Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

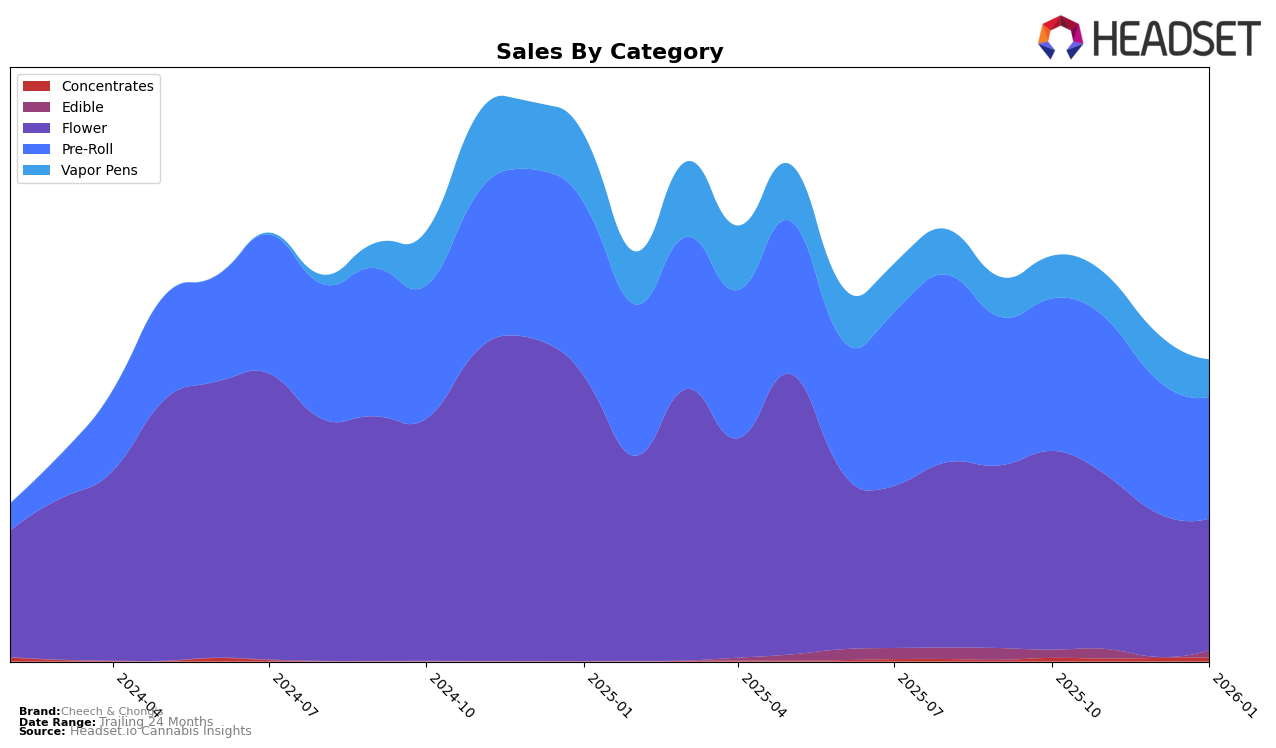

Cheech & Chong's brand performance shows a varied picture across different states and categories. In Arizona, the brand has shown consistent strength in the Pre-Roll category, maintaining a steady rank of 4th or 5th over the months, indicating a solid foothold in this segment. However, their presence in the Edible category was not strong enough to make it into the top 30, highlighting a potential area for growth. In the Vapor Pens category, there was a noticeable improvement from 38th in November to 29th by January, suggesting a positive trend in consumer interest. On the other hand, in Massachusetts, the brand's performance in the Flower category saw a decline from 23rd in October to 41st by January, which could be a cause for concern.

In Michigan, Cheech & Chong's showed a strong performance in the Pre-Roll category, consistently ranking within the top 25, though their performance in Vapor Pens was less impressive, with rankings hovering around the 70s and 80s. Meanwhile, in Ohio, the brand's Flower category maintained a stable presence, with rankings fluctuating slightly between 35th and 40th. Conversely, in Illinois, the brand struggled to break into the top 30 for Vapor Pens, indicating a competitive market or a need for strategic adjustments. These insights suggest that while Cheech & Chong's has strongholds in certain categories and states, there are opportunities for growth and improvement in others.

