Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

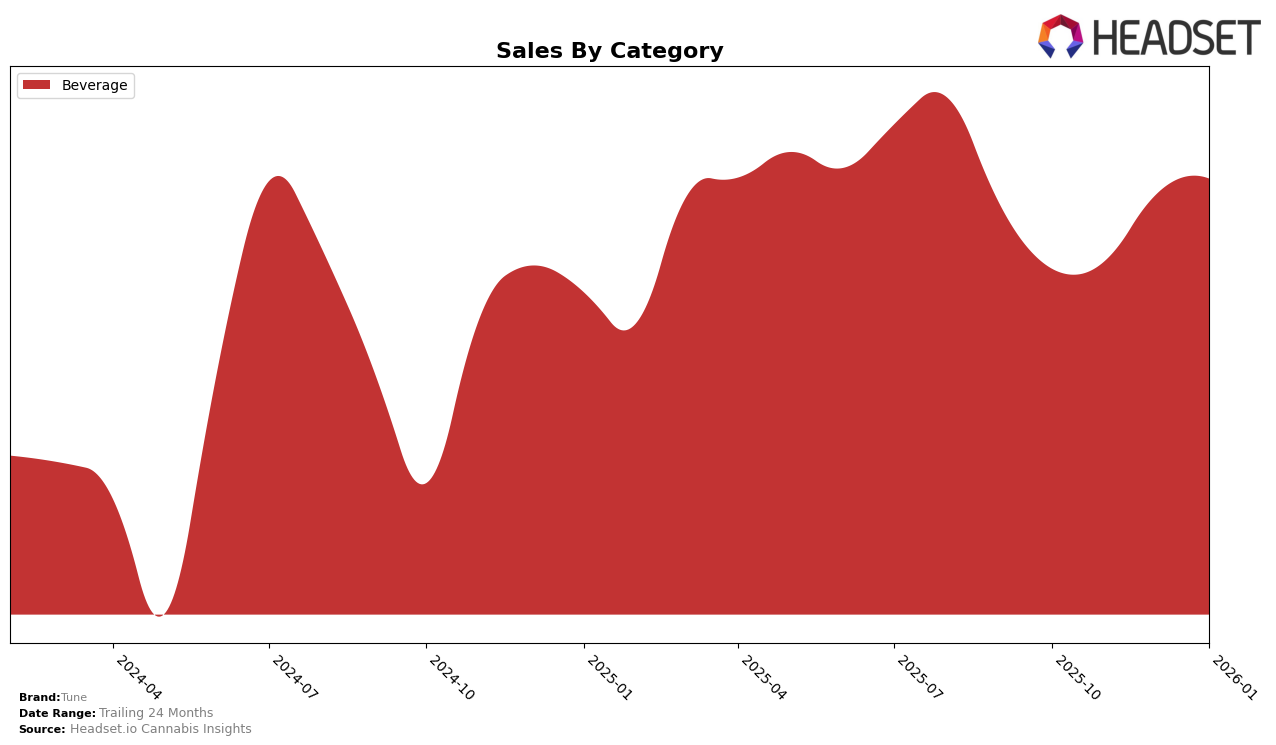

In the state of New York, Tune has shown consistent performance in the Beverage category, maintaining a strong presence with a ranking that fluctuated slightly but remained within the top four throughout the observed period. Specifically, Tune held the 3rd position in October 2025, dropped to 4th in November, and then climbed back to 3rd in December and January 2026. This indicates a stable demand for Tune's beverages in New York, suggesting effective market strategies and consumer loyalty. The upward trend in sales from October to January, with a notable increase from approximately $111,000 to nearly $130,000, further underscores the brand's strong foothold in this category and market.

While Tune's performance in New York is commendable, the absence of rankings in other states or categories highlights areas for potential growth and market expansion. The lack of top 30 rankings in additional states or categories could be seen as a limitation, suggesting that Tune's current market penetration and brand recognition may be concentrated primarily in the New York Beverage sector. This presents an opportunity for Tune to explore new markets and diversify its category presence to enhance its overall brand performance and reach. By leveraging its success in New York, Tune could strategize to replicate its achievements in other regions and categories.

Competitive Landscape

In the competitive landscape of the New York cannabis beverage market, Tune has consistently maintained a strong position, ranking third in both October and December 2025, and recovering to the same position in January 2026 after a brief dip to fourth in November 2025. This stability in rank is notable given the fierce competition from brands like Harney Brothers Cannabis, which briefly surpassed Tune in November 2025. Despite this, Tune's sales have shown a positive upward trend, increasing steadily from October 2025 to January 2026. This growth trajectory is particularly impressive when compared to High Peaks, which fluctuated between fourth and fifth place, and Layup, which maintained a steady second place but with sales figures significantly higher than Tune's. The consistent market leadership of Ayrloom as the top brand underscores the competitive challenge Tune faces, yet Tune's ability to hold its ground and grow sales suggests a robust brand strategy that continues to resonate with consumers.

Notable Products

In January 2026, the top-performing product for Tune was the Black Cherry Infused Seltzer (10mg THC, 12oz) in the Beverage category, regaining its top spot from October 2025 with sales of 4977 units. Closely following was the Blackberry Cardamom Infused Seltzer (10mg THC, 12oz), which slipped to second place despite strong sales. The Sicilian Lemon & Rose Infused Seltzer (10mg THC, 12oz) maintained its third position, showing consistent performance over the months. The Raspberry Lime Infused Seltzer (10mg THC, 12oz) dropped to fourth place, a position it held in December 2025. A new entry, the Raspberry Lime Infused Seltzer 4-Pack (40mg), debuted at fifth place, indicating growing consumer interest in multi-pack options.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.