Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

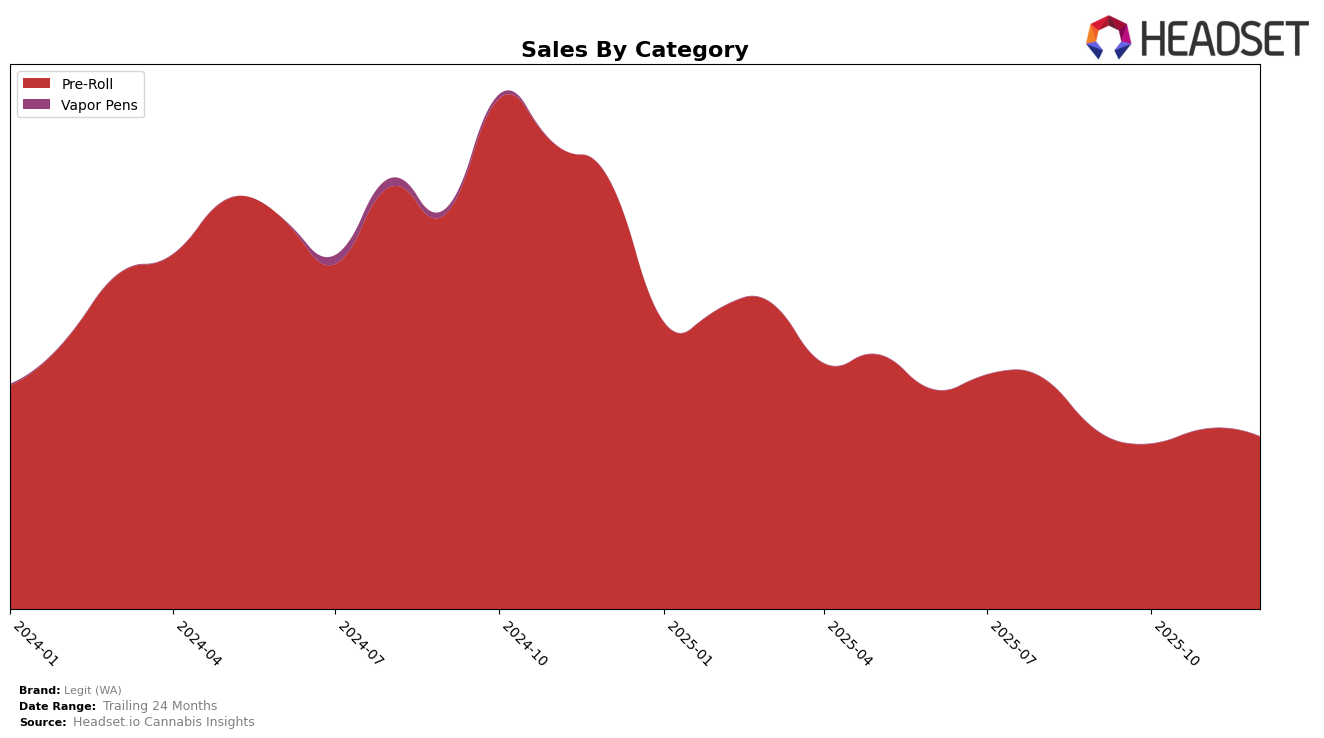

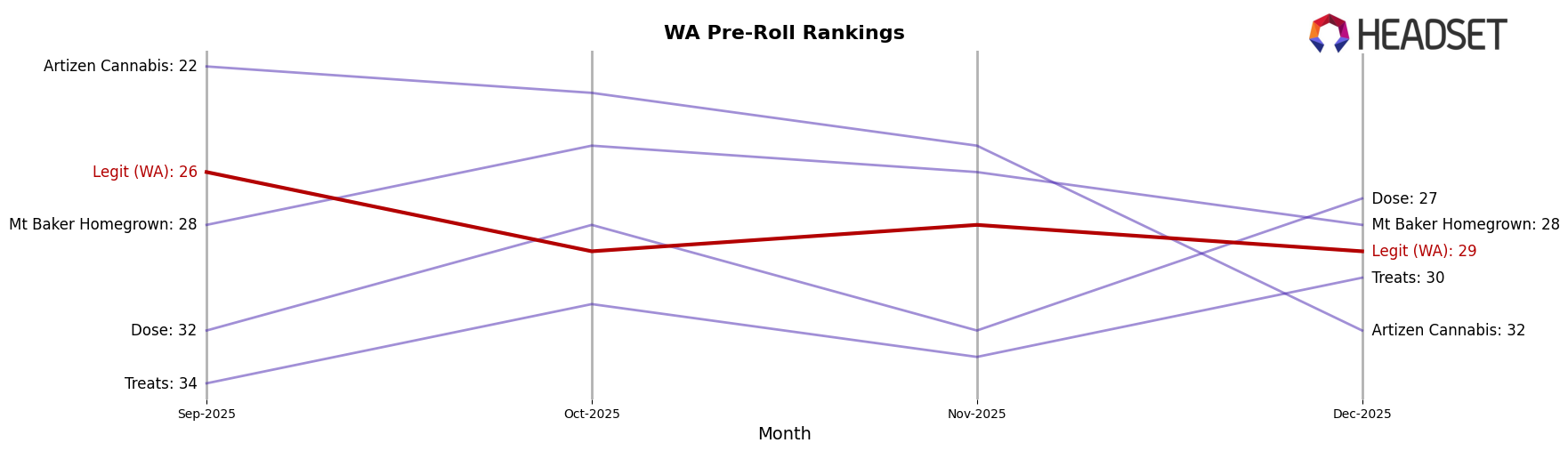

Legit (WA) has shown a consistent presence in the Pre-Roll category in Washington over the last few months of 2025. Despite not breaking into the top 25, the brand maintained rankings within the top 30, fluctuating slightly between the 26th and 29th positions. This consistency suggests a stable market presence, although it highlights the competitive nature of the Pre-Roll category. Notably, Legit (WA) experienced a small dip in sales from September to October, with a subsequent recovery in November, indicating a resilient performance despite market fluctuations.

While Legit (WA) has managed to stay within the top 30 in Washington, the absence of rankings in other states or categories might suggest a limited geographical reach or category focus. This could be seen as a missed opportunity for expansion or diversification. However, maintaining a steady rank in a competitive market like Washington's Pre-Roll category could also imply a strategic focus on strengthening their position locally before considering broader expansion. Such a strategy, if successful, could provide a solid foundation for future growth in other states or product categories.

Competitive Landscape

