Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

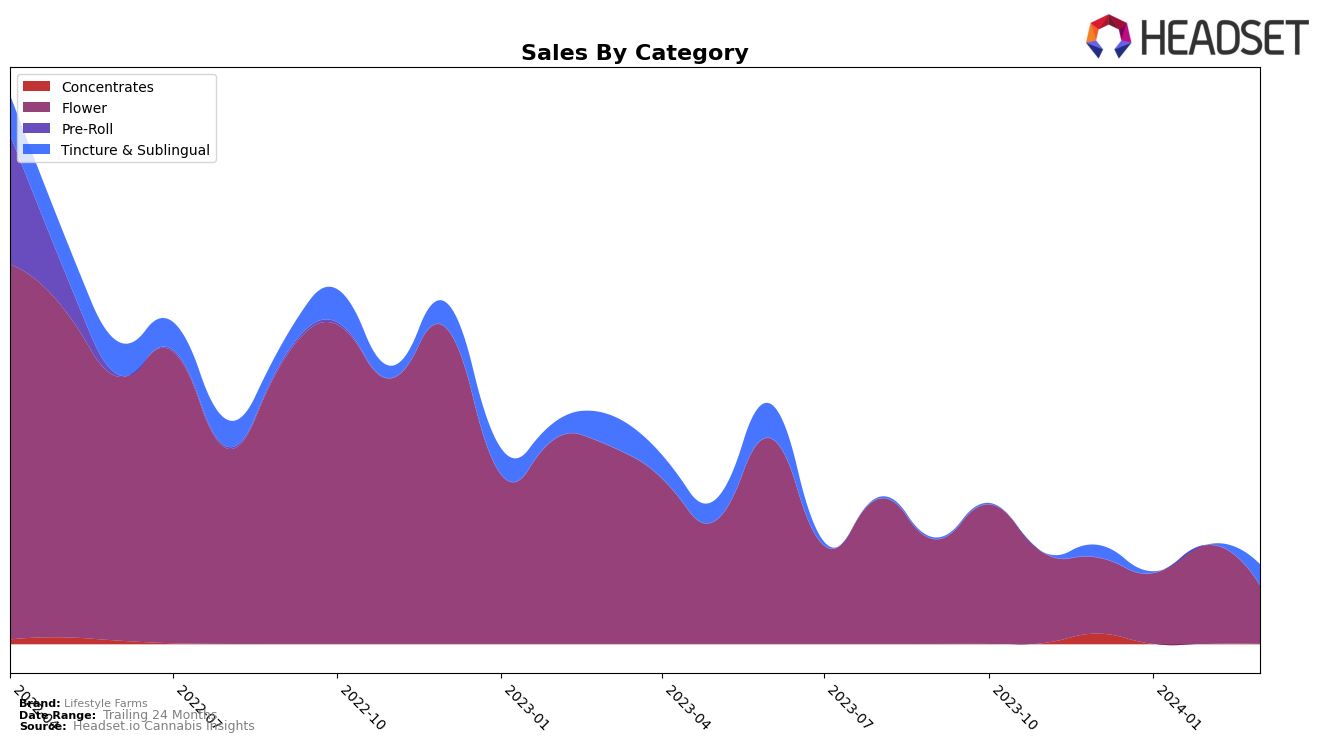

In the Tincture & Sublingual category within Oregon, Lifestyle Farms has shown a notable performance trajectory over the recent months. Starting from a rank of 29 in December 2023, the brand experienced a disappearance from the top 30 rankings in both January and February 2024, which could be interpreted as a significant setback. However, Lifestyle Farms made a commendable recovery by March 2024, securing the 26th position. This fluctuation in rankings highlights a period of volatility for the brand in this category, yet the rebound in March suggests a potential turnaround. The sales figures further bolster this narrative, with a jump from 647 units sold in December 2023 to 1103 units in March 2024, indicating a strong recovery and increased consumer interest or strategic adjustments by the brand to regain its footing in the Oregon market.

It is crucial to note that the absence of Lifestyle Farms from the top 30 rankings in the Tincture & Sublingual category for January and February 2024 raises questions about the brand's consistency and market strategies during these months. The reasons behind this could range from inventory issues, increased competition, or shifts in consumer preferences, which are not uncommon challenges in the dynamic cannabis market. The significant sales increase in March, however, suggests that whatever strategies or changes Lifestyle Farms implemented, were effective in not only bringing them back into the competitive landscape but also in significantly boosting their sales. This kind of resilience and ability to bounce back is noteworthy, though the brand's future performance will require monitoring to determine if this recovery is sustainable or if further fluctuations are to be expected.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Oregon, Lifestyle Farms has shown a notable trajectory, despite not being ranked in January and February 2024, it secured the 26th position by March 2024. This indicates a positive momentum when compared to its competitors, such as She Don't Know, which saw a decline from being outside the top 20 in December 2023 to 28th by March 2024. Similarly, Altered Alchemy also did not rank in February 2024 and dropped to 29th in March. On the other hand, Rebel Roots Farms made a significant leap into the rankings in February at 17th and maintained a strong presence by March. Mule Extracts showed resilience by entering the rankings in January, dipping in February, but then climbing to 24th by March. Lifestyle Farms' performance, particularly its re-entry and climb in rank amidst fluctuating competitor standings, suggests a recovering and potentially growing interest in their offerings within the Oregon market, positioning them as a brand to watch as they vie for a stronger foothold against their competitors.

Notable Products

In March 2024, Lifestyle Farms saw White Rhino (3.5g) from the Flower category taking the top spot with remarkable sales of 74 units, marking a consistent rise from its previous rankings over the last three months. Following closely, Maui Wowie (3.5g), also in the Flower category, which had maintained the first position from December 2023 to February 2024, dropped to the second position in March with a notable decrease in sales. The Citrus Tincture (1000mg THC, 30ml, 1oz) from the Tincture & Sublingual category made a comeback to the top ranks, securing the third position after not being ranked in January and February 2024. Alaskan Thunder Fuck (3.5g) from the Flower category also showed significant movement, improving its rank to the fourth position in March from the fifth in January and second in February, indicating fluctuating consumer interest. These shifts highlight dynamic consumer preferences within Lifestyle Farms' product range, with the Flower category showing strong performance yet experiencing shifts in the top product rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.