Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

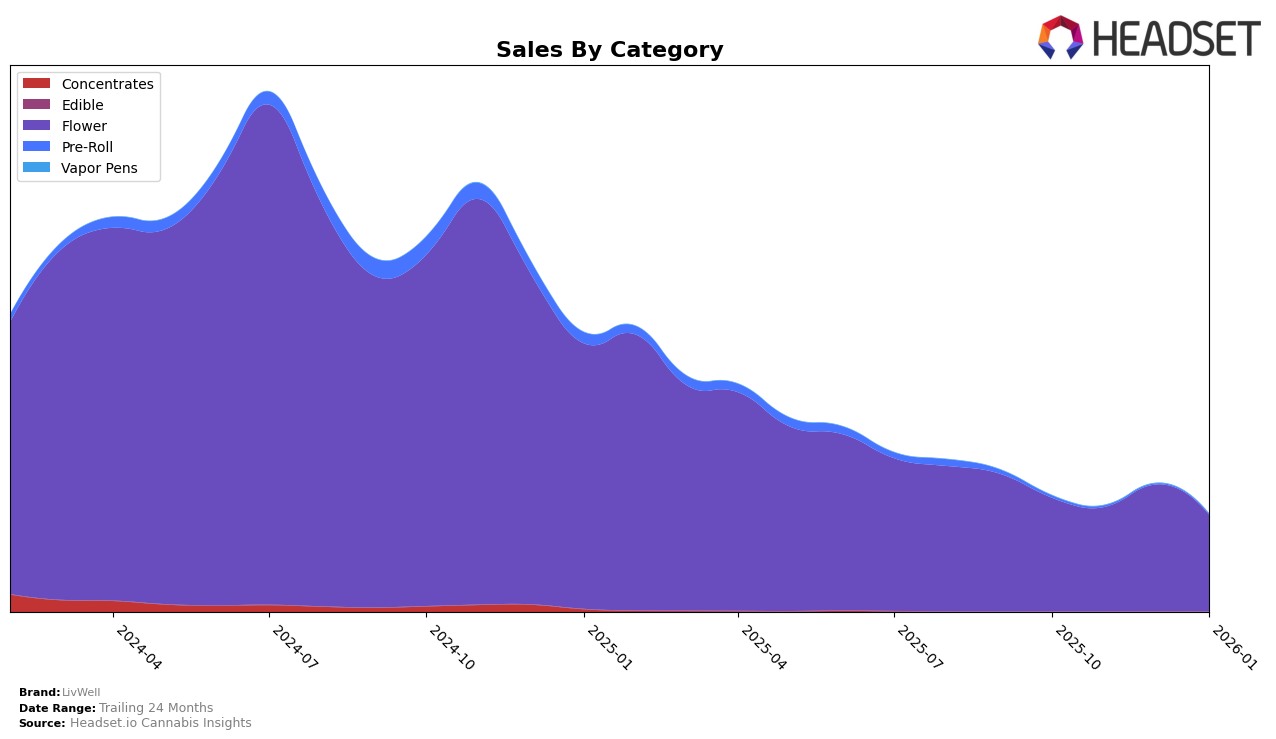

LivWell's performance across various states and categories has shown interesting trends over recent months. In the state of Maryland, LivWell's rank in the Flower category has seen a consistent improvement, moving from 37th in October 2025 to 34th by January 2026. This upward trend suggests a strengthening presence in the market, despite not being in the top 30 brands. The sales figures also reflect this positive momentum, with a noticeable increase from $131,380 in November to $198,970 in January. This growth might indicate successful strategies or a rising consumer preference for LivWell's offerings in Maryland.

