Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

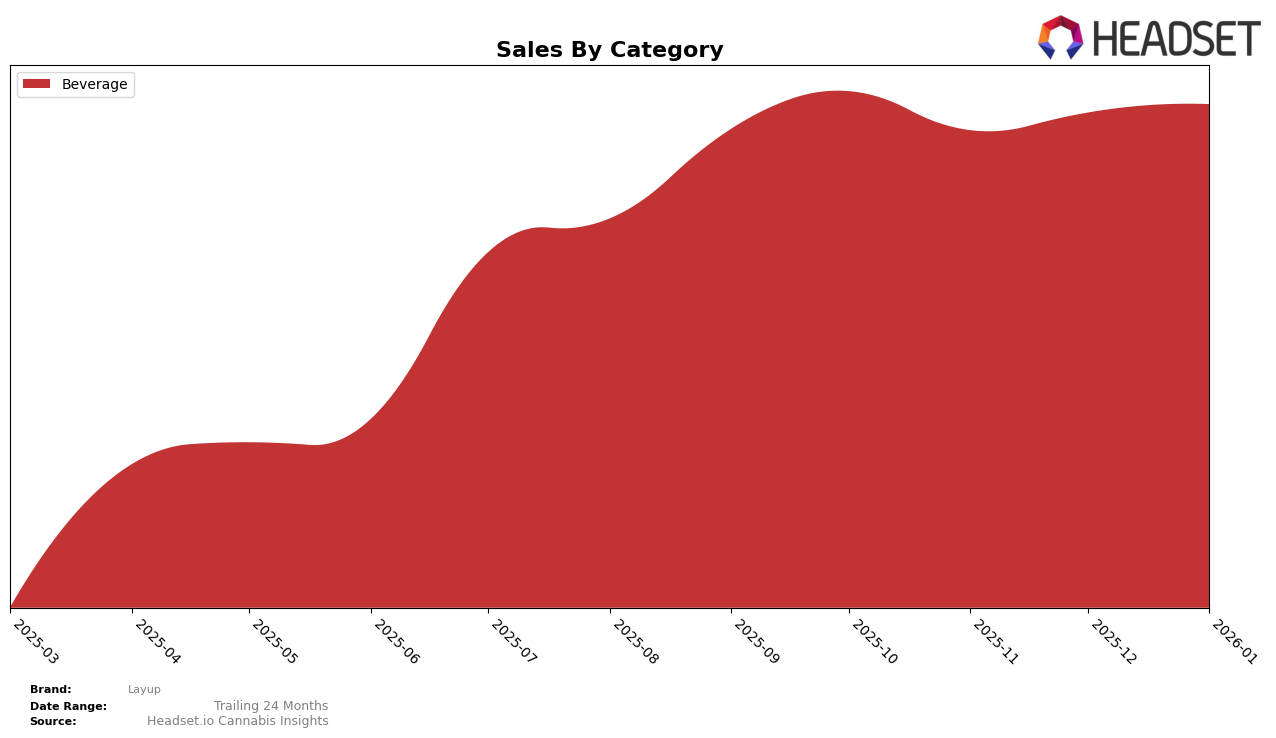

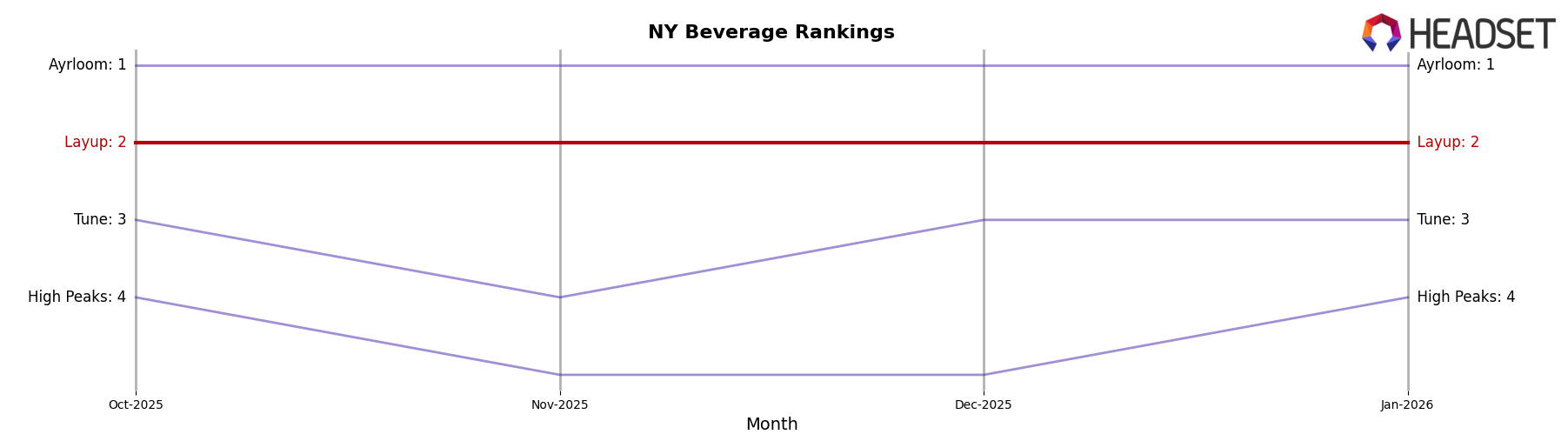

Layup has demonstrated remarkable consistency in the New York cannabis beverage category, maintaining a steady rank of 2nd place from October 2025 through January 2026. This consistent performance suggests a strong foothold in the market, with sales figures showing minor fluctuations but overall stability. The brand's ability to sustain its position in New York's competitive beverage sector underscores its strong market presence and consumer loyalty. However, it's worth noting that Layup's absence from the top 30 in other states or provinces indicates potential areas for growth or challenges in expanding its market reach beyond New York.

While Layup's sales figures in New York reveal a slight dip in November 2025, followed by a recovery in the subsequent months, it is crucial to consider the broader implications of these trends. The brand's resilience in maintaining its ranking amidst fluctuating sales could point to effective marketing strategies or a loyal customer base that compensates for seasonal or competitive pressures. The absence of Layup in the top 30 rankings in other states or provinces suggests either a strategic focus on New York or potential hurdles in scaling operations or brand recognition elsewhere. This presents an intriguing opportunity for the brand to explore new markets or strengthen its presence in existing ones.

Competitive Landscape

In the New York beverage category, Layup consistently holds the second rank from October 2025 to January 2026, showcasing stability in its market position. Despite maintaining its rank, Layup faces stiff competition from Ayrloom, which dominates the top spot with significantly higher sales figures, indicating a strong brand presence and consumer preference. Layup's sales figures, although stable, are notably lower than Ayrloom's, suggesting a potential area for growth if Layup can enhance its market appeal or product offerings. Meanwhile, Tune and High Peaks trail behind Layup, with Tune consistently ranking third and High Peaks fluctuating between fourth and fifth positions. This competitive landscape highlights Layup's need to innovate and differentiate to close the sales gap with Ayrloom while maintaining its lead over Tune and High Peaks.

Notable Products

In January 2026, Limeade Lemonade maintained its position as the top-selling product for Layup, with consistent sales figures of 11,468 units. Black Cherry Lemonade saw a notable rise in rank, moving from fourth place in the previous months to second in January, with sales reaching 8,115 units. Strawberry Lemonade held steady in third place, showing little change in its sales trajectory. Peach Tea entered the rankings at fourth, demonstrating a significant increase compared to previous months where it was unranked. Ice Tea Lemonade rounded out the top five, maintaining its fifth-place position from December 2025, with a modest increase in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.