Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

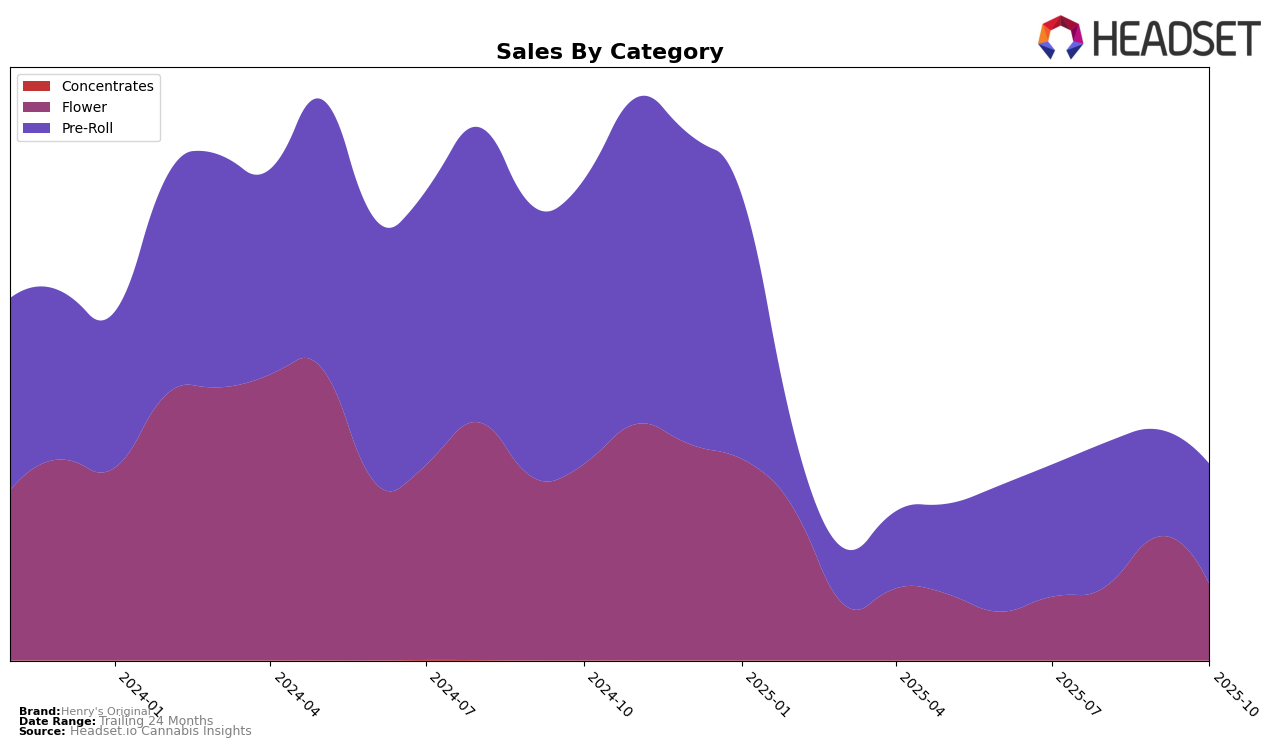

In the state of California, Henry's Original has shown varying performance across different cannabis product categories. In the Flower category, the brand struggled to maintain a consistent presence in the top rankings, failing to appear in the top 30 for both July and October 2025. This indicates a potential challenge in maintaining a competitive edge in this category. However, there was a notable improvement in August, where the brand climbed to the 64th position, suggesting a temporary boost in sales or market strategy that month. The fluctuations in rankings highlight the competitive nature of the Flower market in California, where maintaining a stronghold can be quite challenging for brands.

Conversely, in the Pre-Roll category, Henry's Original displayed a relatively stable performance, consistently ranking within the top 35 from July to October 2025. This indicates a stronger foothold and possibly a more loyal customer base within this category. The brand's best performance was in August, where it reached the 27th position, demonstrating a peak in consumer interest or effective marketing efforts during that period. Despite a slight dip to 35th in September, the brand regained momentum by October, ranking 29th. The consistent presence in the top 35 suggests that Henry's Original has a competitive product offering in the Pre-Roll segment in California, which could be a strategic focus area for the brand moving forward.

Competitive Landscape

In the competitive landscape of the California pre-roll category, Henry's Original has experienced fluctuating rankings over the past few months, which may impact its market positioning and sales strategy. In July 2025, Henry's Original was ranked 31st, improving to 27th in August, but then dropping to 35th in September before rebounding to 29th in October. This volatility contrasts with competitors like Fig Farms, which maintained a relatively stable position, ranking 29th in July and improving to 27th by October. Meanwhile, Sublime Canna showed consistent improvement, moving from 34th in July to 28th by October. Despite these fluctuations, Henry's Original's sales figures reveal a robust performance, particularly in August, where it outperformed brands like NUG and Raw Garden. However, maintaining a competitive edge will require strategic adjustments to stabilize rankings and capitalize on sales opportunities amidst strong competition.

Notable Products

In October 2025, the top-performing product for Henry's Original was the Acapulco Gold Pre-Roll 4-Pack (2g) in the Pre-Roll category, which achieved the highest rank of 1 with notable sales of $1,543. The Strawberry Cough Pre-Roll (1g) followed closely, securing the second position. Purple Hashplant Pre-Roll 4-Pack (2g) and Blue Dream Pre-Roll (1g) were ranked third and fourth, respectively, with the Blue Dream Pre-Roll dropping from its previous second place in July. Sensi Star Pre-Roll (1g) rounded out the top five, marking its first appearance in the rankings. This month's rankings highlight a shift in consumer preference towards multi-pack pre-rolls, as seen in the top three products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.