Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

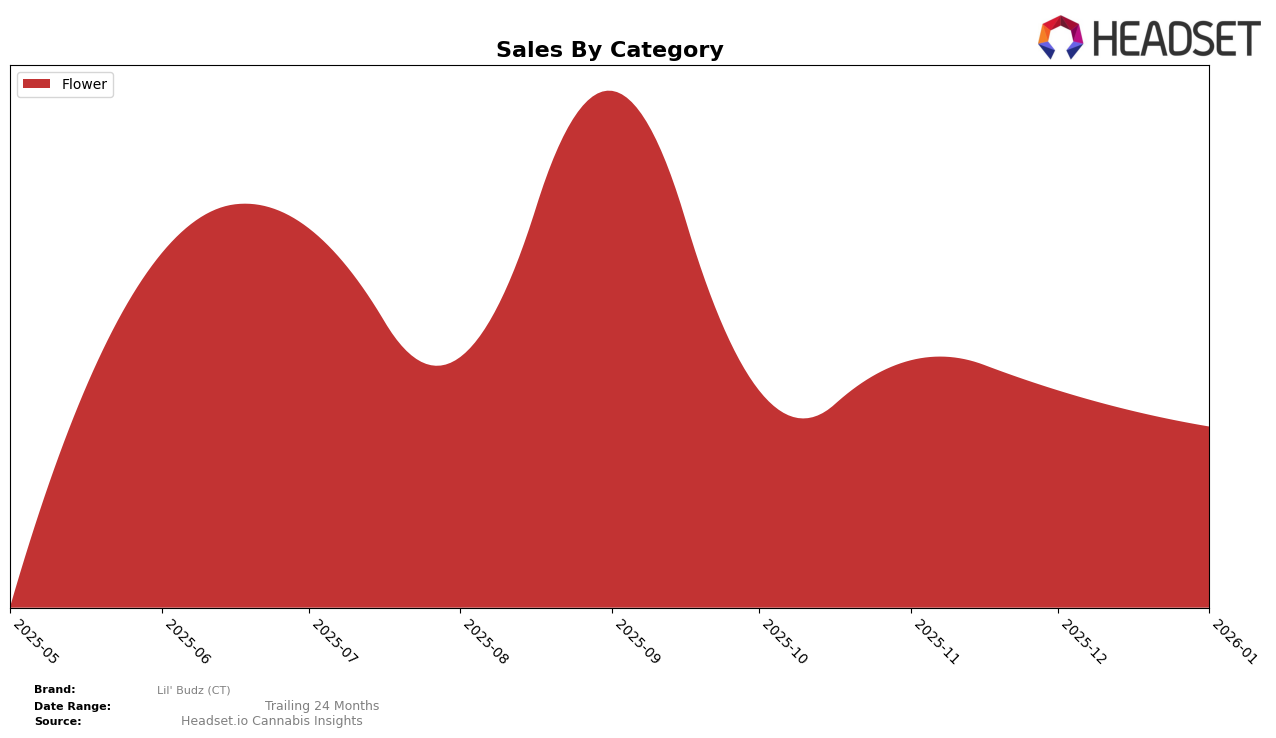

In the state of Connecticut, Lil' Budz (CT) has shown a consistent presence in the Flower category, maintaining its position within the top 20 brands over the past few months. Starting from a rank of 16 in October 2025, the brand experienced a slight decline, settling at rank 18 by January 2026. This indicates a relatively stable performance, though the slight drop might suggest increased competition or shifting consumer preferences within the state. Despite the decrease in ranking, it's important to note that Lil' Budz (CT) has managed to stay within the top 20, which is a testament to its resilience and sustained consumer interest.

Sales figures for Lil' Budz (CT) in the Flower category reveal some fluctuations, with a notable peak in November 2025 followed by a gradual decline through January 2026. The brand's sales dropped from over 73,000 in November to approximately 57,000 in January, which could be indicative of seasonal trends or changes in market dynamics. While the brand has not broken into the top 15, its ability to maintain a presence in the competitive landscape of Connecticut suggests a solid foundation and potential for future growth. The absence of data from other states or provinces highlights the brand's focus or limited reach, which may present both challenges and opportunities for expansion.

Competitive Landscape

In the competitive landscape of the Connecticut flower category, Lil' Budz (CT) has seen a relatively stable performance in terms of rank, maintaining positions between 16th and 18th from October 2025 to January 2026. Despite its consistent ranking, Lil' Budz (CT) faces stiff competition from brands like Rodeo Cannabis Co., which started at 12th in October 2025 but experienced a downward trend, ending at 17th in January 2026. Meanwhile, AGL / Advanced Grow Labs showed a more resilient performance, only slightly dropping from 13th to 16th over the same period. Notably, Springtime re-entered the top 20 in December 2025 and maintained the 19th position through January 2026, indicating potential volatility in the lower ranks. These dynamics suggest that while Lil' Budz (CT) has maintained its position, the brand may need to strategize to improve its sales and rank amidst fluctuating performances of its competitors.

Notable Products

In January 2026, Chem D Smalls (7g) from Lil' Budz (CT) retained its position as the top-performing product, maintaining the number 1 rank for two consecutive months, with sales reaching 573 units. Cap Junk Smalls (7g) showed a slight improvement, rising to the second position from fourth place in December 2025, despite a decrease in sales. C-Stata Smalls (14g) climbed from the second rank in December to third in January, indicating consistent performance. Chem D (7g) entered the rankings at fourth place, demonstrating a new interest in this product. Meanwhile, C-Stata Smalls (7g) dropped to fifth place, reflecting a decline in sales compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.