Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

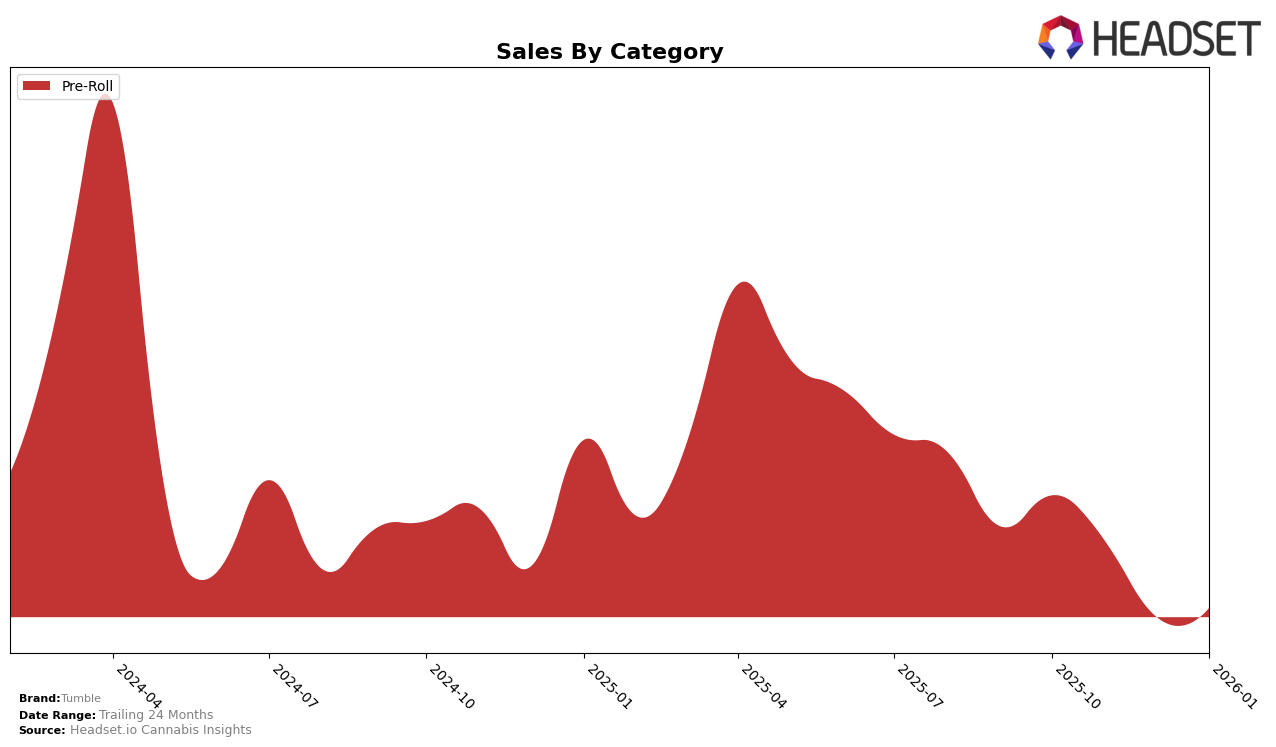

In the Arizona market, Tumble has maintained a steady presence in the Pre-Roll category, consistently ranking within the top 10 brands over the past few months. Despite a slight dip in December 2025, where the brand fell to the 8th position, it quickly rebounded to reclaim the 6th spot by January 2026. This indicates a resilient performance in a competitive market. However, it's worth noting that while the brand's sales saw a decrease from October to December, there was a notable recovery in January, suggesting a potential seasonal influence or successful promotional efforts.

Conversely, Tumble's performance in the Missouri market presents a different narrative. The brand has struggled to secure a consistent top 30 ranking in the Pre-Roll category, with its position fluctuating significantly from 35th in October 2025 to 44th by January 2026. This downward trend may indicate challenges in market penetration or consumer preference shifts. The substantial drop in sales from November to January further emphasizes the difficulties faced by Tumble in Missouri, highlighting the need for strategic adjustments to regain traction in this market.

