Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

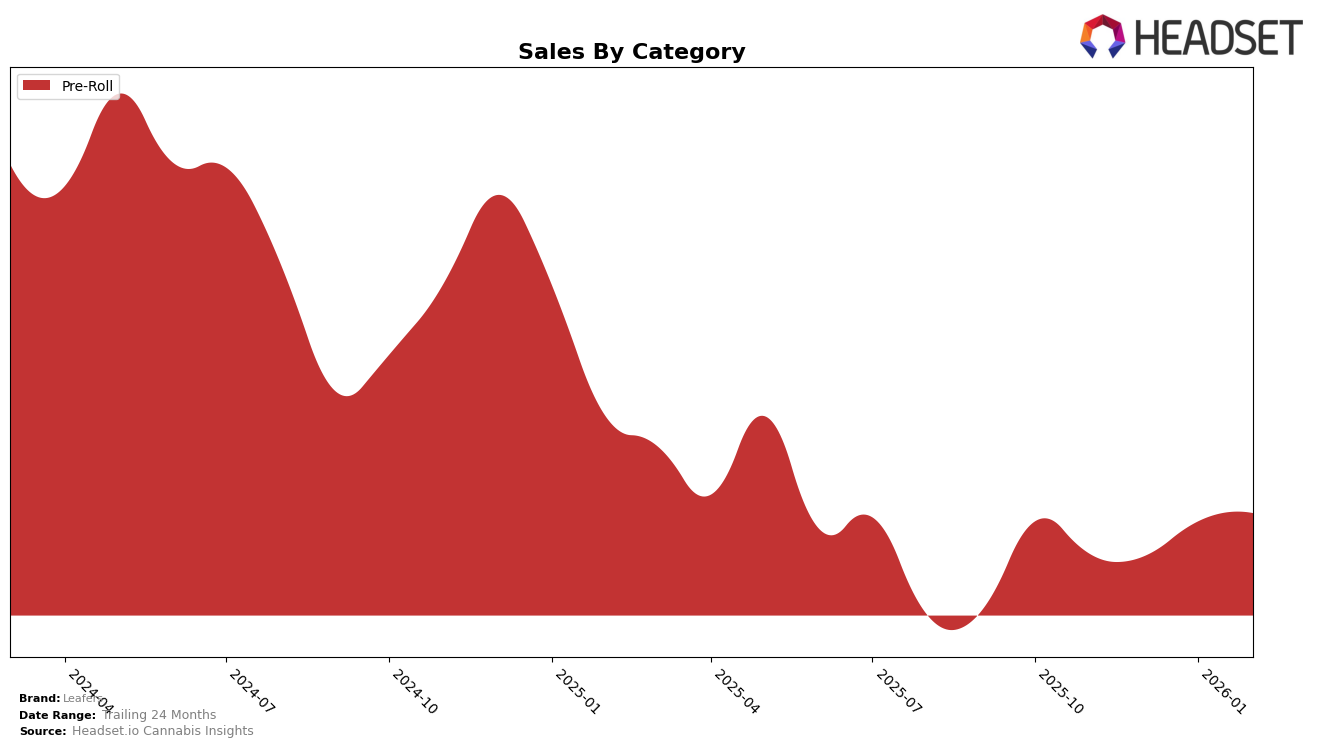

Leafers has shown a dynamic performance across various categories and states, with notable movements in their rankings. In the Pre-Roll category in Arizona, Leafers maintained a strong position, holding steady at rank 4 from November to December 2025. However, a slight decline was observed in early 2026, as they moved to rank 5 in January and further to rank 7 in February. Despite this drop in rankings, Leafers' sales figures in Arizona showed an upward trend, indicating a potential increase in consumer demand or effective sales strategies, with February sales reaching $530,385.

Interestingly, Leafers did not make it into the top 30 brands for certain categories or states during these months, which could be a point of concern or a strategic decision to focus on specific markets. Such absences from the top rankings in other states or categories could imply either a lack of market penetration or a targeted approach where Leafers concentrates its efforts on more promising or established markets like Arizona. Overall, while Leafers experiences fluctuations in rank, the upward trend in sales suggests resilience and potential for growth in key markets.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Arizona, Leafers has experienced notable fluctuations in its market position from November 2025 to February 2026. Initially holding steady at rank 4 in November and December 2025, Leafers saw a slight dip to rank 5 in January 2026, and further to rank 7 by February 2026. This decline in rank is particularly significant when compared to Cheech & Chong's, which maintained a strong position, moving from rank 5 to 4, before slipping to 6 in February, yet consistently showing higher sales figures. Meanwhile, Sluggers Hit made a remarkable leap from rank 15 in November to rank 5 in February, indicating a surge in popularity and sales, which could pose a threat to Leafers' market share. Tumble and Find. also present competitive pressures, with Tumble showing a significant sales increase in February despite fluctuating ranks, and Find. re-entering the top 10 in February. These dynamics suggest that Leafers needs to strategize effectively to regain and sustain its competitive edge in the Arizona Pre-Roll market.

Notable Products

In February 2026, the top-performing product for Leafers was the Exotic Blend Live Resin Diamond Infused Pre-Roll 3-Pack (1.5g), which climbed to the number one spot with sales reaching 3545. The Indica Blend Infused Live Resin Diamond Pre-Roll 3-Pack (1.5g) slipped to second place, despite maintaining the top rank for the previous three months. The Sativa Blend Live Resin Diamond Infused Pre-Roll 3-Pack (1.5g) improved its position to third, up from fifth in January. The Cookie Blend Live Resin Diamond Infused Pre-Roll 3-Pack (1.5g) held steady at fourth place, showing consistent performance. Lastly, the Indica Blend Live Resin Diamond Infused Pre-Roll (1g) dropped to fifth place, indicating a slight decline in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.