Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

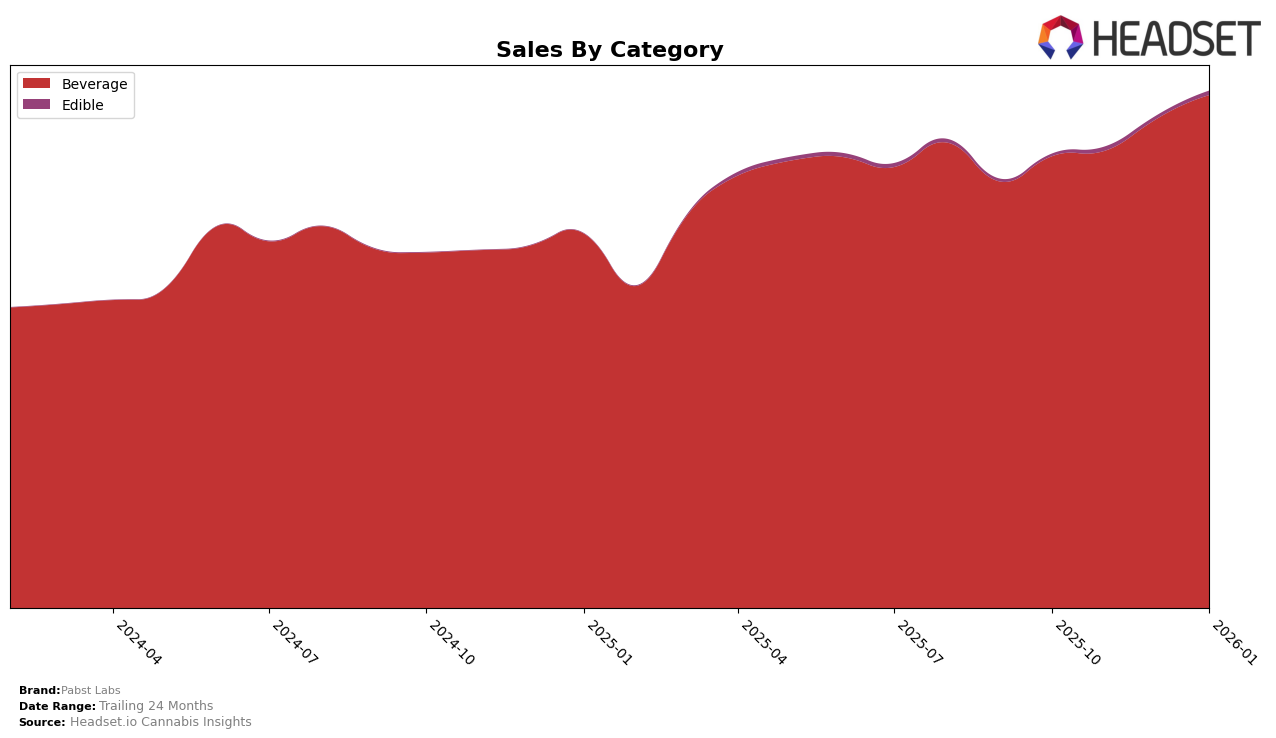

Pabst Labs has demonstrated a consistent performance in the California beverage category, maintaining a steady rank of 4th place from October 2025 through January 2026. This stability suggests a strong foothold in the California market, where they have managed to sustain their position despite the competitive nature of the cannabis beverage sector. Notably, their sales figures have shown an upward trend, with a notable increase from November to January, indicating a positive reception and possibly an expanding consumer base. However, it is worth mentioning that Pabst Labs has not appeared in the top 30 rankings in any other state or province during this period, which highlights both the strength of their California presence and the opportunity for growth in other regions.

Across the evaluated months, Pabst Labs' performance in terms of sales has been robust, with the brand experiencing a consistent increase in sales figures in California. This upward trajectory is indicative of either successful marketing strategies, product acceptance, or a combination of both. The brand's ability to maintain its 4th place rank amidst increasing sales suggests that competitors are also growing, yet Pabst Labs is effectively holding its ground. While the absence of rankings in other states may initially seem concerning, it also highlights the potential for strategic expansion and the untapped markets that could benefit from Pabst Labs' offerings. This data provides a snapshot of their current market position and hints at potential areas for growth and development.

Competitive Landscape

In the competitive landscape of the cannabis beverage market in California, Pabst Labs consistently holds the 4th rank from October 2025 through January 2026, demonstrating a stable position amidst dynamic shifts among competitors. Notably, Uncle Arnie's maintains a strong lead at the 2nd rank throughout this period, highlighting a significant gap in market dominance. Meanwhile, Not Your Father's Root Beer consistently ranks 3rd, closely trailing behind Uncle Arnie's but still ahead of Pabst Labs. The competition between Manzanita Naturals and CANN Social Tonics for the 5th and 6th positions indicates a more volatile market segment, with CANN Social Tonics showing a positive trend by moving up to 5th place in January 2026. Pabst Labs' steady rank suggests resilience but also highlights the need for strategic initiatives to close the sales gap with the top three brands and capitalize on the fluctuating positions of its trailing competitors.

Notable Products

In January 2026, Pabst Labs' top-performing product was the Cherry Limeade Soda Pop, maintaining its first-place ranking consistently since October 2025 and achieving sales of 10,542 units. The High Seltzer - THC/THCV 2:1 Daytime Energy Guava Seltzer held steady in the second position, showing a positive sales trend from previous months. The High Seltzer - CBD/CBN/THC Midnight Berries Seltzer remained in third place, reflecting stable demand. The Strawberry Kiwi High Seltzer stayed at fourth, indicating consistent performance over the months. Notably, the Watermelon Melon Soda Pop 4-Pack, which entered the rankings in November 2025, retained its fifth position in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.