Competitive Landscape

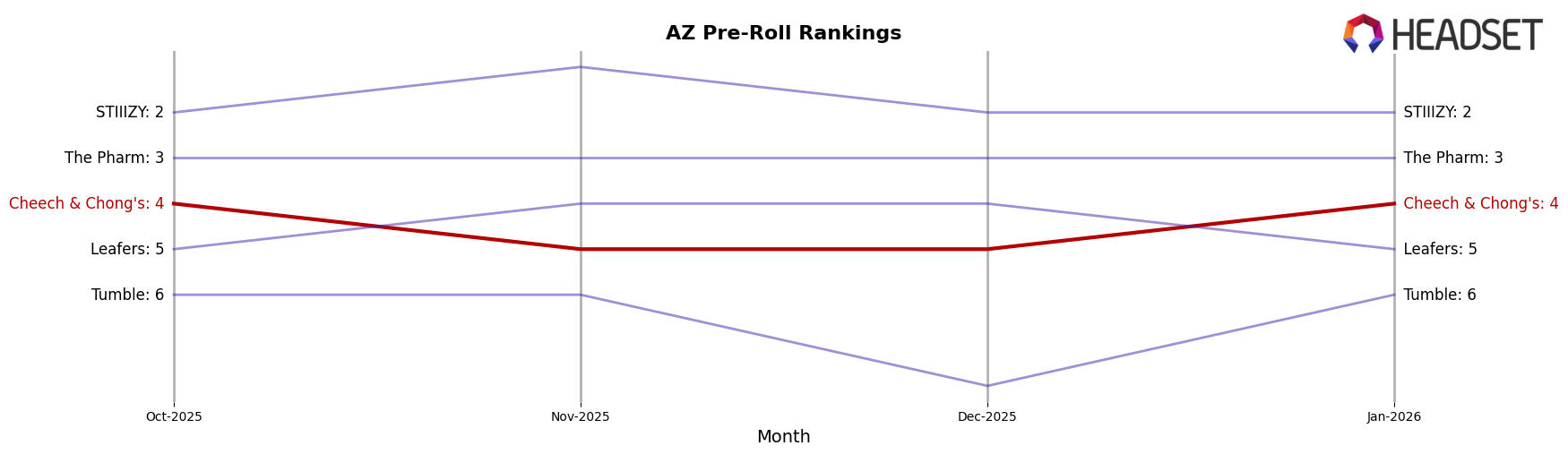

In the competitive landscape of the Arizona pre-roll category, Cheech & Chong's experienced a dynamic shift in rankings and sales over the observed months. Starting in October 2025, Cheech & Chong's held the 4th position, but slipped to 5th in November and December, before regaining the 4th spot in January 2026. This fluctuation indicates a competitive tussle with brands like Leafers, which swapped ranks with Cheech & Chong's in November and January. Despite these changes, Cheech & Chong's consistently maintained a higher rank than Tumble, which remained outside the top 5 for most months. However, Cheech & Chong's trails behind leaders like STIIIZY and The Pharm, which consistently held the top spots. Notably, Cheech & Chong's sales saw a dip in November but rebounded in December and January, suggesting resilience and potential for growth amidst stiff competition.

Notable Products

In January 2026, Cheech & Chong's top-performing product was the Key Lime Pie Infused Pre-Roll (1.2g) in the Pre-Roll category, maintaining its consistent number one ranking from previous months with sales of 35,778 units. The Pink Champagne Cryo Infused Pre-Roll (1.2g) climbed to the second spot, improving from its fifth place in December 2025. The Apple Fritter Cryo Infused Pre-Roll (1.2g) secured the third position, dropping one rank from the previous month. Granddaddy Purple Infused Pre-Roll (1.2g) held steady in fourth place, showing resilience in its sales performance. Sour Pebbles Injected Infused Pre-Roll (1.2g) rounded out the top five, experiencing a decline from third place in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.