Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

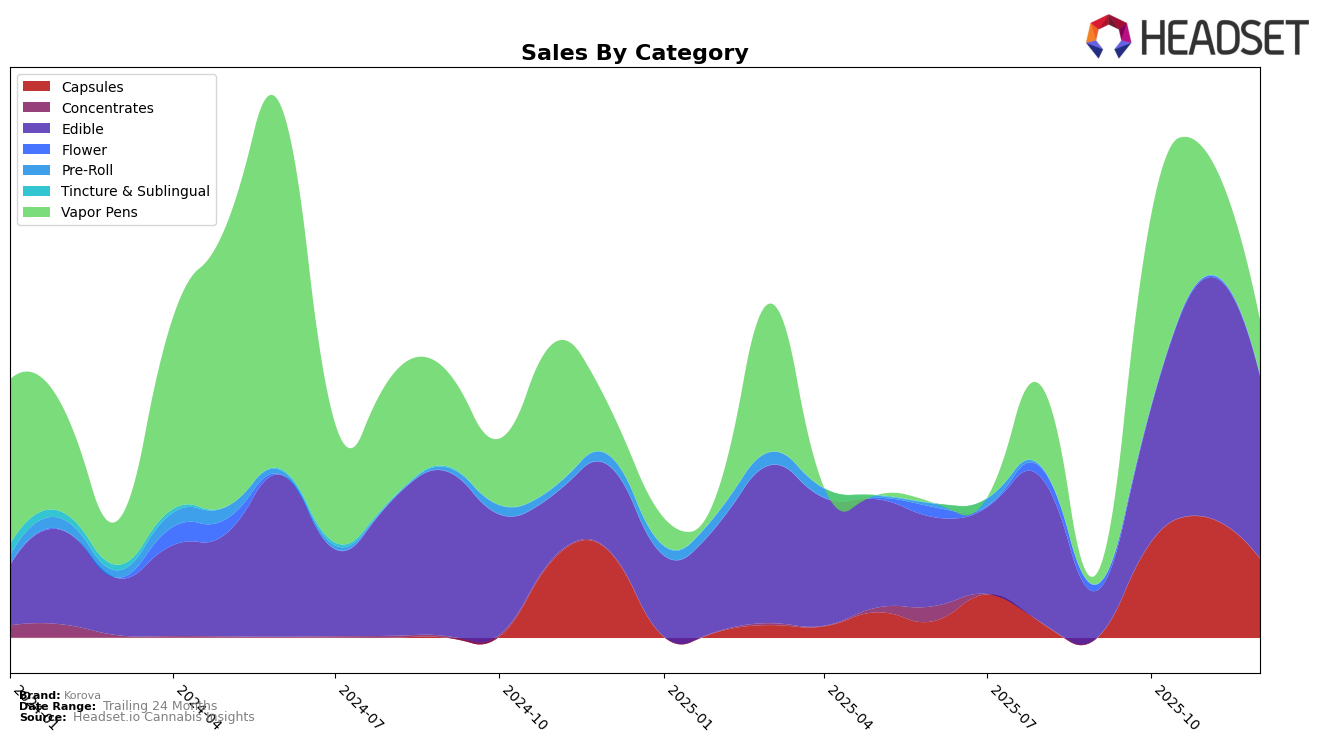

Korova has shown notable performance fluctuations across different categories and states in recent months. In the California market, for instance, Korova's presence in the Capsules category has been consistent, maintaining a steady rank of 14 from October to December 2025. This consistency suggests a solid foothold in this category, despite not being in the top 30 in September. Conversely, their performance in the Edible category has seen a more dynamic shift, moving up from rank 74 in September to reach 39 by November, before settling at 49 in December. This indicates a volatile yet improving presence in the Edible market, although the drop in December might warrant further analysis to understand underlying causes.

While Korova's sales figures in the Edible category in California show an upward trend from September to November, peaking at over $61,000, the subsequent decrease in December raises questions about sustainability and market strategy. The absence of a top 30 ranking in the Capsules category in September, followed by a consistent rank of 14, highlights a significant breakthrough in market penetration. This could be indicative of successful product launches or strategic marketing efforts that resonated well with consumers. However, to fully understand Korova's competitive stance and potential growth opportunities, a deeper dive into specific consumer behaviors and market conditions would be beneficial.

Competitive Landscape

In the competitive landscape of the edible category in California, Korova has demonstrated notable fluctuations in rank and sales over the last few months of 2025. Starting from a rank of 74 in September, Korova climbed to 39 in November before settling at 49 in December. This upward trajectory in the earlier months coincided with a significant increase in sales, peaking in November. In contrast, Breez maintained a relatively stable position, hovering around the low 40s, with consistent sales figures. Meanwhile, Lavinia showed steady performance with minimal rank changes, indicating a stable market presence. City Roots, although starting lower, made a notable jump in December, reflecting a potential growth trend. The absence of Green Revolution in the top 20 suggests a less competitive stance in this category. Korova's dynamic rank changes highlight both opportunities for growth and the need for strategic positioning to maintain its competitive edge in the evolving California edibles market.

Notable Products

In December 2025, Korova's top-performing product was Citrus Geltab 10-Pack (1000mg) in the Capsules category, maintaining its first-place rank from the previous two months with sales of 563 units. Chocolate Chip Dip Mini Cookies 10-Pack (100mg) in the Edible category held steady in second place, despite a sales decrease from November to December. Pineapple Sorbet Distillate Disposable (1g) in Vapor Pens climbed to third place, showing an improvement from its fifth-place ranking in October. Mimosa Diamonds Live Resin Disposable (1g) dropped to fourth place, continuing its decline from second place in October. Lastly, Biggie Cookie 10-Pack (1000mg) entered the rankings in December, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.