Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

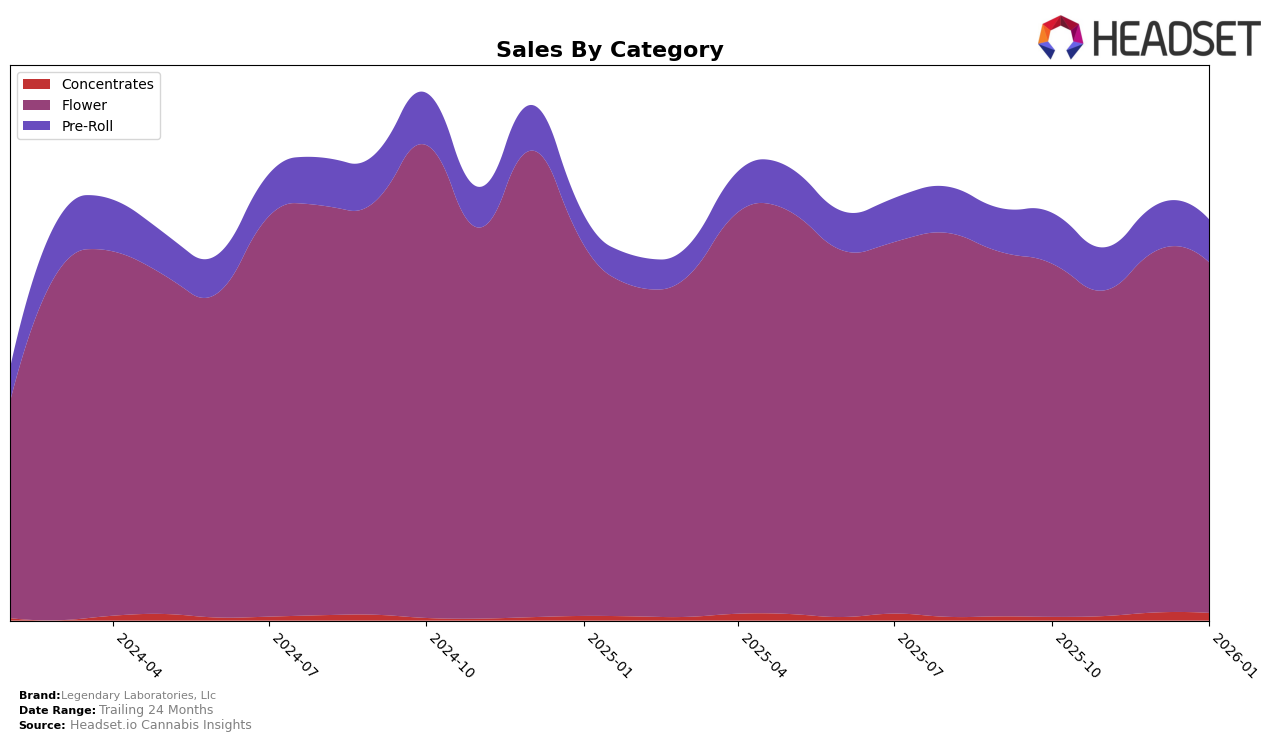

Legendary Laboratories, Llc exhibits a steady presence in the Washington market, particularly in the Flower category. The brand maintained a consistent ranking, fluctuating slightly between 23rd and 24th place from October 2025 to January 2026. This stability suggests a strong foothold in the Flower category, despite slight sales fluctuations, with sales peaking in December 2025. However, it's noteworthy that Legendary Laboratories did not break into the top 30 rankings in any other state or category during this period, indicating potential areas for expansion or improvement.

In contrast, the performance of Legendary Laboratories, Llc in the Pre-Roll category within Washington shows an upward trend, albeit outside the top 30 rankings. The brand improved its position from 94th in November 2025 to 85th by January 2026, suggesting a positive reception and growing popularity in this segment. While the sales figures for Pre-Rolls are significantly lower than those for Flower, this upward movement in rankings could indicate an opportunity for Legendary Laboratories to capitalize on a growing market segment and potentially increase its market share in this category.

Competitive Landscape

In the competitive landscape of the Washington Flower category, Legendary Laboratories, Llc has shown a consistent presence, maintaining a rank of 23rd in both October 2025 and January 2026, despite a slight dip to 24th in November and December 2025. This stability in ranking is notable given the fluctuations observed in competitors like Forbidden Farms, which dropped from 13th to 25th, and Passion Flower Cannabis, which fell from 17th to 24th over the same period. Meanwhile, Ooowee made a significant leap from 28th to 21st, and Hustler's Ambition demonstrated volatility, peaking at 20th in December before settling at 22nd in January. Despite these shifts, Legendary Laboratories, Llc's sales have shown resilience, with a notable increase in December 2025, contrasting with the declining sales trends of some competitors. This suggests a potential for growth and market share stability for Legendary Laboratories, Llc amidst a dynamic competitive environment.

Notable Products

In January 2026, Bubblegum Runtz (3.5g) maintained its top position as the leading product from Legendary Laboratories, Llc, with sales reaching 2147 units. Lemon Cherry Gelato (3.5g) emerged as the second-best performer, while Lemon Cherry Gelato Pre-Roll 2-Pack (1g) secured the third rank, both newly appearing in the top rankings. Bubblegum Runtz Pre-Roll 2-Pack (1g) held steady at fourth place, consistent with its ranking in December 2025. Bubblegum Gelato (3.5g) saw a decline, dropping from third to fifth place. This shift in rankings highlights the growing popularity of the Lemon Cherry Gelato products in the brand's lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.