Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

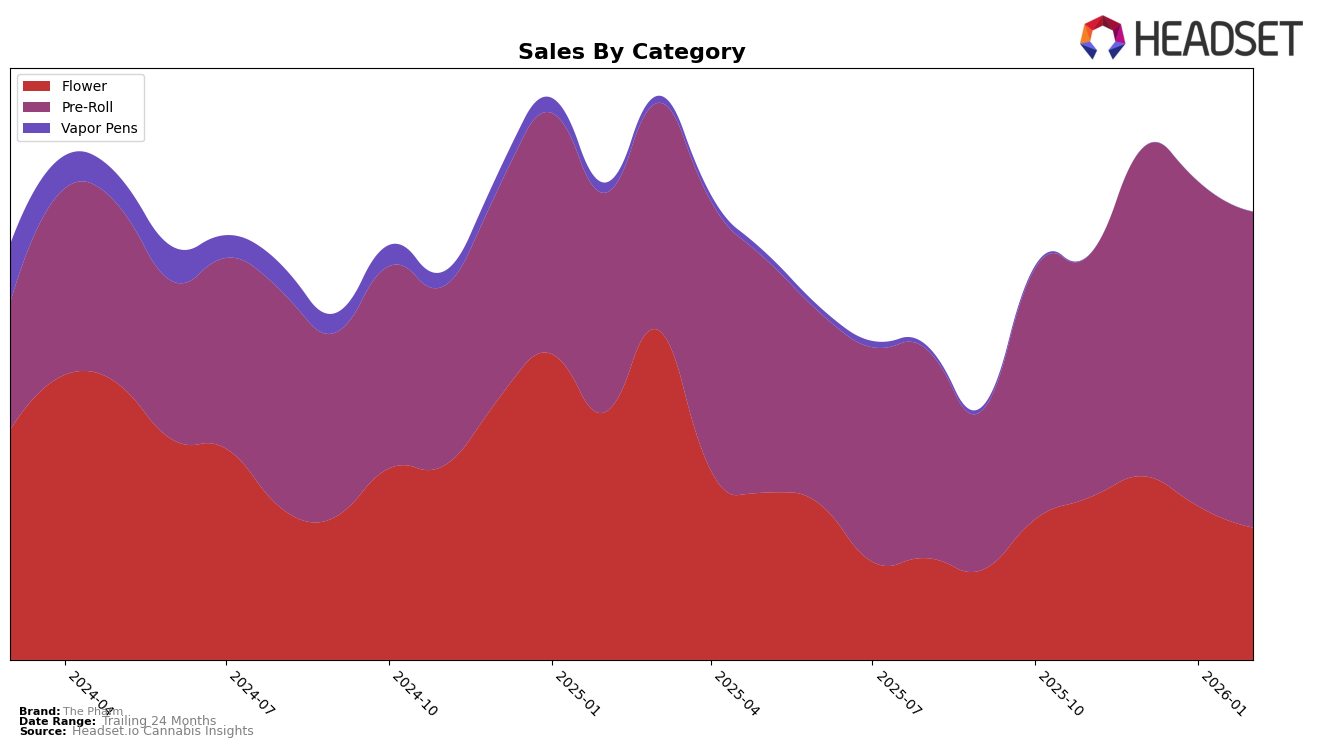

The Pharm has shown varied performance across different categories and states. In the Arizona market, The Pharm's Flower category experienced a slight decline in ranking, moving from 18th place in December 2025 to 21st place by February 2026. This shift is accompanied by a noticeable decrease in sales, which fell from $534,269 in December 2025 to $384,757 in February 2026. This downward trend in the Flower category could indicate increasing competition or shifting consumer preferences within the state. It's important to note that not being in the top 30 in other states or categories could signal areas of opportunity or concern for The Pharm.

Conversely, The Pharm's performance in the Pre-Roll category in Arizona remains strong and consistent, maintaining a steady 3rd place ranking from November 2025 through February 2026. Despite a slight decline in sales from $957,310 in December 2025 to $919,550 in February 2026, the brand's high ranking suggests a strong market presence and consumer loyalty in this category. The stability in the Pre-Roll segment might reflect successful brand strategies or product offerings that resonate well with consumers. While these insights provide a glimpse into The Pharm's positioning, further exploration of their strategies and performance in other states could offer a more comprehensive understanding of their market dynamics.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Arizona, The Pharm consistently held the third position from November 2025 through February 2026. Despite maintaining a stable rank, The Pharm's sales figures indicate a slight decline from January to February 2026. This is noteworthy as competitors like Jeeter and STIIIZY have consistently occupied the top two positions with significantly higher sales, suggesting a strong market presence. Meanwhile, brands such as Sluggers Hit and Anthem have shown remarkable upward mobility, with Anthem climbing from 19th place in November 2025 to 4th in February 2026, indicating a potential shift in consumer preferences that could impact The Pharm's market share if these trends continue. This dynamic environment underscores the importance for The Pharm to innovate and adapt to maintain its competitive edge.

Notable Products

In February 2026, the top-performing product for The Pharm was the Dusties - Emerald Infused Pre-Roll 6-Pack, which climbed to the number one rank from second place in January. Notably, this product achieved sales of $6,195. The Dusties - Sapphire Infused Pre-Roll 6-Pack, previously holding the top spot, fell to second place, showing a decline in sales compared to the previous month. The Dusties - Ruby Infused Pre-Roll 6-Pack maintained a consistent ranking at third place, continuing its stable performance. The AK-1995, a Flower product, appeared in the rankings at fourth place, while the Mule Fuel also made its entry into the rankings this month, indicating potential growth in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.