Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

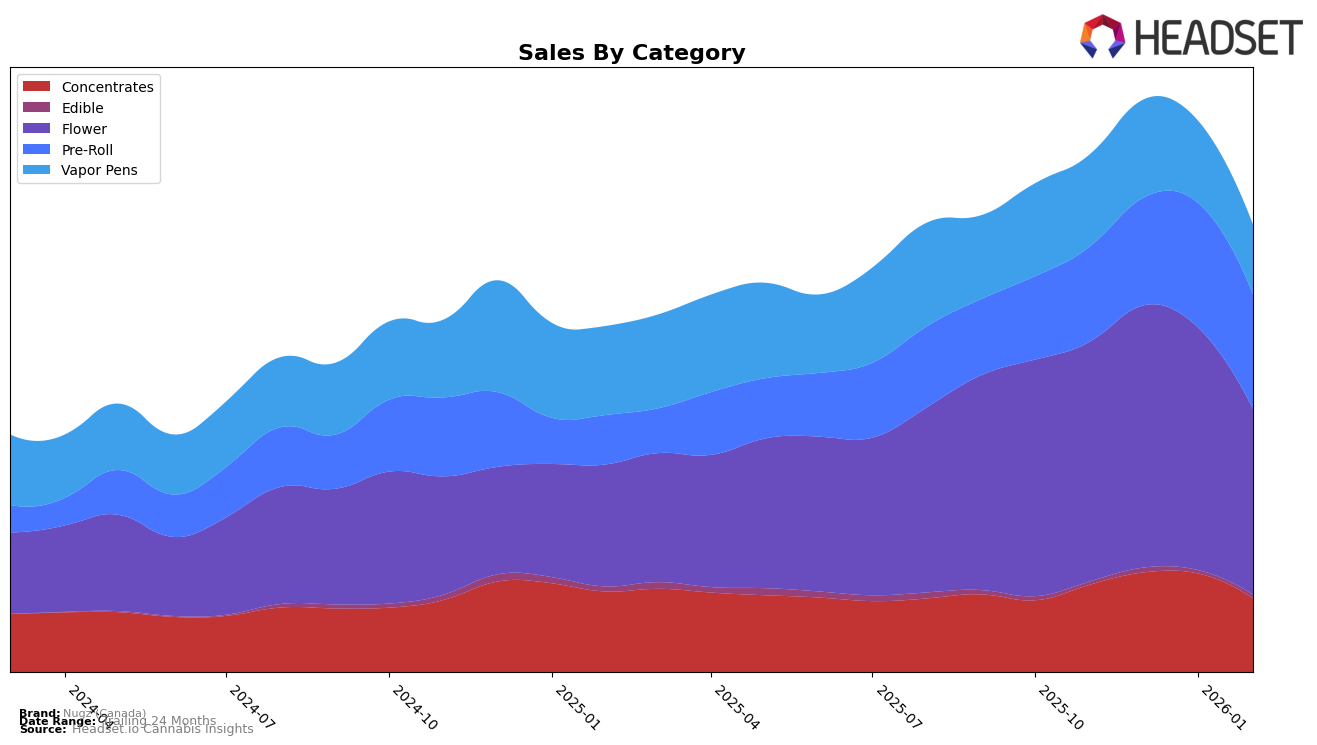

Nugz (Canada) has shown varied performance across different provinces and categories, highlighting both strengths and areas for improvement. In Alberta, the brand maintained a stable position in the Concentrates category, consistently ranking 6th from November 2025 to February 2026, despite a noticeable decline in sales. However, their performance in the Flower category saw a downward trend, slipping from 15th to 20th position over the same period. The Pre-Roll category also reflected a challenging landscape, with Nugz dropping out of the top 30 in January 2026, only to slightly recover to 26th by February. This indicates potential volatility in consumer preferences or increased competition in these segments.

In Ontario, Nugz (Canada) demonstrated a strong presence in the Concentrates category, maintaining a solid 2nd place ranking over four months. This consistency was mirrored in the Flower category, where the brand retained a top 10 position, fluctuating slightly between 10th and 11th place. Interestingly, the Pre-Roll category in Ontario saw significant improvement, with Nugz climbing from 54th in November 2025 to a steady 23rd by January and February 2026, suggesting a successful strategy or product offering in this area. In contrast, British Columbia presented challenges, particularly in the Flower category, where Nugz failed to make it into the top 30 by February 2026, indicating a need for strategic reassessment in this market.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Nugz (Canada) has experienced some fluctuations in its rank over the months from November 2025 to February 2026. Starting at the 12th position in November, Nugz (Canada) improved to the 10th spot in December and January, before slightly dropping to 11th in February. This indicates a relatively stable performance amidst a competitive market. Notably, Pepe has shown strong performance, consistently ranking higher than Nugz (Canada), with a peak at 9th place in January and February. Meanwhile, Redecan experienced a decline from 10th in November to 12th in February, suggesting potential challenges that Nugz (Canada) could capitalize on to improve its standing. Additionally, Tenzo demonstrated a positive trend, moving up to 10th place in February, which could pose a competitive threat to Nugz (Canada) if this upward trajectory continues. Overall, while Nugz (Canada) maintains a competitive position, the dynamic shifts among its competitors highlight the importance of strategic adjustments to sustain and improve its market rank.

Notable Products

In February 2026, the top-performing product for Nugz (Canada) was the Flavour Bomb 40- Fruit Blast Taster Pack Infused Pre-Roll 5-Pack (2.5g) in the Pre-Roll category, climbing to the number one rank with notable sales of 9,889 units. Kingpin Wrap Sativa Infused Pre-Roll (1g) maintained a strong position, moving up to second place from its previous third position in January 2026. The Flower category's Wagyu Delight (7g) saw a drop to the third rank after consistently holding the top spot for the past three months. Wagyu Delight Pre-Roll 7-Pack (3.5g) remained stable in fourth place, while Guava Jam (7g) continued its decline, slipping to fifth place. This shift in rankings highlights a growing preference for infused pre-rolls over traditional flower products among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.