In the competitive landscape of the Washington Pre-Roll category, Legit (WA) has experienced fluctuating rankings, maintaining a relatively stable position between 26th and 29th from September to December 2025. Despite a slight dip in October, Legit (WA) managed to recover its sales by November, demonstrating resilience amidst competitive pressures. Notably, Mt Baker Homegrown showed a strong performance, consistently ranking above Legit (WA) and even peaking at 25th in October. Meanwhile, Artizen Cannabis experienced a downward trend, dropping out of the top 30 by December, which could indicate a potential opportunity for Legit (WA) to capture some of their market share. Additionally, Dose and Treats both demonstrated upward momentum, with Dose notably surpassing Legit (WA) in December, suggesting that Legit (WA) may need to strategize to maintain its competitive edge in this dynamic market.

Notable Products

In December 2025, Legit (WA) maintained its top position with Gold - Banana Cake Infused Pre-Roll (1g) leading the sales, consistently ranking first across all months and achieving sales of 3259 units. Cherry Blossom OG Infused Pre-Roll (1g) held the second spot, showing a slight improvement from October's fourth rank. The Gold - Oil Tanker Live Resin Infused Pre-Roll (0.75g) emerged as a strong contender, securing the third position despite lacking previous data. Gold - High Octane Haze Infused Pre-Roll (1g) experienced a drop from second to fourth place, indicating a decline in sales momentum. Meanwhile, Gold - Strawberry Pushpop Infused Pre-Roll (1g) slipped to fifth place, reflecting a gradual decrease in its standing over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.