Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

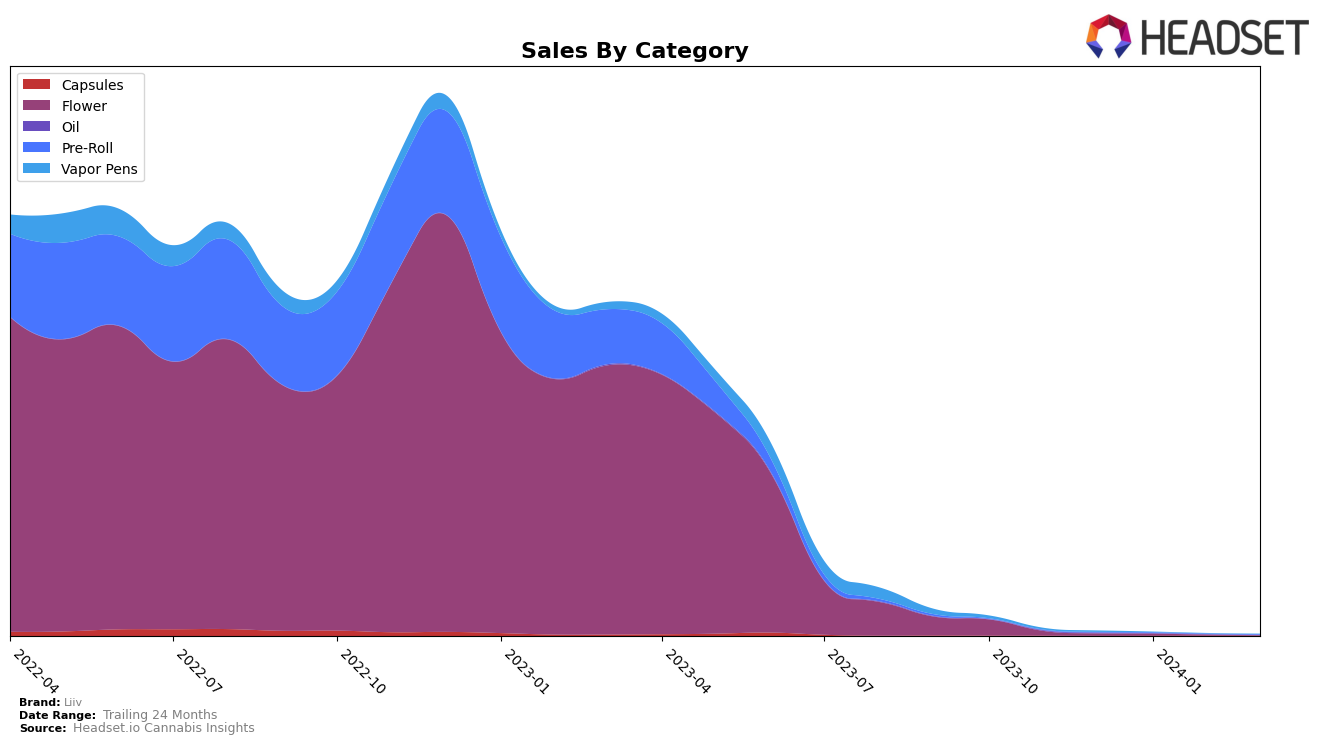

In the competitive cannabis market of Ontario, Liiv has shown a notable performance in the Capsules category, gradually climbing the ranks from not being in the top 30 in December 2023 to securing the 30th position by March 2024. This upward movement is indicative of a positive trend, especially considering the sales figures that have seen a significant uptick from January to February, before experiencing a slight dip in March. However, the absence from the top rankings in December suggests there was room for improvement, which Liiv seems to have capitalized on effectively. Conversely, in the Oil category, Liiv's position has seen a slight decline, starting from the 41st rank in December 2023 and slipping further down by March 2024. This downward trend, coupled with fluctuating sales figures that notably decreased from January to March, highlights challenges in maintaining market share amidst stiff competition in this segment.

While Liiv's performance in the Oil category might raise concerns, the brand's resilience and potential for recovery are evident in the Capsules market within Ontario. The fluctuating sales figures across both categories underscore the volatile nature of consumer preferences and market dynamics in the cannabis industry. The slight dip in Capsule sales in March, following a peak in February, could signal a need for strategic adjustments or marketing efforts to sustain the growth trajectory. Similarly, the consistent drop in rankings and sales in the Oil category may prompt a reassessment of Liiv's approach to this segment. It's crucial for stakeholders to monitor these trends closely, as they offer insights into the brand's operational strengths and areas for improvement. Liiv's journey through the rankings and sales performance provides a fascinating case study on navigating the complexities of the cannabis market in Ontario.

Competitive Landscape

In the competitive landscape of the cannabis capsule market in Ontario, Liiv has shown a notable upward trajectory in rankings from not being in the top 20 in December 2023 to securing the 30th rank by March 2024. This improvement in rank is indicative of a growing presence and possibly an increase in consumer preference within the province. However, Liiv faces stiff competition from established brands such as Synr.g, which held a higher rank in December but did not maintain a top 20 position afterwards, and Indiva - US, which consistently hovered around the 29th to 32nd ranks, showing a more stable but slightly declining position. Notably, Noon & Night and NightNight have also been significant competitors, with Noon & Night demonstrating a strong performance and NightNight experiencing fluctuations but ending slightly below Liiv in March. The dynamics of these rankings and sales volumes, without disclosing specific figures, suggest that while Liiv is gaining ground, the competition remains fierce with several brands showing varying degrees of market penetration and consumer loyalty.

Notable Products

In Mar-2024, Liiv's top-performing product was the Greatest Apex Of All Time Pre-Roll 3-Pack (1.5g) within the Pre-Roll category, securing the first rank with sales figures reaching 25 units. Following closely, Something About Larry (3.5g) from the Flower category took the second position, showcasing a notable shift from not being ranked in Feb-2024 to securing a high rank. The third spot was claimed by CBD Capsules 15-Pack (150mg CBD) in the Capsules category, ascending from the second rank in Feb-2024. Grapes 'N Cream Pre-Roll (1g) also made its debut on the list in Mar-2024, landing at the fourth rank. It's interesting to note the dynamic shifts in rankings, especially for products like Buddha Haze Distillate Cartridge (0.5g) in the Vapor Pens category, which consistently held a position but dropped to the fifth rank in Mar-2024 from its initial top rank in Dec-2023.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.