Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

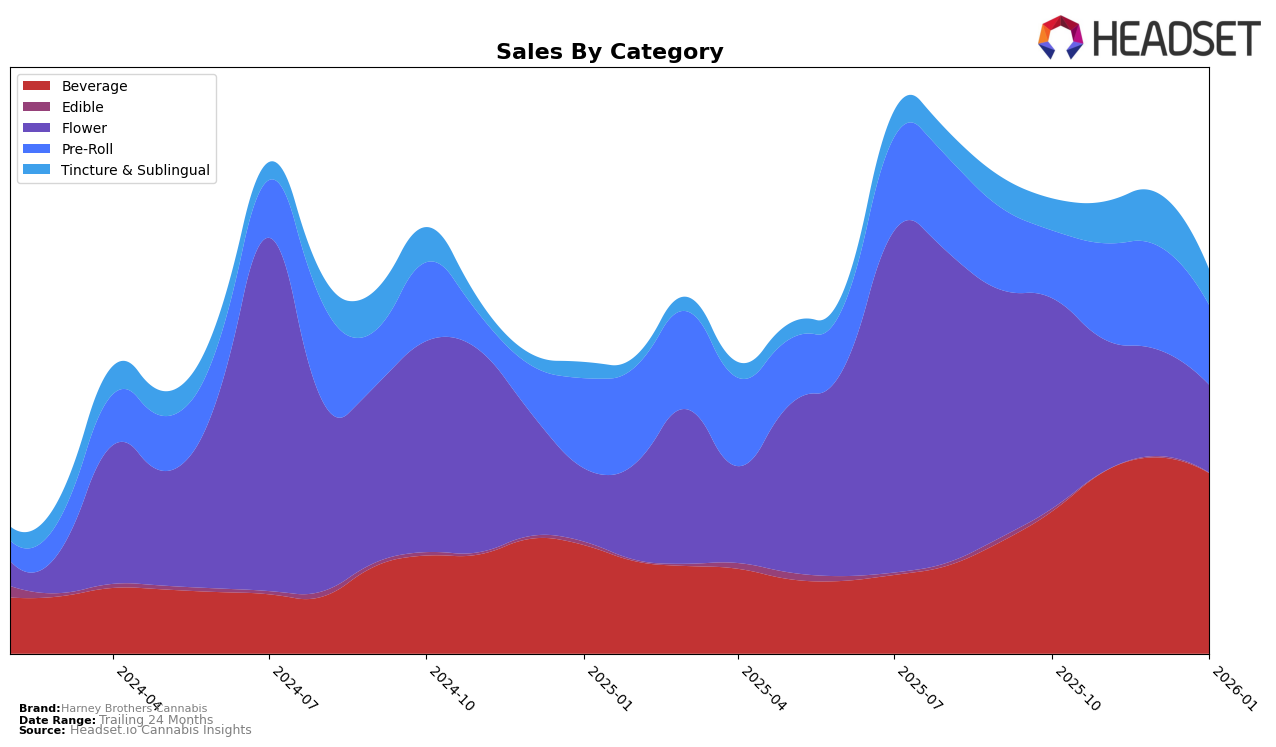

Harney Brothers Cannabis has shown a dynamic performance in the New York market, particularly in the Beverage category. Over the past few months, the brand has consistently ranked within the top five, peaking at third place in November 2025. This upward movement is indicative of a strong consumer preference for their beverage products, which saw significant sales growth in November. However, it's worth noting that their ranking slightly dipped back to fifth in January 2026, suggesting potential seasonal fluctuations or increased competition. In contrast, their performance in the Flower category has been less prominent, with an initial ranking of 77th in October 2025, after which they did not appear in the top 30 for subsequent months, indicating a challenge in maintaining visibility in this competitive sector.

In the Pre-Roll category, Harney Brothers Cannabis has faced difficulties in gaining traction within the top rankings. Starting from outside the top 30 in October 2025, they managed to enter the rankings at 85th position in November, but their position gradually declined to 97th by January 2026. This downward trend highlights potential areas for improvement in product offerings or marketing strategies. Conversely, the brand has maintained a more stable presence in the Tincture & Sublingual category, with rankings fluctuating between eighth and tenth place over the four-month period. This consistency suggests a steady consumer base for these products, although the slight drop from eighth to ninth in January could indicate emerging competitive pressures. Overall, Harney Brothers Cannabis exhibits a mixed performance across categories, with notable strengths in beverages but challenges in other areas.

Competitive Landscape

In the competitive landscape of the New York cannabis beverage market, Harney Brothers Cannabis has experienced notable fluctuations in its ranking over recent months. From October 2025 to January 2026, Harney Brothers Cannabis saw its rank shift from 5th to 3rd, then back to 5th, indicating a dynamic competitive environment. This fluctuation is particularly significant when compared to consistent performers like Tune, which maintained a strong position in the top 3 throughout the same period. Meanwhile, High Peaks showed resilience by climbing back to 4th place in January 2026, after a temporary dip to 5th. The rise of Klaus from 10th to 8th place suggests increasing competition in the lower ranks, potentially impacting Harney Brothers Cannabis's ability to maintain its position. These shifts highlight the importance for Harney Brothers Cannabis to innovate and adapt in order to secure a more stable and higher rank in the evolving market.

Notable Products

In January 2026, the top-performing product for Harney Brothers Cannabis was the CBD/THC 1:1 Hibiscus Herbal Tea (10mg CBD, 10mg THC, 16oz), which climbed to the number one rank with sales reaching 3473 units. Previously, it held the second position for three consecutive months. The Sour Diesel Pre-Roll (1g), which had been the top product from October to December 2025, slipped to second place with sales of 3219 units. The CBD/THC 1:1 Peach Black Tea (10mg CBD, 10mg THC, 16oz) maintained its consistent performance, holding steady at third place. Additionally, the CBD/THC 2:1 Orange Mango Sparkling Water (10mg CBD, 5mg THC, 12oz) improved its position to fourth rank in January from fifth in the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.