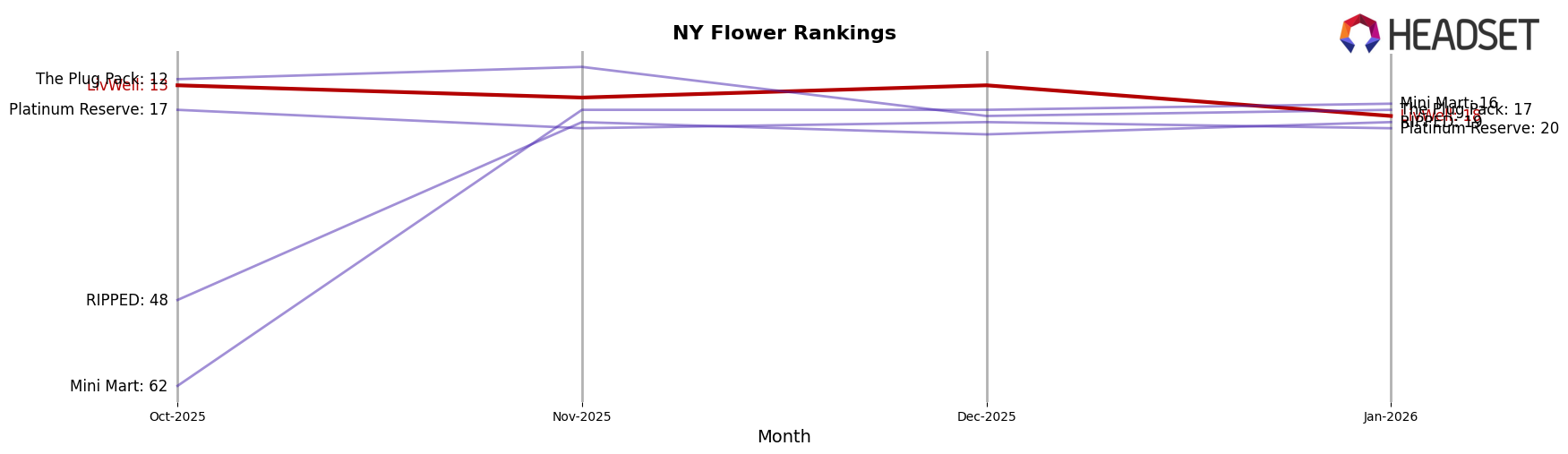

In contrast, LivWell's performance in the New York Flower market has been more volatile. The brand was ranked 13th in both October and December 2025 but saw a decline to 18th by January 2026. This drop in ranking, coupled with fluctuating sales figures, highlights potential challenges or increased competition in the New York market. Despite a peak in December 2025, where sales reached over $1.3 million, the subsequent decrease to $926,467 in January 2026 suggests that LivWell may need to reassess its strategies to regain its footing and improve its competitive edge in New York.

Competitive Landscape

In the competitive landscape of the New York flower category, LivWell experienced notable fluctuations in its ranking and sales from October 2025 to January 2026. Starting at rank 13 in October, LivWell saw a decline to rank 18 by January, indicating a potential challenge in maintaining its market position. In contrast, The Plug Pack initially ranked higher at 12 and, despite a dip in December, managed to stabilize at rank 17 by January. Meanwhile, RIPPED showed a remarkable ascent from rank 48 in October to 19 by November, maintaining a similar position through January, which could suggest a growing consumer preference or effective marketing strategies. Mini Mart also demonstrated significant improvement, jumping from rank 62 in October to 16 by January, potentially indicating a successful product launch or promotion. These shifts highlight the dynamic nature of the market and suggest that LivWell may need to reassess its strategies to regain its competitive edge in the New York flower category.

Notable Products

In January 2026, Intimidator OG #1 (Bulk) reclaimed its top spot as the leading product for LivWell, having previously ranked first in November 2025 and third in December 2025. GG#4 (28g) emerged as the second-best seller, marking its debut in the rankings. Berry Blissful (3.5g) followed closely as the third highest-selling product, with Sour Juice (3.5g) and Blue Coral (14g) rounding out the top five. Notably, Intimidator OG #1 (Bulk) achieved sales of 756 units in January, demonstrating strong performance despite a dip from previous months. This shift in rankings suggests a dynamic change in consumer preferences or promotional strategies by LivWell.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.