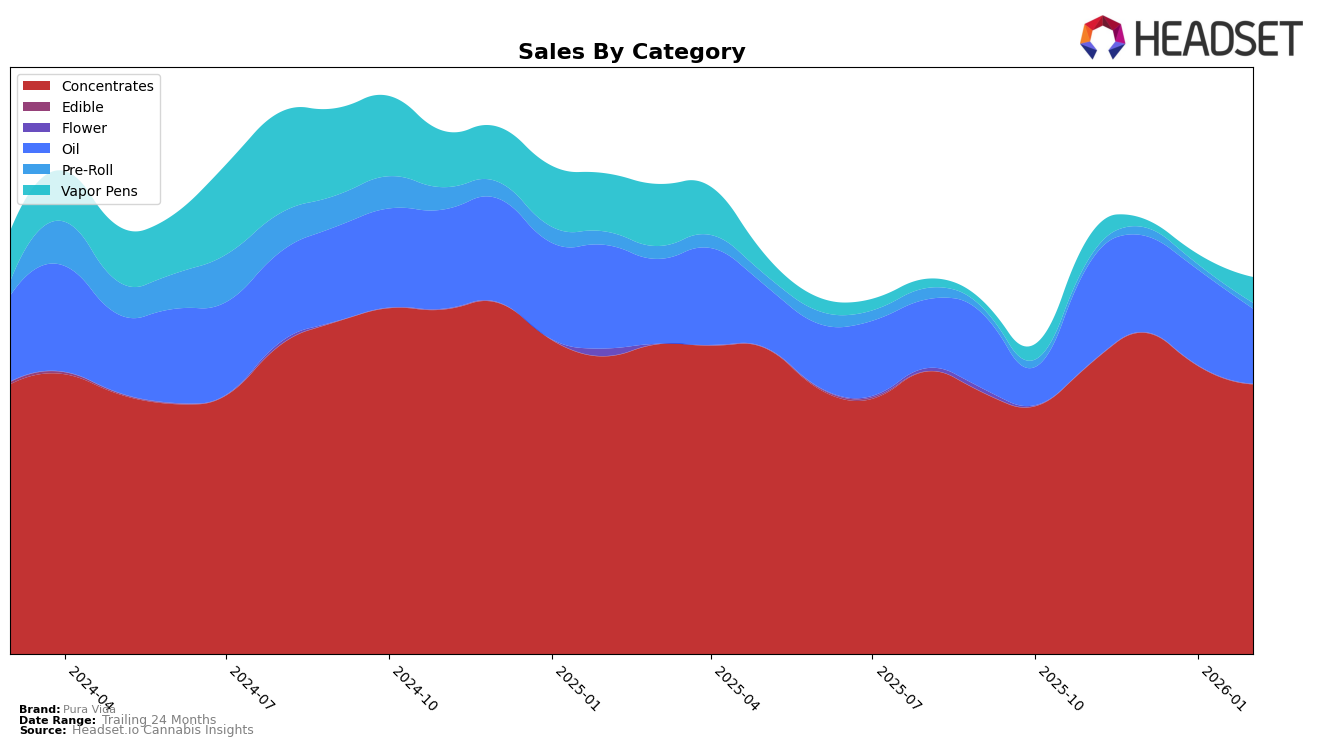

Pura Vida has shown varied performance across different categories and regions, highlighting both strengths and areas for improvement. In Alberta, the brand has experienced a notable upward trajectory in the Concentrates category, moving from 24th in November 2025 to 16th by February 2026. This improvement is underscored by a steady increase in sales, indicating growing consumer interest. Conversely, in British Columbia, Pura Vida maintained a consistent top 10 ranking in the Concentrates category, although there was a slight dip in sales towards February 2026. The Oil category in British Columbia is where Pura Vida shines brightest, consistently holding the 2nd position, showcasing the brand's strong foothold in this segment.

In Ontario, Pura Vida's performance in the Concentrates category has been relatively stable, fluctuating slightly but maintaining a strong presence within the top 4 positions. This stability is reflected in the sales figures, which, although showing a decline in February 2026, still indicate a significant market presence. However, the brand's entry into the Vapor Pens category in Ontario, achieving a 67th rank, suggests room for growth and potential market penetration strategies. Meanwhile, in Saskatchewan, Pura Vida's performance in the Oil category remains strong, consistently ranking within the top 5, while its recent entry into the Concentrates category at 11th position indicates a promising start. These movements highlight Pura Vida's strategic positioning and potential for further expansion across these regions.

Competitive Landscape

In the Ontario concentrates market, Pura Vida has shown a consistent performance, maintaining a strong presence with ranks fluctuating between 3rd and 4th place from November 2025 to February 2026. Despite facing stiff competition from leading brands like Vortex Cannabis Inc., which consistently held the top spot, and Nugz (Canada), which secured the 2nd position throughout this period, Pura Vida has managed to hold its ground. Notably, Pura Vida's sales figures have seen a slight decline, which is a trend mirrored by other competitors such as Endgame. This indicates a potential market-wide contraction or seasonal fluctuation. However, the brand's ability to reclaim the 3rd position in February 2026, after a brief dip to 4th in December 2025 and January 2026, suggests resilience and a strong brand loyalty among consumers. Meanwhile, Thrifty has been climbing the ranks, moving from 7th to 5th, which could indicate rising competition in the lower ranks that Pura Vida should monitor closely.

Notable Products

In February 2026, Pura Vida's top-performing product was the Sativa Honey Oil Dispenser (1g) in the Concentrates category, maintaining its leading position from January with sales of 2998 units. The Indica Honey Oil Dispenser (1g) secured the second spot, consistent with its January ranking, showing a slight decrease in sales. Pineapple Express Jumbo Slab Shatter (1.2g) rose to third place, improving from its fourth position in January, indicating a positive trend in consumer preference. Indica Nightfall Honey Oil Drops (30ml) ranked fourth, maintaining its January position but with a notable decrease in sales figures. Zombie Kush Cured Resin (1.2g) held steady at fifth place, showing stability in its sales performance over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.