Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

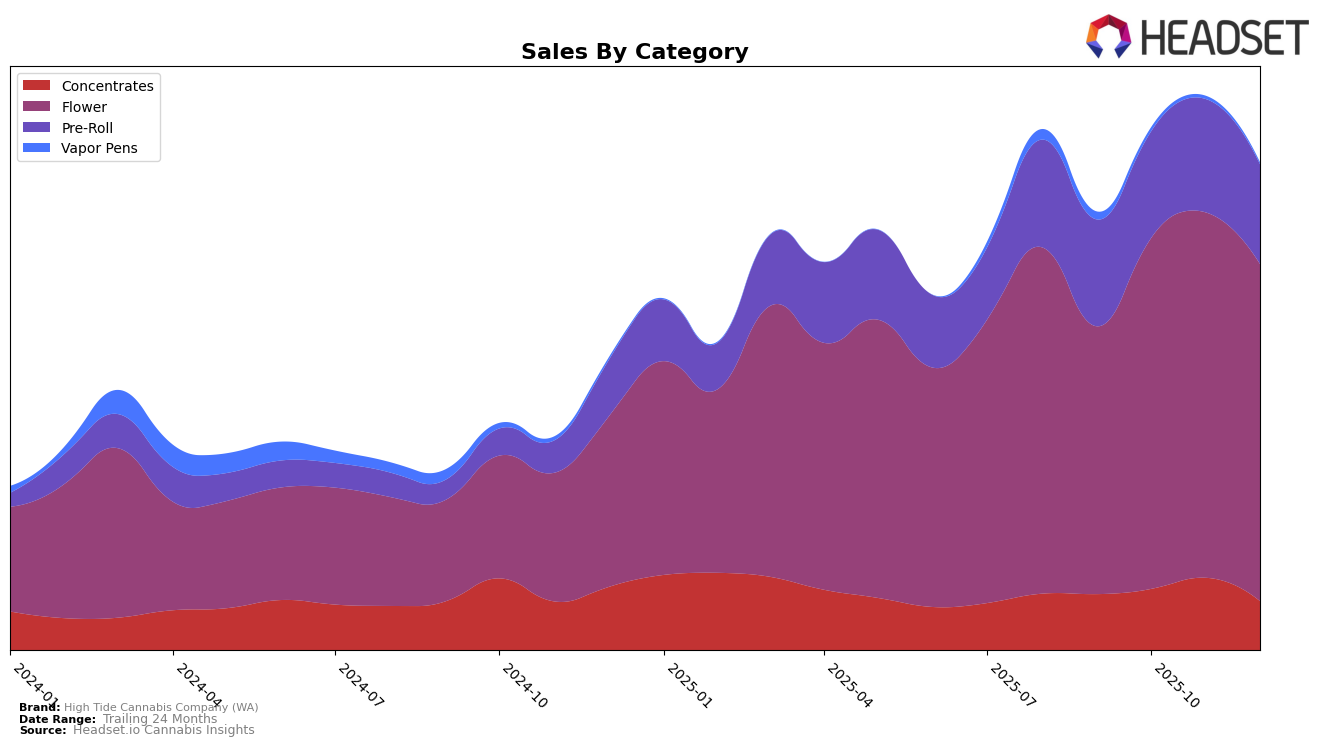

High Tide Cannabis Company (WA) has shown varied performance across different product categories in Washington. In the Concentrates category, the brand made a noticeable improvement from 43rd place in September to 39th in November, before slipping to 51st in December, indicating some volatility in this segment. The Flower category, however, tells a more positive story, with the brand climbing from 32nd in September to 21st in November, before settling at 27th in December. This upward trend in the Flower category suggests a strengthening position and possibly a growing consumer preference for their products in this segment. The Pre-Roll segment also saw some fluctuations, with rankings improving from 47th in September to 39th in November, although it fell back to 49th by December.

It's important to note that High Tide Cannabis Company (WA) did not make it into the top 30 brands in any category in Washington during the observed months, which could be seen as a challenge for the brand as it seeks to increase its market share. However, the upward movement in the Flower category rankings, despite not breaking into the top 20, is a positive indicator of potential growth and market traction. The fluctuations in the Concentrates and Pre-Roll categories might suggest areas where the brand could focus on improving product offerings or marketing strategies to enhance its positioning. Overall, while there are challenges, the trends in the Flower category offer a glimpse of optimism for the brand's future performance.

Competitive Landscape

In the competitive landscape of the flower category in Washington, High Tide Cannabis Company (WA) has demonstrated significant fluctuations in its market position, reflecting dynamic shifts in consumer preferences and competitive pressures. Notably, High Tide Cannabis Company (WA) improved its rank from 32nd in September 2025 to 22nd in October 2025, marking a substantial leap likely driven by strategic marketing or product innovation. However, by December 2025, its rank slipped to 27th, indicating increased competition or potential challenges in maintaining market share. Competitors such as Agro Couture and SKÖRD have also experienced rank volatility, with SKÖRD dropping from 18th to 29th between September and December 2025, suggesting potential opportunities for High Tide to capitalize on SKÖRD's declining sales. Meanwhile, Hustler's Ambition maintained a relatively stable presence, hovering around the mid-20s rank, which could indicate a consistent consumer base that High Tide might aim to attract. Overall, these shifts underscore the importance of agility and strategic positioning for High Tide Cannabis Company (WA) to enhance its competitive edge in the Washington flower market.

Notable Products

In December 2025, the top-performing product for High Tide Cannabis Company (WA) was Crunch Berriez Infused Pre-Roll 2-Pack (1g), reclaiming the number one rank after briefly dropping to the second position in November. Lemon Cherry Rocket Pre-Roll 2-Pack (1g) rose to the second spot, showing an improvement from its fourth position in November. Blue Lobster Pre-Roll 2-Pack (1g) slipped to third place, having been the top seller in October and November. Blue Lobster (3.5g) maintained a consistent presence in the top five, ranking fourth in December. Notably, Crunch Berriez Infused Pre-Roll 2-Pack (1g) achieved sales of 2,262 units, marking a significant recovery from its October dip.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.