Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

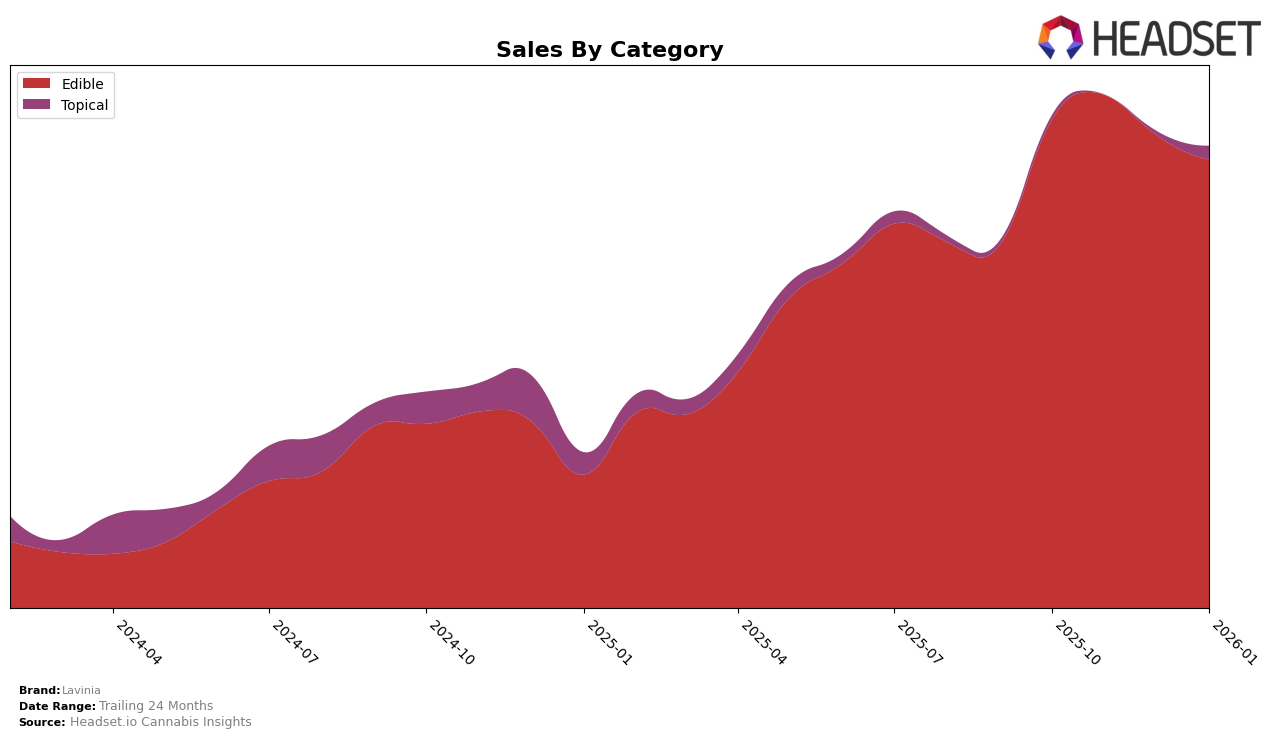

In the competitive landscape of cannabis brands, Lavinia has shown a consistent presence in the edible category within California, although it has not broken into the top 30 rankings over the past few months. Despite this, the brand has maintained a stable performance, with a slight decline in sales from November 2025 to January 2026. This indicates a potential challenge in gaining a stronger foothold in the market, as the brand's rank has slightly decreased from 45th in October and November 2025 to 47th by January 2026. The stability in sales figures suggests that while Lavinia has a loyal customer base, it faces stiff competition from other brands in the same category.

Interestingly, while Lavinia's position in the edible category in California shows a downward trend in rankings, the sales figures reveal a more complex picture. The brand experienced a peak in sales in November 2025, reaching $50,741, before seeing a gradual decrease over the following months. This fluctuation could be attributed to seasonal buying patterns or promotional strategies that were more effective during that period. The absence of Lavinia in the top 30 rankings in any month could be seen as a challenge for the brand to enhance its market presence and visibility. However, the consistent sales figures suggest that there is room for growth and potential strategies that could be employed to improve its ranking and market penetration in the coming months.

Competitive Landscape

In the competitive landscape of the edible cannabis category in California, Lavinia has experienced slight fluctuations in its rank over the past months, moving from 45th in October 2025 to 47th by January 2026. This indicates a minor decline in its competitive positioning. Notably, Kikoko has maintained a consistent presence, holding steady at 40th place, suggesting strong brand stability and consumer loyalty. Meanwhile, Breez has shown some volatility, yet managed to improve its rank from 45th in December 2025 to 41st in January 2026, indicating a positive trend in consumer preference. Korova and Care By Design have not been in the top 20 during this period, but Korova's sales spike in November 2025 suggests potential for future growth. For Lavinia, these insights highlight the need for strategic marketing efforts to regain competitive ground and capitalize on emerging consumer trends within this dynamic market.

Notable Products

In January 2026, Before Sleep - Peach-Mango Gummies 10-Pack (100mg) emerged as the top-performing product for Lavinia, with sales reaching 788 units. This product climbed from third place in December to secure the first rank. Before Sex - Watermelon Gummies 10-Pack (100mg) fell to the second position despite consistently holding the top rank in the previous months. Before Sex - Orange Creamsicle Gummies 10-Pack (100mg) maintained its third-place ranking. Notably, Oh.Hi Lubricant entered the rankings in January, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.