Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

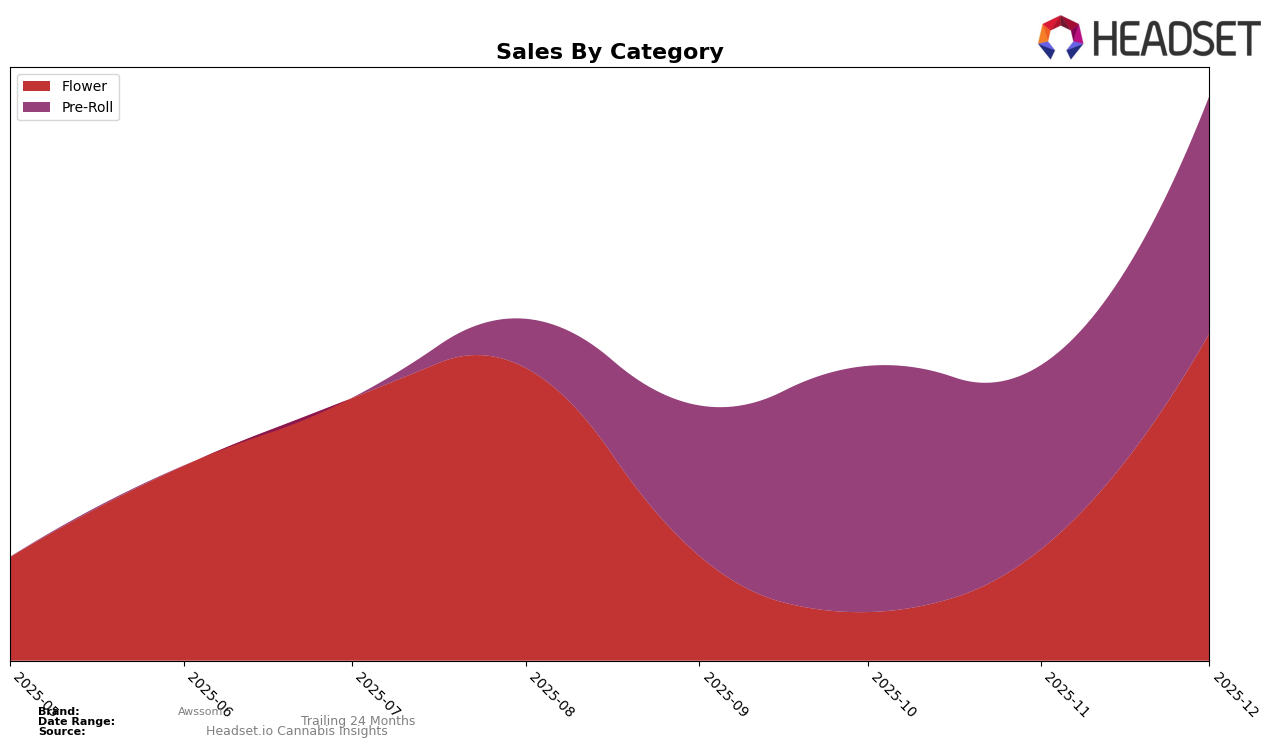

Awssom's performance in the Connecticut market has shown significant fluctuations across different categories. In the Flower category, the brand experienced a noticeable improvement in its ranking, moving from 16th place in October 2025 to 10th place by December 2025. This upward trend is noteworthy, especially considering the brand was not in the top 10 earlier in the year. However, the sales figures for October were notably lower than in other months, which might indicate a temporary setback or market fluctuation. In contrast, the Pre-Roll category demonstrates a more consistent performance, maintaining a top 10 position throughout the last quarter of 2025 and even securing 4th place by December. This steady climb in rankings suggests a growing preference for Awssom's Pre-Roll products among consumers in Connecticut.

While the brand has shown resilience and growth in the Connecticut market, the absence of Awssom in the top 30 for other states and categories is a point of concern. The lack of presence in these rankings could imply either a strategic focus on specific markets or a need for expansion and increased brand visibility elsewhere. The sales trajectory in Connecticut, particularly the sharp increase in Flower sales in December, could serve as a model for potential growth strategies in other regions. Understanding the dynamics behind Connecticut's success might provide insights into how Awssom can replicate similar achievements in other states or provinces.

Competitive Landscape

In the competitive landscape of the Flower category in Connecticut, Awssom has shown a notable upward trajectory in its rankings over the last few months of 2025. Starting from a rank of 13 in September, Awssom experienced a dip to 16 in October, but then climbed back up to 14 in November and reached a commendable rank of 10 by December. This positive shift in rank is accompanied by a significant increase in sales, particularly in December, where Awssom's sales surged, indicating a strong market presence. In contrast, Earl Baker maintained a steady rank around 9, with a notable sales spike in December, suggesting robust competition. Meanwhile, All:Hours experienced a slight dip from 8 to 9 in December, despite consistent sales figures. Find. re-entered the top 20 in December at rank 11, highlighting the dynamic nature of this market. The absence of Good Green from the top 20 in earlier months, only appearing at rank 12 in December, further emphasizes the competitive shifts within the Connecticut Flower category.

Notable Products

In December 2025, the top-performing product for Awssom was Blockberry Pre-Roll (1g) in the Pre-Roll category, climbing from third place in November to first place, with impressive sales of 15,374 units. Gold Cash Gold Pre-Roll (1g) also saw a significant rise, moving from fourth to second place. Blueberry Hashplant Pre-Roll (1g) experienced a drop from first to third place, indicating a shift in consumer preferences. Don Mega Pre-Roll (1g) entered the rankings at fourth place, while Georgia Pie Pre-Roll (1g) secured the fifth position. These changes highlight a dynamic market where Awssom's pre-roll products continue to perform strongly with varying consumer interest month over month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.