Competitive Landscape

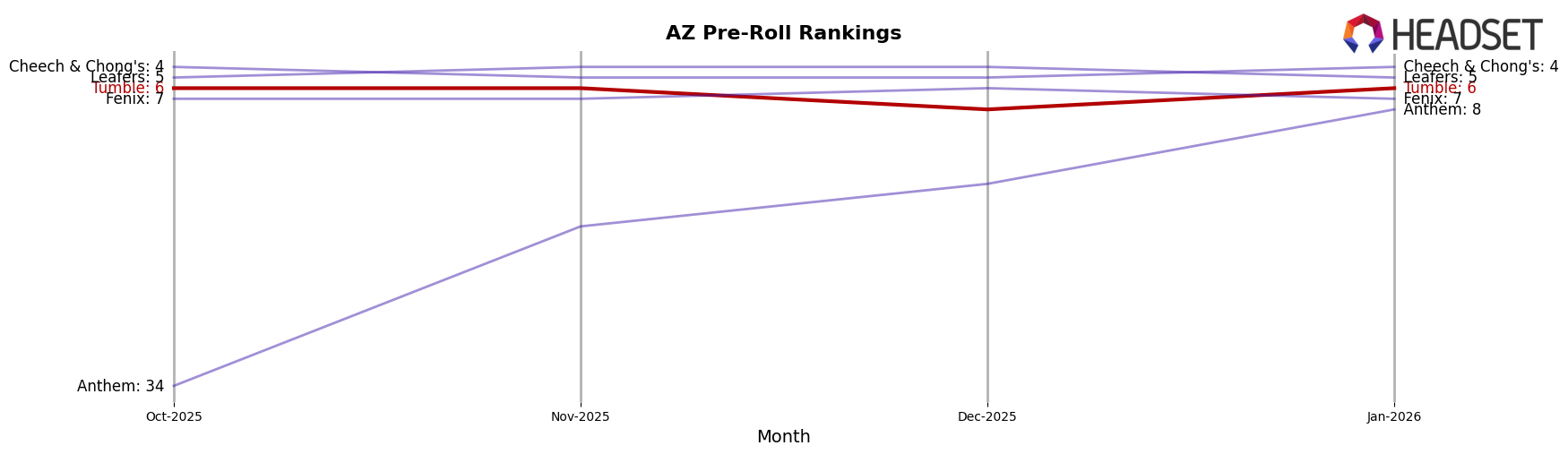

In the competitive landscape of the Arizona pre-roll category, Tumble has experienced notable fluctuations in its rankings and sales over the past few months. Despite maintaining a consistent 6th place in October and November 2025, Tumble dropped to 8th in December before recovering to 6th in January 2026. This volatility contrasts with the more stable performance of competitors like Cheech & Chong's and Leafers, which consistently held higher ranks, with Leafers even climbing to 4th place in November and December. Meanwhile, Fenix remained close behind Tumble, showing a slight upward trend by moving to 6th place in December. Interestingly, Anthem made a significant leap from 34th in October to 8th in January, signaling a potential emerging threat. These dynamics suggest that while Tumble has managed to hold its ground against some competitors, the brand faces challenges from both established and rising brands, necessitating strategic adjustments to sustain and enhance its market position.

Notable Products

In January 2026, the top-performing product from Tumble was the Blackberry Kush Diamond Infused Pre-Roll (1g), maintaining its number one rank for the third consecutive month with sales reaching 2223 units. The Blue Dream Infused Pre-Roll 3-Pack (1.5g) debuted at the second position, showing strong initial sales figures. Alaskan Thunder Fuck Infused Blend Pre-Roll 3-Pack (1.5g) secured the third spot, marking its first appearance in the rankings. Cactus Chiller Diamond Infused Pre-Roll (1g) experienced a drop from second to fourth place, with sales decreasing to 1599 units. Alaskan Thunder Fuck Diamond Infused Pre-Roll (1g) remained steady at the fifth position, reflecting consistent performance over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.